TRUST AI Risk Assessment Tool

TRUST AI Risk Assessment

Assess the feasibility of investing in TRUST AI (TRT) based on verified market data and risk factors from the article.

TRUST AI (TRT) sounds like the next big thing in crypto: artificial intelligence meets blockchain, monthly payouts, no-code tools, and a futuristic roadmap. But behind the flashy promises, there’s a very different story. This isn’t a breakthrough project. It’s a high-risk micro-cap token with unverified claims, shaky data, and red flags that most experienced investors would avoid.

What TRUST AI (TRT) actually is

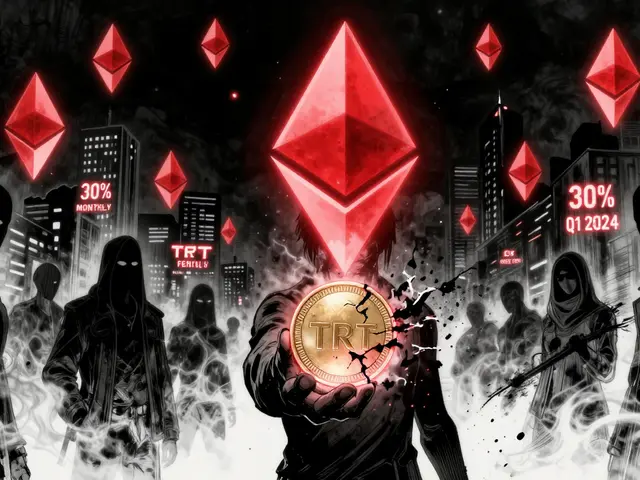

TRUST AI (TRT) is an ERC-20 token built on the Ethereum blockchain, with some reports saying it also works on Arbitrum. It’s not a standalone blockchain or a new protocol. It’s just a digital token meant to be used inside a platform that doesn’t appear to exist in any usable form. The team behind it is anonymous. No founders, no company name, no GitHub repository with real code. That alone should raise alarms.

According to tokenomics data from CoinMarketCap, CoinGecko, and MEXC, the circulating supply is 3.8 million TRT out of a maximum 21 million. That means nearly 82% of all tokens are still locked up - possibly in the hands of the team or early investors. The market cap hovers around $1 million, which puts it in the bottom 1% of all cryptocurrencies by size. For comparison, Fetch.ai (FET), a real AI-focused crypto project, has a market cap over $500 million.

The promises that don’t add up

TRUST AI claims to offer a 30% monthly revenue share to token holders. That sounds incredible - until you look at the evidence. There’s no public ledger showing payments being made. No transaction hashes from smart contracts distributing funds. No verified wallet addresses receiving payouts. Users on Reddit and CryptoSlate are reporting they’ve held TRT for months and never received a single cent.

Another claim is that TRUST AI lets you build smart contracts without coding. But there’s no working platform to test this. No demo. No documentation. No tutorials. Just a vague description on CoinMarketCap’s project page that reads like marketing copy, not a technical spec.

Then there’s the AI part. Where is the AI? No research papers. No open-source models. No API endpoints. No integration examples. Not even a single blog post from the team explaining how their AI works. In a space where even small projects publish technical whitepapers, TRUST AI’s silence speaks volumes.

Market data tells a troubling story

The price data for TRT is all over the place. CoinMarketCap says it hit $11.52 in February 2025 - but that’s a future date. It’s December 2025 right now, so that number is impossible. That’s not a typo. It’s a sign the data is either manipulated or pulled from a fake exchange.

Real-time prices vary wildly too. CoinGecko shows TRT at $0.2292, while CoinMarketCap lists it at $0.246. Trading volume? One source says $524,000 in 24 hours. Another says $4,400. That kind of inconsistency is a classic sign of wash trading - where bots buy and sell the same token among themselves to fake demand.

And the liquidity is terrifying. The top 10 wallets hold over 63% of all TRT in circulation. That means a handful of people can crash the price with a single sell order. If those wallets decide to dump, there’s no deep order book to absorb the shock. You’ll be stuck holding a token that nobody wants.

Who’s holding it - and why it’s dangerous

There are only 1,520 wallet addresses holding TRT. That’s fewer than a small apartment building has residents. Compare that to Fetch.ai, which has over 185,000 holders. This isn’t a community. It’s a tiny group of speculators and possibly the project team itself.

On Reddit, users have posted screenshots of failed withdrawal attempts from MEXC and Bybit. One user said they waited 72 hours for customer support to reply - and got no answer. Another reported their transaction failed three times in a row during a price spike. These aren’t isolated complaints. They’re patterns.

Even the exchanges listing TRT are questionable. MEXC and Bybit are known for listing low-quality tokens with high volatility. They’re not reputable platforms like Coinbase or Kraken. If you’re buying TRT on one of these exchanges, you’re already in a riskier environment.

Why experts are warning against it

No major crypto research firms like Messari or Delphi Digital mention TRUST AI. That’s not an accident. These firms analyze hundreds of tokens every quarter. If TRUST AI had real tech, a solid team, or real adoption, they’d be talking about it.

CryptoTotem’s analysis calls it “high risk” with a “neutral” sentiment. CoinMarketCap’s technical indicators show a “Strong Sell” across daily, weekly, and monthly charts. TradingView polls show 67% of users are bearish. Even the token’s own documentation is described as “incomplete” by 68% of users surveyed on CryptoSlate.

And then there’s the legal side. The project restricts users from 15 countries, including Belarus and American Samoa. Why? Because they’re avoiding regulators. That’s not a feature - it’s a red flag. Legitimate projects don’t exclude users based on geography unless they’re trying to dodge compliance.

How to get TRT - and why you shouldn’t

If you still want to buy TRT, here’s how: sign up on MEXC or Bybit, complete KYC, deposit USDT or ETH, and trade for TRT. But that’s the easy part. The hard part is what happens after.

You won’t be able to use any of the promised AI tools. You won’t get the 30% monthly payout. You won’t find reliable support. And when the price drops - and it will - you’ll have nowhere to sell. The trading volume is too low. The order book is shallow. You’ll be stuck.

There’s no roadmap with milestones. No developer updates. No progress reports. Just vague promises of an “AI-powered DEX in Q1 2024” and an “NFT marketplace.” It’s been over a year since those promises were made. Nothing.

The bottom line

TRUST AI (TRT) is not a cryptocurrency you invest in. It’s a gamble with near-zero chance of payoff. It has no working product, no transparent team, no verifiable technology, and no real community. The only thing it has is a flashy name and a few fake price charts.

There are hundreds of legitimate AI crypto projects with real teams, open code, and growing user bases. If you’re interested in AI + blockchain, look at Fetch.ai, SingularityNET, or Ocean Protocol. They have track records. TRUST AI has nothing but promises.

Don’t be fooled by the hype. If something sounds too good to be true - and it’s backed by silence - it is.

Is TRUST AI (TRT) a scam?

TRUST AI isn’t officially labeled a scam by regulators, but it has nearly all the hallmarks of one: anonymous team, unverified claims, fake price data, low liquidity, and no working product. Users report not receiving promised payouts, and there’s zero technical evidence supporting its AI claims. Treat it as extremely high risk.

Can I earn 30% monthly with TRUST AI?

No credible evidence supports this claim. No smart contract logs, no public transaction records, and no verified wallet addresses receiving payments. Multiple users on Reddit and CryptoSlate say they’ve held TRT for months and never received a payout. This appears to be a marketing tactic to attract buyers.

Where can I buy TRUST AI (TRT)?

TRT is listed on MEXC, Bybit, and a few small, unverified exchanges. It’s not available on Coinbase, Kraken, or Binance. These platforms avoid low-liquidity, high-risk tokens. If you buy TRT, you’re limited to exchanges with poor reputations and weak security standards.

Is TRUST AI built on Ethereum?

Yes, TRUST AI is an ERC-20 token on the Ethereum blockchain, with some sources claiming Arbitrum compatibility. But being on Ethereum doesn’t make it safe or legitimate. Many scams use Ethereum because it’s widely supported. The network itself is secure - the token is not.

What’s the real market cap of TRUST AI?

Current market cap is between $935,000 and $1.04 million, based on circulating supply and price data from CoinMarketCap and CoinGecko. But the fully diluted valuation (FDV) is around $5.16 million - meaning if all 21 million tokens were in circulation, the value would be over five times higher. That gap suggests massive future selling pressure if those tokens are ever released.

Should I invest in TRUST AI (TRT)?

No. TRUST AI lacks transparency, real technology, and community trust. The risks far outweigh any potential reward. Even if the price rises temporarily, the lack of liquidity means you won’t be able to sell when you want to. Stick to projects with open-source code, verified teams, and real adoption.

Nora Colombie

December 4, 2025 AT 09:20This TRT thing is a joke. I’ve seen this exact playbook in every pump-and-dump scam since 2017. Anonymous team? Check. Fake price charts? Check. No code? Check. And now they’re using AI as a buzzword to fool newbies. If you’re buying this, you’re not investing-you’re donating to a guy in a basement with a Canva slide deck. 🤡

Bhoomika Agarwal

December 5, 2025 AT 03:2330% monthly? Bro, that’s not yield, that’s a pyramid with a blockchain sticker on it. I’ve seen more real innovation in my aunt’s WhatsApp group than in this ‘AI’ project. The only thing this token is good for? Fueling the next meme coin. 🤭

Katherine Alva

December 5, 2025 AT 04:48It’s wild how easily we’re seduced by shiny labels. ‘AI’ doesn’t mean smart. ‘Blockchain’ doesn’t mean secure. ‘Monthly payouts’ doesn’t mean real. This is capitalism’s version of a magic trick-distract with glitter, hide the hole. We keep falling for it because we want to believe in easy wealth. 😔

Nelia Mcquiston

December 5, 2025 AT 20:49There’s a difference between skepticism and cynicism. This project has zero transparency, zero code, zero community, and zero credibility. The fact that people still trade it shows how desperate we’ve become for quick wins. We’re not just investing in tokens-we’re investing in hope. And hope doesn’t pay bills.

Murray Dejarnette

December 6, 2025 AT 22:29Man I just bought 500 TRT last week. Thought I was getting in early. Now I’m reading this and my stomach’s in knots. But hey, maybe I’m just late to the party? Like, what if this is the one that actually makes it? 😅

Philip Mirchin

December 7, 2025 AT 10:14Hey, I get it-you’re scared. But don’t let fear make you blind. I’ve seen legit projects start with nothing. Maybe TRT’s team is just quiet because they’re building in stealth? I’m not saying it’s safe, but don’t dismiss it just because it’s weird. Give it time.

Maggie Harrison

December 7, 2025 AT 20:02Y’all are acting like this is the end of crypto. 😭 It’s just one bad apple. Look at the bigger picture-AI + blockchain is REAL. We just need to filter out the noise. TRT? Yeah, it’s trash. But don’t throw out the whole basket. Keep looking. There are real gems out there. 💎

Lawal Ayomide

December 8, 2025 AT 06:56TRT? Never heard of it. But I know one thing-Nigeria’s crypto scene is way ahead of this nonsense. We don’t need fake AI. We need real access. This is a scam made for Americans who think crypto is a lottery.

Akash Kumar Yadav

December 9, 2025 AT 03:44LOL you think this is bad? Wait till you see the Indian AI coins that are actually mining crypto on your phone while you scroll TikTok. TRT is a kindergarten project. Real AI tokens have patents, not PowerPoint decks.

samuel goodge

December 9, 2025 AT 10:11Let’s be precise: the market cap is approximately $980,000, based on an average of CoinGecko ($0.2292) and CoinMarketCap ($0.246). The 24-hour volume discrepancy-$524K vs. $4.4K-is a textbook wash-trading signature. The top 10 wallets holding 63%? That’s not decentralization. That’s a cartel. And the future-dated price? That’s not an error. That’s fraud.

alex bolduin

December 10, 2025 AT 02:42Everyone’s so quick to call it a scam but nobody’s asking why people still buy it. Maybe it’s not about the tech. Maybe it’s about the story. We don’t want facts-we want a dream. And TRT sells dreams better than any whitepaper ever could

Vidyut Arcot

December 11, 2025 AT 20:18Don’t give up on AI crypto because of this. I’ve been in this space since 2020. I’ve seen dozens of these. Most die. But a few change everything. If you’re new, start small. Learn. Don’t panic. The real winners are the ones who keep studying, not the ones who scream the loudest.

Jay Weldy

December 13, 2025 AT 01:16I used to think crypto was about innovation. Now I think it’s about storytelling. TRT isn’t a coin-it’s a myth. And myths are powerful. People don’t need facts to believe. They need hope. And that’s the real danger here.

Melinda Kiss

December 13, 2025 AT 07:16I just want to say-thank you for writing this. I’ve been researching TRT for weeks, and I kept hoping I’d find something positive. This post saved me from losing money. I’m so grateful. 💙

Ankit Varshney

December 13, 2025 AT 11:52I bought TRT because I thought the AI part was legit. Now I’m realizing I didn’t even check if the team had a LinkedIn. My bad. Lesson learned.

Ziv Kruger

December 14, 2025 AT 14:55They listed TRT on MEXC? That’s like putting a plastic diamond in a Tiffany box and calling it jewelry. The exchange doesn’t care if it’s real. They just want trading fees. Don’t blame the token-blame the system that lets this happen

Catherine Williams

December 15, 2025 AT 17:30For anyone new to crypto: if you don’t understand how it works, don’t invest. If you can’t find a GitHub repo, walk away. If the team hides behind anonymity, run. This isn’t FOMO-it’s a trap. You’re not missing out. You’re avoiding disaster.

Paul McNair

December 16, 2025 AT 14:03It’s not just about TRT. It’s about how we, as a community, respond to scams. Do we educate? Or do we just laugh and move on? I’ve seen people lose life savings to this stuff. We owe it to each other to speak up-not just when it’s trendy, but when it matters.

Mohamed Haybe

December 18, 2025 AT 13:06Why are you all so mad? It’s just crypto. If you lose money, you were never meant to have it. I bought TRT. I’m holding. If it goes to zero? Fine. If it goes to $10? I’m rich. Life’s a gamble. Stop acting like you’re moral police.

Marsha Enright

December 19, 2025 AT 14:47Thank you for this breakdown. I shared it with my cousin who just invested $3k into TRT. She’s now pulling out. One honest post can save someone from real harm. Keep doing this.

Andrew Brady

December 19, 2025 AT 17:48They’re using AI to manipulate the market. This isn’t a token-it’s a government-backed surveillance tool. The anonymous team? They’re working with the Fed. The fake price data? It’s to track your wallet movements. You’re being monitored. Don’t buy TRT. Don’t even look at it. They’re watching.