When you think of crypto hubs, you might picture Silicon Valley, Singapore, or Dubai. But the real surprise? A tiny Mediterranean island with just over 400,000 people has become one of the most trusted places in the world for crypto businesses. That’s Malta. Since 2018, it hasn’t just welcomed blockchain companies-it’s built an entire system around them. And it’s working.

Why Malta? It’s Not Luck, It’s Law

Malta didn’t stumble into being the "Blockchain Island." It planned it. In July 2018, the Maltese Parliament passed three groundbreaking laws: the Virtual Financial Assets Act, the Malta Digital Innovation Authority Act, and the Innovation Technology Arrangements and Services Act. These weren’t vague guidelines. They were full legal frameworks. For the first time anywhere, a country gave clear definitions to what a virtual token, a crypto exchange, or a blockchain service provider actually is. No guesswork. No regulatory limbo.That clarity is why Binance moved its headquarters to Malta in 2019. Why OKEx followed. Why dozens of smaller startups now have offices in Valletta or Sliema. If you’re running a crypto business, you need to know where you stand. Malta gives you that. The Malta Financial Services Authority (MFSA) doesn’t just supervise-it explains. It issues detailed circulars, like the one in April 2025, telling crypto asset service providers exactly how to comply with the EU’s new Markets in Crypto-Assets (MiCA) rules. That’s not common. In many places, regulators wait for businesses to break the law before they respond. Malta moves ahead.

Taxes That Actually Work for Crypto

Let’s talk money. Because if the rules are clear but the taxes are brutal, no one stays.Malta doesn’t tax capital gains on cryptocurrency if you’re holding it as an investment. That’s huge. In the U.S., every time you trade BTC for ETH, you trigger a taxable event. In Malta? If you’re not actively trading-just buying and holding-you owe nothing on the profit. That’s a game-changer for long-term investors.

But what if you’re trading daily? Then it’s treated as business income. The tax rate? Between 15% and 35%, depending on your personal income bracket. For companies, the headline corporate tax is 35%. But here’s the twist: Malta’s imputation system lets you get back most of it. If you’re structured right, your effective tax rate can drop to between 0% and 5%. That’s not a loophole. It’s a legal refund system built into the tax code. Companies like Binance use it. So can you, if you set up properly.

There’s also the Global Residence Programme (GRP). If you live in Malta for 183 days a year, you can pay just 15% on foreign-sourced income-like crypto profits earned outside the island. Minimum tax? €15,000 per year. For many crypto entrepreneurs, that’s cheaper than paying 30%+ in taxes back home.

Regulation That Builds Trust, Not Barriers

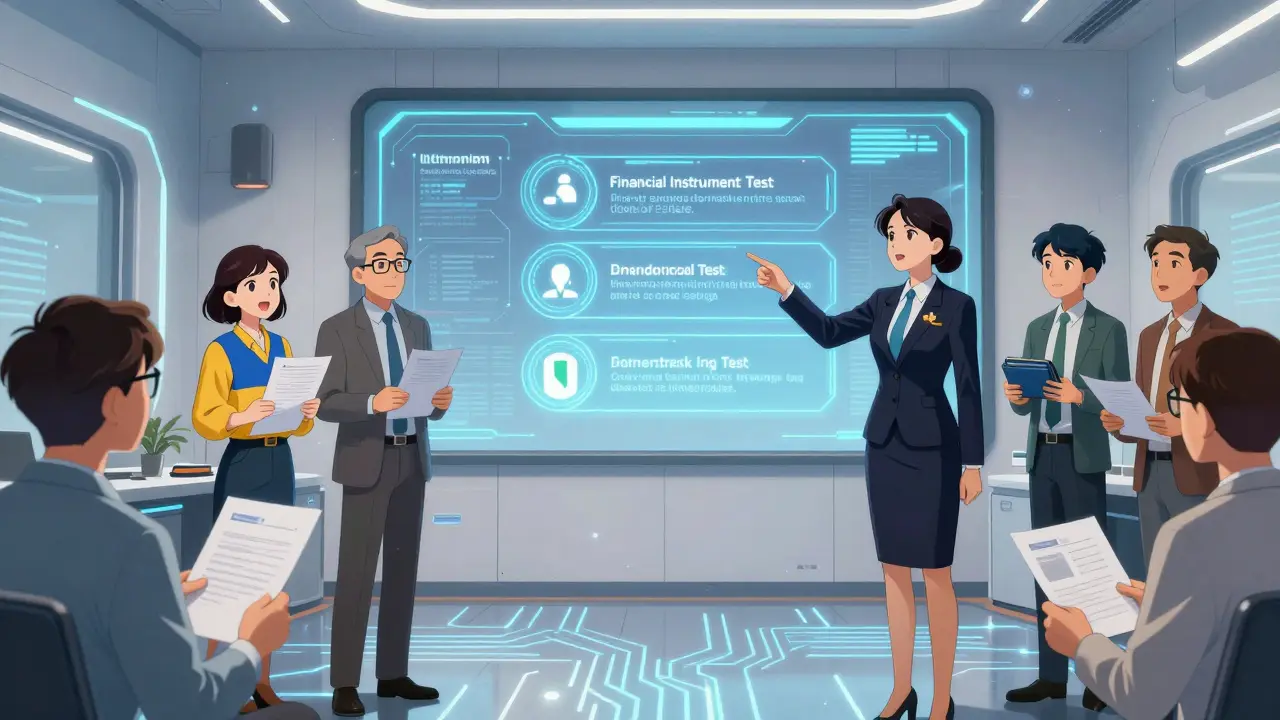

One of the biggest problems in crypto is uncertainty. Who’s regulating? What’s allowed? What’s a security? Malta solved this with the Financial Instrument Test.This three-step test helps you classify your token before you launch. Is it a utility token? A security? A payment token? The answer determines which rules apply. No more guessing. No more legal bills trying to figure it out after the fact. You know upfront. That’s why startups from Ukraine, Nigeria, and Canada now come to Malta to structure their ICOs. They don’t want to risk being shut down by the SEC later.

The MFSA doesn’t just approve applications. It monitors. It checks for market abuse. It enforces transparency. It requires CASPs to keep detailed records, report suspicious activity, and protect customer funds. This isn’t "light-touch" regulation. It’s smart, enforceable, and designed to protect both investors and legitimate businesses.

And now, with MiCA fully in force across the EU in 2025, Malta’s rules are even stronger. It’s the only country that had its own system ready before MiCA arrived-and then seamlessly aligned with it. That’s leadership.

Residency and Citizenship for Crypto Investors

If you’re serious about crypto, you don’t just want a business license. You want a life. Malta offers that too.The Malta Permanent Residence Programme (MPRP) lets you get indefinite residency by investing in property or renting, making a government donation, and passing background checks. You don’t need to be a citizen. You just need to live there part-time and prove your crypto wealth is clean. Documentation? Yes. But it’s clear. You need bank statements, wallet addresses, transaction histories-nothing shady.

Want citizenship? Malta’s Citizenship by Exception program allows it. You need to live there for at least a year, invest €600,000+ in property or government bonds, and pass strict due diligence. Crypto funds count-if you can prove they’re legitimate. Once you get the passport, you get visa-free access to 187 countries, including the Schengen Area, the UK, and Canada. For a crypto entrepreneur who travels constantly, that’s priceless.

How Malta Compares to Other Crypto Hubs

You’ve heard of Estonia, Switzerland, Singapore. Let’s cut through the noise.Estonia offers e-residency and a flat 20% corporate tax. Sounds good. But it’s expensive to set up. The capital requirements for crypto firms are high, and banking access is shrinking. Many crypto businesses there are being pushed out by local banks.

Switzerland has Zug’s Crypto Valley. Strong reputation. But taxes are complex. Cantons vary. And the Swiss Financial Market Supervisory Authority (FINMA) is cautious-sometimes too cautious. Approval times can drag on for months.

Singapore is strict. It’s cracking down on retail crypto trading. Advertising is banned. And the tax rules for crypto are still evolving. Uncertainty is the new norm there.

Malta? It’s the only place that combines:

- Clear, written laws (not just guidelines)

- Low effective corporate tax (0-5% possible)

- No capital gains tax on long-term holdings

- EU membership with global mobility

- A government actively building infrastructure (blockchain in public services, blockchain gaming regulation)

That’s not a coincidence. That’s strategy.

What’s Next for Malta’s Crypto Scene?

The government isn’t resting. In 2025, they’re finalizing updates to clarify crypto-to-crypto trades. Right now, there’s some ambiguity: Is swapping ETH for SOL a taxable event? The law doesn’t say. But new guidelines are coming. Expect clear rules by mid-year.They’re also looking at tax breaks for long-term crypto holders-maybe even a 0% rate after five years. And they’re working with universities to train the next generation of blockchain engineers. The University of Malta now offers a Master’s in Blockchain and Digital Assets. That’s not just PR. It’s a workforce pipeline.

Even the Malta Gaming Authority is using blockchain to make online casinos fairer. They’re testing smart contracts to prove game outcomes aren’t manipulated. That’s innovation with real-world impact.

Is Malta Right for You?

If you’re a crypto business owner, investor, or developer, ask yourself:- Do you want legal certainty, or are you okay playing regulatory roulette?

- Do you want to pay 30%+ in capital gains, or keep your profits?

- Do you need EU access, global mobility, and banking relationships that actually work?

If you answered yes to any of those, Malta isn’t just an option. It’s the best option.

It’s not perfect. Banking relationships can still be tricky. Not every bank wants to work with crypto firms. But the government is helping. They’ve created a sandbox for fintechs to partner with licensed banks. And the number of crypto-friendly financial institutions is growing.

Malta didn’t become the Blockchain Island by accident. It did it by being the first to answer the questions crypto businesses actually care about: Can I operate legally? Can I keep my profits? Can I build here for the long term?

The answer, for the first time, is yes.

Is Malta still a good place for crypto businesses in 2025?

Yes. Malta remains one of the most stable and clear jurisdictions for crypto businesses in 2025. Its alignment with the EU’s MiCA regulation has strengthened-not weakened-its position. Unlike countries that are cracking down, Malta is refining its rules to make compliance easier and more predictable. Companies like Binance and OKEx still operate from Malta, and new startups continue to relocate there for the legal clarity and tax advantages.

Do I have to live in Malta to benefit from its crypto tax rules?

No, but you need to be a tax resident to get the best rates. If you’re not living in Malta, your crypto gains may still be taxed in your home country. To benefit from Malta’s 0% capital gains tax on long-term holdings, you must spend at least 183 days per year in the country and register as a tax resident. For businesses, you need to be incorporated in Malta and have your management and control based there.

Can I use cryptocurrency to qualify for Malta’s residency or citizenship programs?

Yes, as long as you can prove the source of your crypto funds is legitimate. The Maltese government requires full documentation-wallet addresses, transaction histories, exchange records, and KYC verification. Crypto is accepted for property purchases, government donations, and investment requirements under both the Permanent Residence Programme and Citizenship by Exception. But if your funds come from unverified or suspicious sources, your application will be rejected.

What’s the difference between Malta’s VFA framework and the EU’s MiCA regulation?

Malta’s Virtual Financial Assets (VFA) Act was created in 2018 and was the world’s first comprehensive crypto legal framework. MiCA, which came into full effect in 2025, is the EU’s standardized rulebook for crypto assets. Malta didn’t replace its VFA rules-it adapted them to align with MiCA. The result? Businesses licensed under Malta’s VFA system automatically meet MiCA requirements. This gives Maltese firms a head start in the EU market and makes Malta the most predictable gateway to Europe for crypto companies.

Are there any downsides to setting up a crypto business in Malta?

The main challenges are the cost of living and limited local talent. Rent and salaries in Malta are higher than in Eastern Europe. Finding experienced blockchain developers can be tough, so many firms bring in talent from abroad. Banking access is improving but still not universal-some banks remain cautious. And while the government is proactive, bureaucracy can still be slow if you don’t have the right legal or accounting support. But for most serious crypto businesses, these are manageable trade-offs for the clarity and stability Malta offers.

How does Malta handle crypto-to-crypto trades for tax purposes?

Currently, the tax treatment of crypto-to-crypto trades is ambiguous under existing law. Swapping BTC for ETH might be treated as a disposal, triggering a taxable event, or it might not-depending on interpretation. The Maltese government is finalizing new guidelines for 2025 to clarify this. Early signals suggest they’ll treat such trades as non-taxable if they’re part of portfolio management and not frequent trading. But until the rules are official, it’s safest to treat all swaps as taxable events unless you have written advice from a Maltese tax professional.

Sammy Tam

December 16, 2025 AT 12:06Malta’s whole vibe is just… cool. Not the "look at me I’m a crypto hub" kind of cool, but the quiet, confident kind where you don’t need to shout because everyone already knows you’re the one with the answers. I’ve seen startups from Lagos to Lviv pack up and move there not because they had to, but because they finally felt like they could breathe. The MFSA doesn’t play games. They give you the rulebook before you even ask for it. That’s rare.

Jonny Cena

December 17, 2025 AT 06:18For anyone thinking about relocating or setting up shop, just know this: Malta’s not for the lazy. You still gotta do your homework, hire good lawyers, and keep clean books. But compared to the wild west of crypto regulation elsewhere? It’s like going from a haunted house to a five-star hotel with a concierge who speaks blockchain. Seriously, if you’re tired of guessing whether you’re gonna get raided by the SEC, this is your lifeline.

Elvis Lam

December 17, 2025 AT 17:49People keep comparing Malta to Switzerland, but they’re missing the point. Switzerland has tradition. Malta has execution. The VFA Act wasn’t just a law-it was a blueprint. And now with MiCA, Malta didn’t scramble to catch up. They rewrote the script and handed it to the EU. That’s leadership. Also, the 0-5% effective corporate tax isn’t magic-it’s math. Imputation credits, dividend refunds, structured holding companies. Do it right, and you pay less than your coffee budget in taxes.

Sue Bumgarner

December 19, 2025 AT 02:51Malta? Please. They’re just a tax haven with a pretty beach. The EU is forcing them to comply with MiCA because they’re too small to be trusted. Don’t believe the hype. If you’re smart, you keep your assets offshore and your life in the U.S. where the rules are clear-unlike here, where they change every six months just to keep the tourists coming.

Kayla Murphy

December 19, 2025 AT 09:27Just wanted to say-this post made me feel hopeful. For once, someone built something good instead of just trying to get rich. Malta’s proving you can regulate without crushing innovation. That’s rare. I’m not even in crypto, but I’m rooting for them.

Dionne Wilkinson

December 19, 2025 AT 13:54I read this whole thing and just sat there quietly. It’s weird how a tiny island figured out something the whole world is still stumbling over. Maybe it’s because they didn’t have a choice. No big banks. No Silicon Valley ego. Just people trying to make something that lasts. I like that.

Sean Kerr

December 21, 2025 AT 10:10Malta’s the real deal 😎💯 I’ve got a buddy who moved his DeFi firm there last year-now he’s got a villa in Sliema, pays less tax than his dog’s vet bill, and his lawyer sends him updates in memes. No cap. The MFSA even sent him a handwritten note saying "good job" after his audit. That’s not regulation. That’s family.

Heather Turnbow

December 21, 2025 AT 15:54The clarity Malta offers is not just beneficial-it’s ethically necessary. When individuals and enterprises are forced to operate in regulatory gray zones, the burden of compliance becomes a moral hazard. Malta’s framework transforms compliance from a defensive maneuver into a constructive, transparent practice. This is not merely policy-it is governance as stewardship.

Jesse Messiah

December 22, 2025 AT 03:25man i never thought i’d say this but malta kinda wins 😅 i used to think switzerland was the crypto king but after reading this i get it-they actually built something that works. not just a vibe. not just a name. actual rules. actual tax breaks. actual path. respect.

Rebecca Kotnik

December 23, 2025 AT 16:09It is imperative to recognize that Malta’s regulatory architecture represents a paradigmatic shift in the governance of decentralized financial systems. Unlike jurisdictions that impose ad hoc restrictions or rely on reactive enforcement, Malta has constructed a proactive, taxonomy-based legal infrastructure that anticipates technological evolution. The Virtual Financial Assets Act, in particular, demonstrates an unprecedented fusion of legal precision and technological literacy. The imputation system, while complex, is a masterstroke of fiscal design, aligning corporate incentives with long-term economic stability. Furthermore, the alignment with MiCA is not merely compliance-it is institutional leadership. The fact that Malta’s framework predates and now seamlessly integrates with the EU’s regulatory framework underscores its role as a vanguard in global financial innovation. This is not opportunism; it is statesmanship.

Terrance Alan

December 24, 2025 AT 09:45Malta is just another government trying to look cool by playing with crypto. Meanwhile real people are getting scammed by these so-called "regulated" exchanges. You think Binance gives a damn about your safety? They moved there because taxes are low not because they care about you. And don’t even get me started on that citizenship scam where you pay 600k and get a passport. This whole thing is a shell game and you’re the sucker

George Cheetham

December 25, 2025 AT 21:49There’s something beautiful about a small nation deciding to bet everything on the future instead of clinging to the past. Malta didn’t wait for permission. They didn’t ask if it was possible. They just built it. And now the whole world is watching, trying to figure out how they did it. Maybe the lesson isn’t about crypto. Maybe it’s about courage.

Florence Maail

December 26, 2025 AT 12:13Malta? Lmao. They’re just a pawn for the EU. MiCA is coming and they’re just trying to look like they’re ahead. Also, how many of these "crypto businesses" are just money launderers with a nice office view? The MFSA is just letting them run wild under the guise of "clarity." I’ve seen the reports. The real crypto scene is still shady as hell. This post is just corporate PR with extra steps 🤡

Chevy Guy

December 26, 2025 AT 19:49they’re using blockchain in casinos?? yeah right. that’s how they track you. the government is watching every transaction. every wallet. every swap. they’re building a digital ID system under the guise of "fair gaming". next thing you know your crypto wallet gets flagged because you bought ETH on a saturday. this is surveillance capitalism with a beach view

Samantha West

December 27, 2025 AT 23:17It is fascinating how the concept of jurisdictional sovereignty has been redefined through the lens of digital asset governance. Malta, despite its geographic minuscule nature, has achieved what larger economies have failed to do: the institutionalization of trust through codified transparency. The integration of blockchain into public services is not merely symbolic-it is epistemological. The state, in this case, becomes not an arbiter but an enabler. The imputation tax system, while complex, reflects a sophisticated understanding of capital mobility and incentive alignment. This is not policy-it is philosophy made operational.

Greg Knapp

December 29, 2025 AT 15:57why are you all so obsessed with malta its just a tiny island with a few rich guys and a bunch of crypto bros living off their parents money. the whole thing is a scam. the mfsa is just a front for the eu to control crypto. they dont care about you they care about control. and the tax thing? yeah right. you think theyre gonna let you keep your money forever? wait till the next election

Amy Copeland

December 31, 2025 AT 06:59Oh wow, Malta’s "Blockchain Island"-how quaint. Let me grab my monocle and sip my chamomile while I marvel at how a country smaller than Brooklyn managed to outsmart the entire global financial system. Truly, the pinnacle of human ingenuity. Next up: Bermuda’s NFT-based monarchy. I can hardly wait.

Sally Valdez

January 1, 2026 AT 20:10Malta? You mean the place where the guy who runs the local pizzeria has a crypto license? This isn’t innovation-it’s desperation. The U.S. has real markets, real banks, real power. You think some tiny island with 400k people is gonna outlast Wall Street? Please. They’re just the last stop before the dumpster fire. And don’t even get me started on that "citizenship by investment" scam. You think they care about you? They care about your money. That’s it.