The MVRV ratio isn’t just another crypto metric-it’s one of the most reliable indicators for spotting when the market is overheating or hitting rock bottom. Unlike price charts or technical indicators, MVRV looks at what actual investors paid for their coins, not just what they’re worth today. This simple but powerful idea has helped top analysts predict Bitcoin’s biggest rallies and crashes since 2013. If you’ve ever wondered why some traders sell at the top or buy at the bottom, the MVRV ratio often holds the answer.

What Is the MVRV Ratio?

The MVRV ratio stands for Market Value to Realized Value. It’s calculated by dividing Bitcoin’s total market cap by its realized cap. Market cap is easy: current price multiplied by how many coins are in circulation. Realized cap is trickier-but more meaningful. It adds up the price at which every single Bitcoin was last moved on the blockchain. If someone bought a Bitcoin for $10,000 and hasn’t touched it since, that coin still counts as $10,000 in realized value-even if the price is now $70,000.

This means MVRV tells you whether the market is pricing coins based on recent hype or actual cost basis. When MVRV is above 3.5, most coins are sitting at big profits. When it drops below 1.0, most coins are underwater. That’s not speculation-it’s math based on real on-chain behavior.

How MVRV Has Predicted Major Market Turns

Since 2013, Bitcoin has gone through four full bull-bear cycles. MVRV nailed every single one.

- In late 2017, MVRV hit 3.7 just before Bitcoin peaked at nearly $20,000. Within months, the price crashed over 80%.

- In December 2021, MVRV soared to 4.2 as Bitcoin hit $69,000. The subsequent 75% drop over the next year didn’t catch anyone off guard if they were watching this metric.

- At the bottom of the 2022 bear market, MVRV dropped to 0.82 in June 2022. That’s when most holders were losing money. Bitcoin rebounded over 150% in the next 10 months.

- Even during the chaotic March 2020 crash, MVRV fell to 0.82-right before the biggest rally in crypto history.

These aren’t coincidences. Santiment’s backtesting across five cycles showed MVRV correctly identified market tops and bottoms with 92% accuracy. That’s better than most technical indicators used in traditional markets.

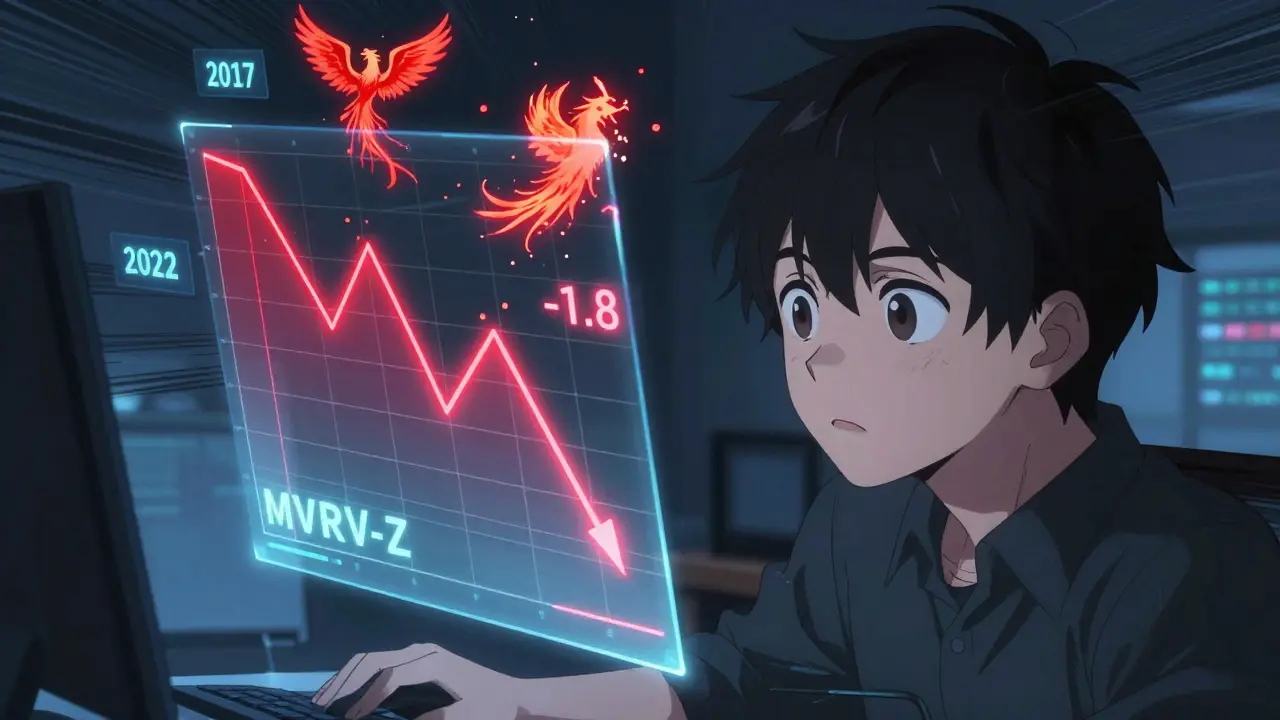

MVRV-Z Score: Why the Simple Ratio Isn’t Enough

Here’s where things get smarter. The basic MVRV ratio changes over time. The same number meant something different in 2017 than it does in 2025. That’s why analysts now use the MVRV-Z score.

The Z score measures how many standard deviations the current MVRV is from its historical average. A Z score above +3 means the market is extremely overvalued compared to its own history. A Z score below -1.5 signals extreme undervaluation.

- In 2017, the MVRV-Z score peaked at +6.3-unheard of in prior cycles.

- In 2022, it hit -1.8, the deepest since 2015.

This adjustment makes MVRV more reliable across cycles. It removes the noise of long-term price growth and focuses purely on sentiment extremes.

Why MVRV Beats Other Crypto Metrics

There are dozens of crypto valuation tools out there. But most have flaws.

The Stock-to-Flow model, for example, assumes scarcity alone drives price. It predicted Bitcoin would hit $100,000 after the 2020 halving. It was wrong-by a lot. MVRV, on the other hand, reflected the actual market psychology during that time: low conviction, slow accumulation. Price didn’t surge until MVRV started climbing in 2021.

NVT (Network Value to Transactions) measures how much value the network handles per transaction. But during bear markets, transactions drop even if people are holding. That makes NVT misleading.

MVRV doesn’t care about transactions or supply schedules. It only asks: What did people pay? That’s why it’s called the “thermometer for market cycles” by Glassnode. It measures the collective emotional state of the market.

How to Use MVRV in Practice

You don’t need a PhD to use MVRV-but you do need the right tools and context.

Free options like Bitbo.io and Santiment’s free tier give you daily or weekly MVRV charts. Professional platforms like Glassnode and CryptoQuant offer deeper analytics, including MVRV-Z scores and confidence bands.

Here’s how to avoid common mistakes:

- Don’t trade on a single number. MVRV above 3.5 doesn’t mean sell immediately. Look at the trend. Is it accelerating? Is it holding above 3.5 for weeks? That’s a warning.

- Combine it with other metrics. The most effective combo is MVRV + NUPL (Net Unrealized Profit/Loss) + Exchange Netflow. If MVRV is high, NUPL is positive, and coins are flowing onto exchanges, that’s a strong distribution signal.

- Watch for false signals. During extreme volatility like the 2020 crash, MVRV can glitch. Always check if large holders are moving coins. If SOPR (Spent Output Profit Ratio) is low, even a high MVRV might not mean a top.

- Understand cycle stage. In early bull markets, MVRV crossing 2.5 might be normal. In late cycles, even 3.2 can be dangerous. Glassnode’s 2023 update adjusted thresholds based on halving cycle stage-something earlier models ignored.

Who Uses MVRV-and Why

MVRV isn’t just for retail traders. It’s embedded in the strategies of the biggest players.

- 87% of the top 100 crypto hedge funds use MVRV in their decision-making, up from 32% in 2019.

- 41 of the 100 public companies holding Bitcoin (like MicroStrategy) use MVRV to time their buys, especially when it drops below 1.0.

- Over 78% of professional crypto analysts cite MVRV as a core tool, according to a 2023 CoinDesk survey.

Even regulators are taking notice. The EU’s MiCA rules, effective in 2024, require firms offering investment advice to disclose how they calculate metrics like MVRV. That means the metric is now officially part of the financial infrastructure.

Limitations and Future of MVRV

MVRV isn’t perfect. It’s less reliable for altcoins with low on-chain activity. It can lag during black swan events. And as more traders watch it, there’s a risk it becomes self-fulfilling-if too many people sell at MVRV 3.5, the market might crash even if fundamentals are strong.

MIT’s 2023 study found that if over 65% of trading volume reacted to MVRV signals, its predictive power could weaken. Currently, only 48% do-so it’s still safe.

The future is even more promising. CryptoQuant’s new “MVRV Confidence Bands” use Bayesian stats to give probability scores: e.g., “89% chance of reversal if MVRV hits 4.1.” Glassnode’s Dynamic Thresholds adjust automatically based on cycle stage. And early research is exploring how Lightning Network data could refine MVRV for short-term signals.

By 2027, Fidelity predicts 95% of institutional strategies will use MVRV inside AI models that analyze 50+ on-chain metrics. It won’t be used alone-but it will be at the center.

Final Takeaway: MVRV Is a Lens, Not a Crystal Ball

MVRV doesn’t tell you when to buy or sell. It tells you where the market is emotionally. Are people euphoric? Afraid? Indifferent?

Its power comes from being grounded in real data-what people actually paid, not what analysts guess. It’s not flashy. It doesn’t generate hype. But for those who’ve studied it across cycles, it’s one of the clearest signals in crypto.

Don’t chase it. Don’t panic when it spikes. Watch it. Understand it. Combine it. That’s how you turn raw data into edge.

What does an MVRV ratio above 3.5 mean?

An MVRV ratio above 3.5 means most Bitcoin holders are in significant profit. Historically, this has signaled the late stage of a bull market, often preceding a major price correction. It indicates widespread speculation and distribution pressure as investors look to cash out.

Is MVRV reliable for altcoins?

MVRV is far less reliable for altcoins than for Bitcoin. Most altcoins lack sufficient on-chain transaction history and have fragmented holder behavior, making realized value calculations noisy or inaccurate. MVRV was designed for Bitcoin’s mature, transparent network and works best there.

How do I access MVRV data for free?

You can view MVRV data for free on Bitbo.io (updated hourly) and Santiment’s free tier (weekly data). These platforms show historical trends and current values without requiring a subscription. For advanced metrics like MVRV-Z scores, paid tools like Glassnode or CryptoQuant are needed.

What’s the difference between market cap and realized cap?

Market cap is the total value of all coins at today’s price. Realized cap is the total value of all coins based on the price each one was last moved. Realized cap ignores speculative price swings and reflects the actual cost basis of holders, making it a more stable indicator of true market sentiment.

Can MVRV predict the next Bitcoin bull run?

MVRV doesn’t predict bull runs-it identifies when the market is overheated or under pressure. A low MVRV (below 1.0) often precedes a bull run because it signals capitulation and accumulation. But it won’t tell you when the rally starts. You need to combine it with other signals like exchange netflow, active addresses, and halving timing.

Why is MVRV better than price-to-earnings ratios in crypto?

Traditional P/E ratios rely on corporate earnings, which don’t exist in decentralized networks like Bitcoin. MVRV uses on-chain data-actual transactions and holder cost bases-to measure value. It’s not based on financial statements or forecasts; it’s based on what real people have done with their coins.

Aaron Heaps

December 21, 2025 AT 18:17Tristan Bertles

December 23, 2025 AT 11:37Earlene Dollie

December 24, 2025 AT 22:06Dusty Rogers

December 26, 2025 AT 19:00Kevin Karpiak

December 28, 2025 AT 14:52Amit Kumar

December 30, 2025 AT 06:40chris yusunas

December 30, 2025 AT 22:49Mmathapelo Ndlovu

December 31, 2025 AT 10:02Jordan Renaud

January 1, 2026 AT 18:12roxanne nott

January 2, 2026 AT 20:46Rachel McDonald

January 3, 2026 AT 13:54Vijay n

January 4, 2026 AT 23:14Alison Fenske

January 6, 2026 AT 20:57