DOB Token Calculator

Token Information

Total Supply: 11,000,000 DOB

Circulating Supply: 10,000,000 DOB

Market Cap: $6,510

24h Volume: $0

Holders: ~1,910

Current Prices

Coinbase: $0.000645

Binance: $0.000275

Price Difference: +134.9% on Binance

Investment Calculator

Investment Summary

Invested Amount:

DOB Purchased:

Current Value:

Risk Level:

Risk Assessment

Liquidity Risk: High

Volatility Risk: High

Adoption Risk: Medium

Development Risk: Medium

Regulatory Risk: High

Key Takeaways

- DOB on Base is a community‑driven token built on Coinbase’s Base Layer‑2 network.

- The token powers a decentralized e‑commerce marketplace that aims to make online buying and selling more transparent.

- Supply: 11million total, 10million circulating; market cap around $6.5k (as of Oct2025).

- Liquidity is thin - 24‑hour volume on major trackers is essentially $0, and prices differ between Coinbase and Binance.

- Risks include price volatility, limited adoption, and unclear development roadmap.

Curious about the buzz around DOB crypto and why it keeps popping up in Base‑related discussions? This guide breaks down everything you need to know - from the token’s DNA to its real‑world use cases and the numbers that matter.

What is DOB on Base?

DOB on Base is a community‑driven digital asset launched on the Base blockchain, a Layer‑2 scaling solution created by Coinbase. The token functions both as a collectible community token and as a utility token inside a dedicated marketplace ecosystem. In plain terms, holding DOB gives you a stake in a budding decentralized e‑commerce platform that lives on a fast, cheap Ethereum‑compatible network.

Technical Foundation: Base Blockchain, Ethereum, and Coinbase

Base blockchain is a Layer‑2 network that inherits Ethereum’s security while offering lower fees and higher throughput. Because Base is built by Coinbase the largest U.S. crypto exchange, it benefits from strong brand recognition and a pipeline for user onboarding. Developers can deploy smart contracts using familiar Ethereum tools (Solidity, Hardhat, Remix) and take advantage of built‑in scaling.

Underlying all of this is Ethereum the world’s leading smart‑contract platform. Base treats Ethereum as the settlement layer: every transaction is ultimately settled on the mainnet, giving DOB holders the same security guarantees as any ERC‑20 token.

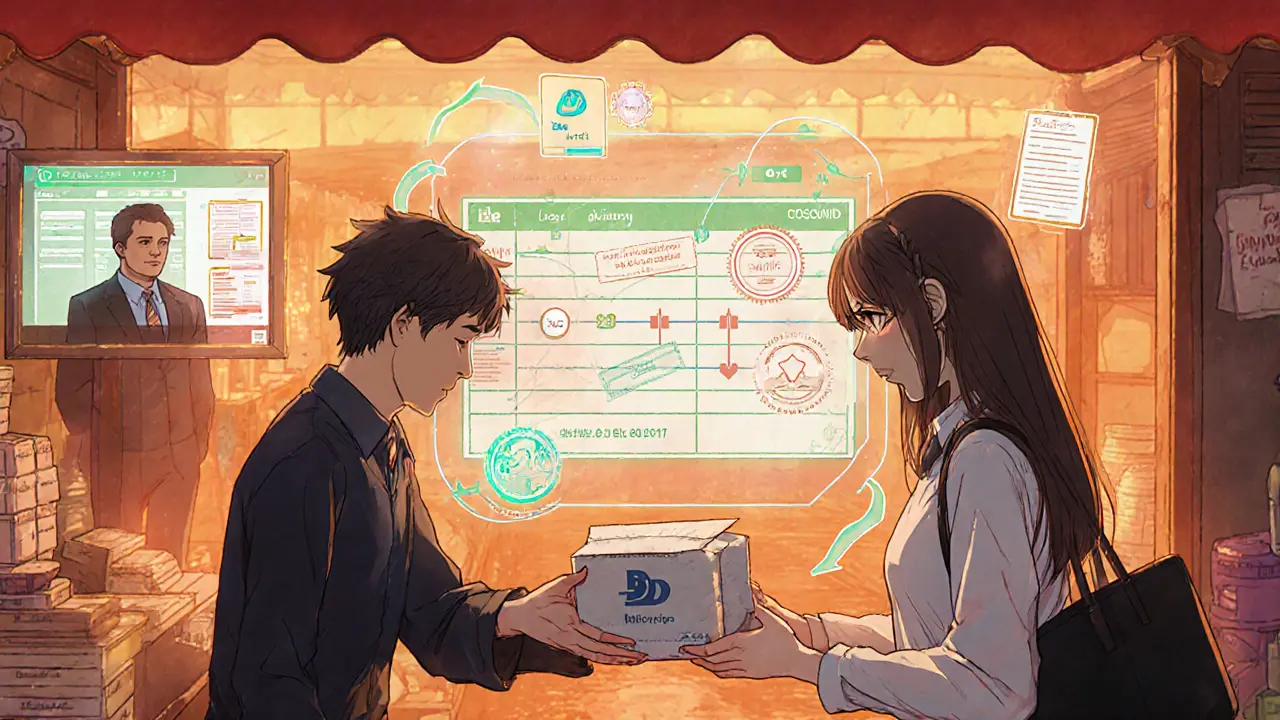

Utility and Marketplace Ecosystem

The heart of DOB’s promise is its marketplace. Think of it as a decentralized Amazon where every sale, shipment, and dispute is recorded on‑chain. Key features include:

- Secure payment routing - buyers pay in DOB, sellers receive instantly, and the smart contract holds escrow until delivery confirmation.

- Shipping management - the platform integrates with logistics APIs to generate real‑time tracking links.

- Dispute resolution - a transparent arbitration module lets community‑chosen arbitrators review evidence and release funds.

- Seller verification - identity checks and reputation scores are stored on‑chain, reducing fraud.

Beyond pure commerce, the whitepaper labels DOB as “DeFi on Base,” hinting at future integrations like lending, borrowing, or yield farming for merchants who lock DOB as collateral. Those features are still in the roadmap, but they illustrate the token’s ambition to blend e‑commerce with decentralized finance.

Tokenomics: Supply, Distribution, and Market Metrics

The token economics are straightforward:

- Total supply: 11million DOB.

- Circulating supply: 10million (≈91% of total).

- Locked/reserved: 1million tokens are held for future development, team vesting, or ecosystem incentives.

As of October2025, market data shows:

- Market cap: about $6,510 (based on Coinbase’s quoted price).

- Fully diluted valuation: $13,680.

- Holder count: roughly 1,910 unique addresses, indicating a modest but distributed community.

- 24‑hour trading volume: $0 on major trackers - a red flag for liquidity.

Prices differ sharply between exchanges. Below is a snapshot comparison:

| Exchange | Price (USD) | 24h % Change | Liquidity Notes |

|---|---|---|---|

| Coinbase | $0.000645 | +0.12% | Low order‑book depth |

| Binance | $0.000275 | +22.29% | Fragmented liquidity, price lag |

The divergence suggests separate trading pairs (e.g., DOB/USDT vs DOB/USDC) and possibly outdated price feeds. Traders should verify the exact pair before executing any order.

How to Acquire and Trade DOB

Because liquidity is thin, you’ll likely need to follow a two‑step process:

- Obtain a Base‑compatible wallet (e.g., MetaMask configured for the Base network, or Coinbase Wallet which natively supports Base).

- Buy DOB on the exchange where it’s listed (Coinbase or Binance). If the exchange offers a direct fiat‑on‑ramp, you can purchase with USD; otherwise you may need to swap a more liquid token like ETH or USDC for DOB.

After purchase, transfer the tokens to your personal Base wallet. From there, you can interact with the DOB marketplace or hold for speculative purposes.

Risks and Challenges

While the concept is appealing, several practical hurdles exist:

- Liquidity scarcity - the $0 24‑hour volume means large trades will move the price dramatically.

- Price volatility - DOB has lost over 80% of its value in the past 90days on Binance, indicating weak market confidence.

- Development opacity - public roadmaps are vague, and code updates on GitHub are infrequent, making it hard to gauge future progress.

- Regulatory uncertainty - as a community token tied to e‑commerce, it could attract scrutiny if it’s deemed a securities offering.

- Competition - other Base projects (e.g., $BASE, $OP) and established DeFi marketplaces already have larger user bases.

Potential investors should treat DOB as a high‑risk, high‑potential experiment rather than a stable store of value.

Future Outlook

The success of DOB hinges on three key factors:

- Marketplace adoption - if enough sellers list real products and buyers experience smooth transactions, network effects will kick in.

- Liquidity incentives - launching staking or liquidity‑mining programs could attract capital and stabilize the price.

- Integration with DeFi primitives - adding borrowing/lending features would expand utility beyond pure commerce.

Given Base’s backing by Coinbase, the project enjoys a technical edge (fast finality, low fees). However, without clear user‑growth strategies, the token may remain a niche community asset.

Frequently Asked Questions

What does DOB stand for?

DOB is simply the ticker symbol for the token. The project does not expand the acronym; it focuses on branding the token as a “community‑driven asset” on the Base network.

Is DOB an ERC‑20 token?

Yes. Because Base is an Ethereum Layer‑2, DOB follows the ERC‑20 standard, meaning any wallet that supports ERC‑20 on Base can hold it.

How can I use DOB in the marketplace?

After transferring DOB to a Base‑compatible wallet, you can connect the wallet to the marketplace dApp, browse listings, pay for goods or services, and participate in escrow‑based trades.

Why are prices different on Coinbase and Binance?

The two exchanges list different trading pairs (e.g., DOB/USDC vs DOB/USDT) and update their order books at different frequencies. Low liquidity amplifies these discrepancies, so always check the specific pair before trading.

Is DOB a good long‑term investment?

DOB carries high risk. Its price has dropped sharply, trading volume is negligible, and the roadmap is vague. Only invest money you can afford to lose, and consider it more as a speculative token than a stable store of value.

Natalie Rawley

May 30, 2025 AT 13:31Whoa, have you seen the DOB token's supply numbers? The total supply sits at a neat 11 million while only 10 million are actually circulating, which means the market cap is hovering just above $6.5 k. That's a tiny slice of the crypto universe, perfect for those who love hunting low‑cap gems. And hey, with a spread like that between Coinbase and Binance, you’ve basically got a built‑in arbitrage playground!

Scott McReynolds

June 1, 2025 AT 17:11The moment you stare at the DOB token data, you realize it’s a micro‑cosm of the entire crypto narrative. Low market cap, lofty volatility, and a risk profile that screams “opportunity” to anyone with an optimistic marrow. Think about liquidity – it’s flagged as “high risk”, meaning you might not be able to exit without dancing around a thin order book. Yet that very thinness is the canvas on which daring traders paint their fortunes. The price discrepancy between Binance and Coinbase, a staggering 134.9 % difference, is a live lesson in exchange arbitrage. If you can move a handful of thousand dollars across the two platforms, you could theoretically capture a slice of that spread. Of course, the regulatory cloud looms, especially for tokens that sit on newer L2 chains like Base, and that adds a philosophical layer about trust and decentralization. From a philosophical standpoint, every token is a social contract: the community believes in its utility, and the market rewards that belief. The DOB token advertises itself as a utility‑driven asset, but the on‑chain activity data is sparse, suggesting the narrative is still being written. That’s where optimism meets reality – you can support a project you believe in while keeping a hard eye on the numbers. The circulating supply of ten million units means each token represents a modest slice of the whole, making dilution less of a nightmare for early adopters. Yet the total supply of eleven million hints at a future minting event that could tilt the balance, so watch the governance forums. When you calculate your potential investment, remember that the calculator on the page is just a toy; real‑world slippage and gas fees will eat into your returns. In the end, whether DOB becomes a footnote or a headline depends on community engagement, developer activity, and your own risk tolerance. So grab your calculator, keep your eyes on the volume (which is currently zero), and decide if you want to be a pioneer or a bystander.

John Corey Turner

June 3, 2025 AT 20:51Looking at the risk matrix, the liquidity and regulatory flags are screaming “caution”, but the token’s price swing is a philosopher’s playground. If you believe in the underlying tech, you can justify the high‑risk label as a cost of early adoption. The circulating supply is already 10 M, so any minting beyond the current total could dilute value. Remember to keep an eye on the governance chatter; that’s where the next move usually surfaces.

Kimberly Kempken

June 6, 2025 AT 00:31Everyone’s parading the arbitrage numbers like it’s a free lunch, but they ignore the fact that zero volume means you’re basically trading ghosts. High liquidity risk isn’t a buzzword, it’s a red flag that should stop anyone with half a brain. If you’re looking for a “high‑risk, high‑reward” story, grab a lottery ticket instead.

Eva Lee

June 8, 2025 AT 04:11From a tokenomics perspective, the cap structure presents a micro‑supply elasticity model that could trigger cascade effects under stress scenarios. The dual‑exchange pricing introduces a bid‑ask spread arbitrage vector, albeit constrained by the nil 24‑hour volume metric. Stakeholder analysis suggests ~1,910 holders, indicating a shallow depth of participation that may amplify price volatility under macro‑shocks.

Laurie Kathiari

June 10, 2025 AT 07:51While the jargon is impressive, the moral implication of promoting a token with such opaque activity is dubious. It’s hard to champion a project that trades on speculation rather than substantive utility.

Matt Nguyen

June 12, 2025 AT 11:31In my view, the overall architecture of DOB on Base is riddled with hidden vectors. If you dig deeper, you’ll find that the governance model is a thin veneer atop a centralized exchange bias. This is the kind of detail most casual investors miss, but it’s crucial for long‑term viability.

Cynthia Rice

June 14, 2025 AT 15:11Arbitrage on Binance versus Coinbase looks shiny, yet it’s just a mirage when volume stays at zero.

Promise Usoh

June 16, 2025 AT 18:51The token’s risk profile is explicit: high liquidity risk, high volatility risk, medium adoption risk. Enthusiam without due diligence may lead to losses. Please review the governance updates for any upcoming mint events.

Tyrone Tubero

June 18, 2025 AT 22:31Yo, I saw the same calcu‑lator thing, but bro, the real world gass feez gonna eat ur profit. Watch out!

Katherine Sparks

June 21, 2025 AT 02:11It’s always good to see people share tools, but remember to diversify – never put all your eggs in one low‑cap basket 😊

Patrick MANCLIÈRE

June 23, 2025 AT 05:51As someone who follows both US and European crypto trends, I can say that tokens on emerging L2s like Base often see bursts of activity when developers release new dApps. Keep an eye on the Dev Discord for announcements about utility upgrades; that’s usually where the price gets a kick.

Greer Pitts

June 25, 2025 AT 09:31Totally feel ya – it’s refreshing to see a community trying to break down these numbers for the rest of us. Stay safe and keep checking the volume charts!

Lurline Wiese

June 27, 2025 AT 13:11Wow, such a massive spread!

Jenise Williams-Green

June 29, 2025 AT 16:51Spreads that wide are a double‑edged sword: they hint at profit potential but also signal market inefficiency. If the order books are thin, you could end up slippage‑filled when you try to cash out. Moreover, the regulatory risk listed as “high” shouldn’t be brushed aside – many jurisdictions are still figuring out how to treat L2‑based tokens. That said, for the truly daring, a calculated entry could be worthwhile, provided you set strict stop‑losses. Remember, hype fades faster than a meme coin’s meme.

Adarsh Menon

July 1, 2025 AT 20:31Oh great another “hot token” on Base look its just another fad no volume no real use lol

Jim Griffiths

July 4, 2025 AT 00:11Check the governance forum for any upcoming supply changes; that’s where the real impact lies.

Marc Addington

July 6, 2025 AT 03:51Americans should stay away from foreign tokens that aren’t backed by real assets. This is just another money‑losing scheme for our kids.

Amal Al.

July 8, 2025 AT 07:31It’s encouraging to see community members share calculators and risk breakdowns; such transparency fosters trust! However, please remember that high‑risk tokens can affect personal finances; always allocate only what you can afford to lose. 🌟

Alex Gatti

July 10, 2025 AT 11:11Good point, Amal. I’d add that looking at on‑chain activity could give clues about genuine usage versus pure speculation.

stephanie lauman

July 12, 2025 AT 14:51From a regulatory standpoint, the token’s high risk classification should raise red flags for any prudent investor. Nonetheless, the potential upside remains attractive for those willing to accept the volatility. 🙂

Twinkle Shop

July 14, 2025 AT 18:31When evaluating nascent tokens like DOB, it is essential to adopt a multidisciplinary lens that incorporates macro‑economic indicators, tokenomics fundamentals, and community sentiment analysis. First, the macro environment currently favors short‑term speculative assets due to elevated fiat inflation rates, which can drive demand for alternative stores of value. Second, tokenomics reveals an 11 M total supply with 10 M already circulating, implying limited future dilution but also exposing the token to supply‑side shocks if governance approves additional minting. Third, community sentiment, as gauged by Discord activity and Twitter mentions, shows a modest but growing interest, yet the lack of substantive developer updates signals a potential stagnation risk. Fourth, the price discrepancy between Binance and Coinbase-over 130 %-creates an arbitrage play, but the zero 24‑hour volume dramatically reduces execution confidence. Finally, regulatory risk remains pronounced, especially for assets operating on L2 solutions that may fall into gray‑zone compliance. In sum, a cautious allocation coupled with vigilant monitoring of governance proposals is advisable for any investor considering exposure to DOB.

Carthach Ó Maonaigh

July 16, 2025 AT 22:11Yo, if you’re not checking the volume, you might as well be buying air.

Ciaran Byrne

July 19, 2025 AT 01:51Thanks for the breakdown; I’ll keep an eye on the governance updates.

Brooklyn O'Neill

July 21, 2025 AT 05:31Interesting points, everyone. It’s good to see a balanced discussion.