The AB coin, also known as AB, isn't another speculative crypto gamble. It doesn't promise to make you rich. It doesn't give you voting rights. And it certainly doesn't pay dividends. If you're looking for a coin that behaves like Bitcoin or Ethereum - with price swings, governance votes, or yield farming - you're looking in the wrong place. AB is something else entirely: a utility token built for one job and one job only - keeping a blockchain network running.

What AB actually does

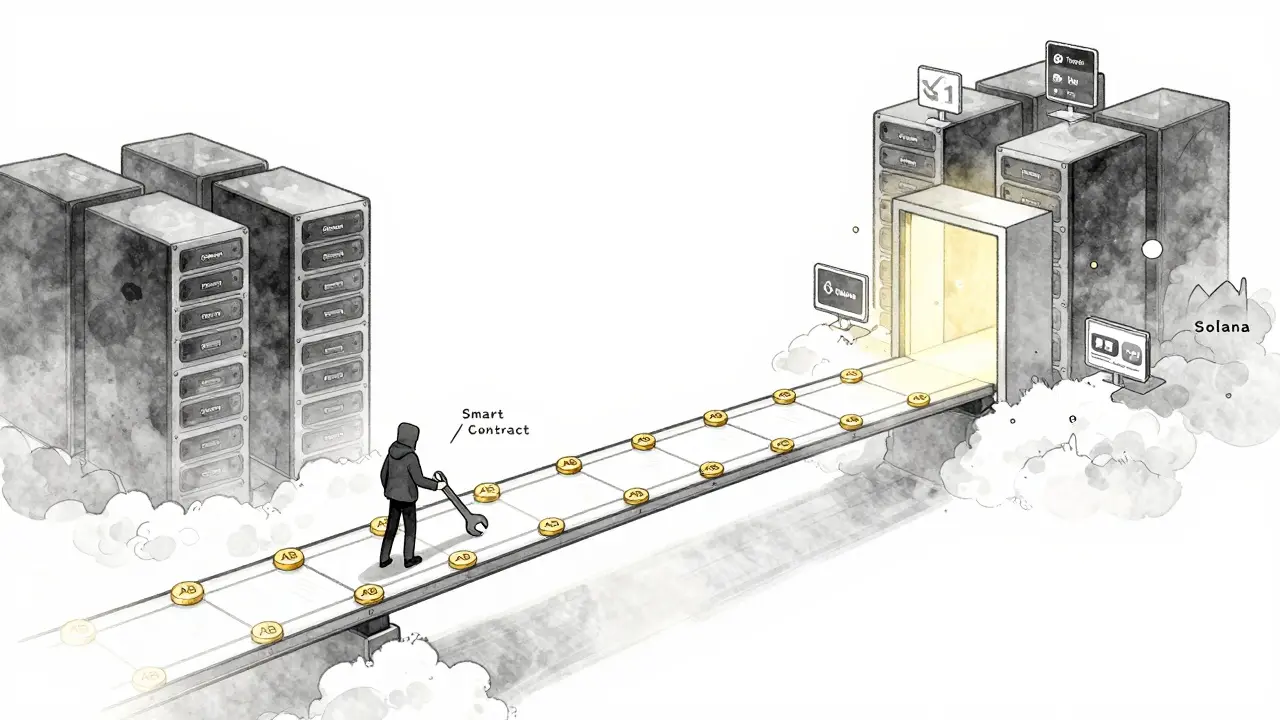

AB is the fuel for the AB blockchain, a platform that started as the Newton Project back in 2018. Think of it like electricity for a power grid. You don't buy electricity to invest in the power company. You buy it because you need to run your fridge, charge your phone, or power your lights. AB works the same way. Every time someone sends a transaction, deploys a smart contract, or interacts with an app on the AB network, they pay a fee in AB tokens. That fee pays for the computing power needed to process the action.

There's no mystery here. No complex financial structure. No hidden promise of future value. The AB whitepaper is blunt: AB tokens have no governance functions. They don't entitle you to anything beyond access to the network. You can't vote on upgrades. You can't earn staking rewards. You can't use them to claim profits from the network. They are not an investment. They are a tool.

How AB powers cross-chain connectivity

One of the biggest technical claims behind AB is its ability to move assets between blockchains - without needing to swap tokens or pay gas fees in multiple currencies. This is handled by something called the UTP protocol. It lets users pay transaction fees using stablecoins like USDT or USDC, or even real-world assets like gold-backed tokens. The AB network handles the rest behind the scenes.

For example: you can send USDT from your wallet directly to a Solana address, and AB’s system automatically converts the fee into AB tokens to cover the Solana network’s gas cost. You never touch AB. You just use what you already have. This removes friction. It lowers the barrier for everyday users who don’t want to juggle multiple tokens just to send money.

AB connects to Ethereum, Tron, Binance Smart Chain, and Solana. It also supports Bitcoin, Litecoin, and Dogecoin transfers. That’s not because AB wants to be a crypto exchange. It’s because it’s trying to be the plumbing underneath all these networks - a neutral, interoperable layer that just works.

The infrastructure behind AB

The AB blockchain isn’t just one chain. It’s a modular system with multiple components:

- AB Chain: The core network where transactions happen.

- AB Wallet: A tool for managing assets and making fast trades.

- AB Explorer: A public tool to view every transaction on the network.

- AB Connect: Makes AB tokens usable across apps and services.

- NFT Viewer: Lets users track and manage non-fungible tokens on the AB Chain.

- Stablecoin and Payments Layer: Designed for real-world use cases like tipping, shopping, or remittances.

All of these tools are built to be used by developers and businesses - not investors. The AB Foundation doesn’t market these as money-making opportunities. Their website clearly states: "Documentation is for technical information purposes only and does not constitute investment advice."

Supply and distribution: No speculation allowed

AB has a fixed supply of 100 billion tokens. That’s a lot. But here’s the catch: none of these tokens were sold to the public as an investment. The distribution is controlled by smart contracts designed to fund network operations - not to create a speculative market.

Starting in February 2025, tokens from the infrastructure reserve began being released on a set schedule. These go to validators (the computers that keep the network running), security auditors, and developers maintaining the code. There’s no mining. No airdrops to early adopters. No token sales to venture funds. The entire distribution is automated, transparent, and tied to technical needs.

If you bought AB on MEXC or another exchange, you’re trading a token that was never meant to be traded. The market price is entirely driven by speculation - not utility. That’s not the fault of AB. It’s the fault of people who treat infrastructure like a stock.

Why confusion exists

Here’s the messy part: AB isn’t the only project using the "AB" ticker. On MEXC, you’ll find listings that call AB a "community economy ecosystem" with "governance functions." That’s misleading. The official whitepaper says the opposite. Other projects like ABcoin and AB DeFi on Solana also use the same symbol. It’s a branding mess.

Some exchanges promote AB as if it’s a DeFi coin with staking rewards. The AB Foundation doesn’t control those listings. They don’t approve them. They don’t benefit from them. The whitepaper even warns users: "AB tokens are provided as-is without any warranties or guarantees of functionality, value, or fitness for any particular purpose."

Who should care about AB?

If you’re a developer building a game, payment app, or IoT service - AB might be worth looking at. Its modular design lets you plug into a cross-chain network without dealing with 10 different gas fees. If you’re a business trying to accept crypto payments without the volatility, AB’s UTP protocol could simplify things.

If you’re a retail investor hoping AB will 10x? You’re misunderstanding the whole point. AB doesn’t need to rise in price to succeed. It just needs to get used. The more apps and services that rely on it, the more value the network gains - not the token.

Compare it to HTTP. Nobody buys HTTP to make money. But the entire internet runs on it. AB is trying to be the HTTP of blockchain infrastructure. It’s not glamorous. It’s not flashy. But if it works, it’ll be everywhere.

What you should know before buying AB

- AB has no governance. You can’t vote on anything.

- AB doesn’t pay staking rewards. Any claims otherwise are false.

- AB’s value is tied to network usage - not speculation.

- Multiple projects use the AB ticker. Always check the official website (ab.org) before acting.

- Buying AB on an exchange is purely speculative. The AB Foundation doesn’t endorse trading.

- AB is not a security. It’s a utility token with no legal guarantees.

The AB blockchain could become a backbone for decentralized apps across payments, gaming, and finance. But that only happens if developers build on it - not if traders buy it.

Is AB coin a good investment?

No, AB is not designed as an investment. It’s a utility token meant to pay for network fees. Any price movement is driven by speculation, not fundamentals. The AB Foundation explicitly states that AB tokens carry no guarantees of value or future functionality. If you’re looking for returns, AB is not the right choice.

Can I use AB to pay for transactions on other blockchains?

Not directly. But through the UTP protocol, you can use stablecoins like USDT or USDC to send assets across blockchains, and AB will automatically cover the underlying gas fees. You don’t need to hold AB to use the system - it works behind the scenes.

Is AB the same as Newton?

Yes. AB is the updated name for the Newton Project, which launched in 2018. The token symbol remained AB, and the core technology stayed the same. Some exchanges still list it as "Newton (AB)" - but it’s the same asset.

Does AB have staking or yield features?

No. The official whitepaper confirms AB has no staking, yield, or profit-sharing features. Any platform claiming to offer staking rewards with AB is either mistaken or misleading users. The AB Foundation does not support or endorse such activities.

Why is AB trading on exchanges if it’s not meant to be traded?

Exchanges list AB because there’s demand - even if it’s based on misunderstanding. The AB Foundation doesn’t control these listings. They don’t profit from them. Their stance is clear: AB is a technical utility, not a tradable asset. Trading AB is risky and goes against the project’s intended purpose.

Can I build apps on the AB blockchain?

Yes. The AB blockchain is designed for developers. It supports smart contracts, cross-chain asset transfers, and integration with real-world assets. Comprehensive documentation is available on ab.org for building payment systems, gaming platforms, IoT services, and DeFi tools - all without relying on native token speculation.