El Salvador Bitcoin Legal Tender: What It Means for You

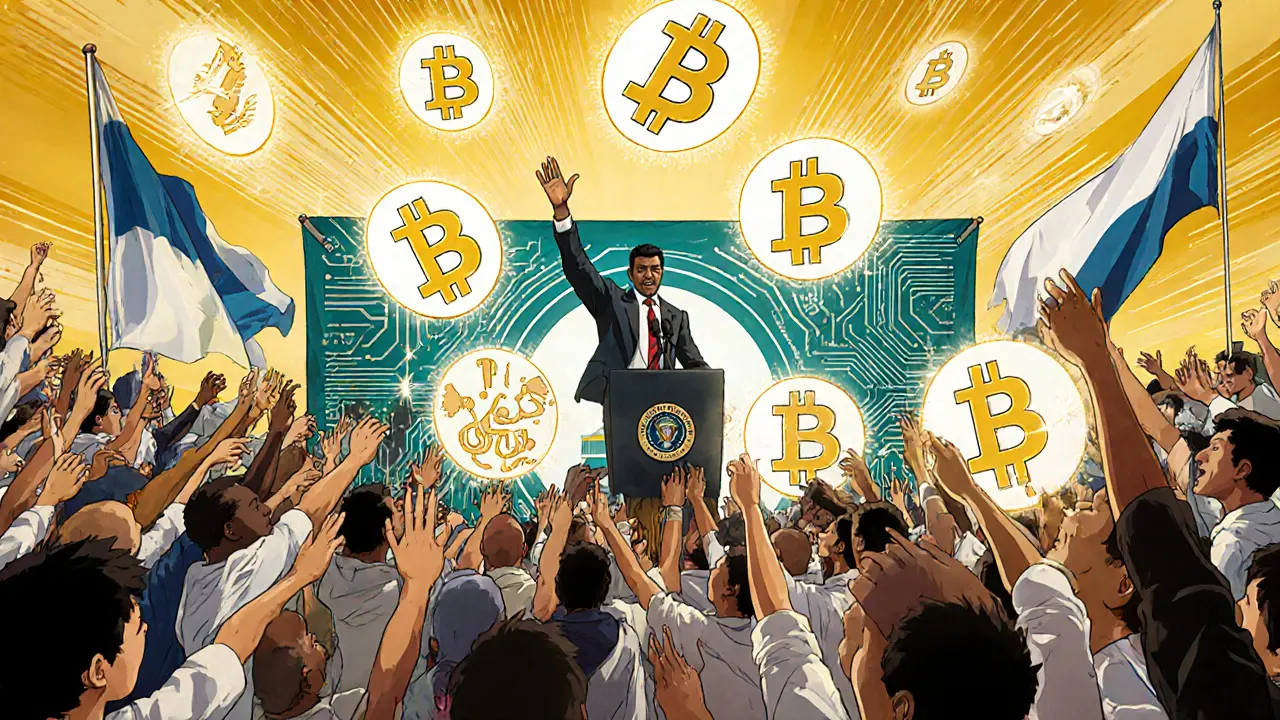

El Salvador Bitcoin legal tender is the 2021 law that made Bitcoin an official currency alongside the US dollar in the country. When working with El Salvador Bitcoin legal tender, the groundbreaking policy that forces merchants to accept Bitcoin and lets citizens pay taxes with it. Also known as Bitcoin as legal tender, it reshapes daily transactions and financial inclusion. This move ties directly to Bitcoin, the first decentralized cryptocurrency created in 2009, which runs on a peer‑to‑peer network without a central authority. The policy also brings the Central Bank, the national monetary authority that usually controls money supply into a new role of overseeing a digital asset. President Nayib Bukele, who championed the law and launched the state‑run Bitcoin wallet “Chivo”, argues the adoption will boost foreign investment, reduce remittance costs, and put the country on the map of crypto innovation.

Understanding the broader cryptocurrency regulation, the set of rules that governments apply to digital assets helps explain why El Salvador’s decision is both bold and controversial. While the law removes traditional barriers, it also forces regulators to grapple with anti‑money‑laundering (AML) compliance, tax reporting, and consumer protection in a space that lacks clear precedent. At the same time, the country’s embrace of Bitcoin has sparked a surge in Bitcoin mining, the process of validating transactions and securing the network by solving computational puzzles. New mining farms have popped up, promising jobs and energy revenue, but they also raise concerns about environmental impact and grid stability. The interplay between mining incentives, the legal tender status, and the Central Bank’s monetary tools creates a unique experiment: the government must balance price volatility, inflation control, and the growing demand for mining power. Moreover, the law influences other sectors—real‑estate agents now list prices in both dollars and Bitcoin, freelancers can invoice in crypto, and tourists enjoy the option to pay for hotels with digital coins. All these shifts illustrate how a single policy can ripple through finance, technology, and everyday life, forging a new ecosystem where traditional finance meets decentralized networks.

Below you’ll find a curated set of articles that break down every angle of this experiment. From deep dives into how mining pools work, to comparisons of blockchain data structures, to guides on new airdrops that leverage El Salvador’s crypto-friendly stance, the collection gives you practical insights and actionable tips. Whether you’re curious about the legal framework, want to gauge the economic impact, or are hunting for the next opportunity in the crypto space, the posts below will equip you with the knowledge you need to navigate the fast‑moving world of Bitcoin as legal tender.

A deep dive into El Salvador's Bitcoin legal tender experiment, its rollout, challenges, IMF‑driven reversal, and lessons for future crypto policies.

Read More