AOFEX Risk Assessment Tool

Regulatory Compliance

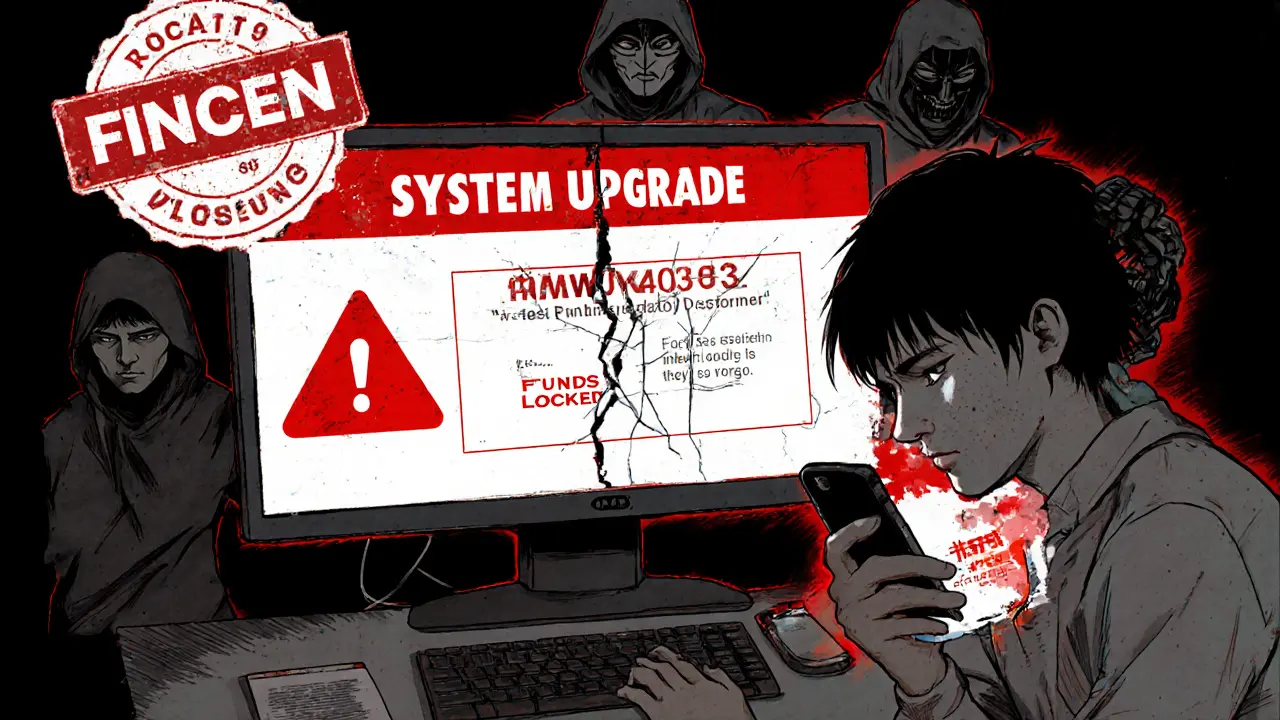

AOFEX had reported FinCEN violations and lacked proper licensing in many jurisdictions.

Transparency

No public audits or proof-of-reserves were ever published.

Leverage Offered

Offered up to 100x leverage, which is extremely risky without proper safeguards.

User Funds Safety

After the 'system upgrade', user funds were locked and support became inaccessible.

Platform Status

As of 2025, the platform is completely defunct with no recovery efforts.

Community Sentiment

Users reported negative experiences including no withdrawal capability and poor support.

Based on the indicators above, AOFEX presents a critical risk profile for investors and traders.

Key Takeaways

- AOFEX was flagged for regulatory violations and lacked transparency.

- It offered extremely high leverage without adequate risk management.

- After the 'system upgrade', user funds were locked and support became inaccessible.

- The platform ultimately shut down, making fund recovery impossible.

- This serves as a strong reminder to avoid unregulated exchanges with poor track records.

Recommendations

- Use regulated exchanges with clear licensing and audits.

- Avoid platforms promising excessive leverage without risk disclosures.

- Keep only necessary funds on exchanges; use hardware wallets for long-term storage.

- Verify community feedback and official regulatory standing before depositing.

Looking for an honest AOFEX review? Below you’ll find exactly what happened to the platform, the features it once offered, why it vanished, and what you can learn to stay safe.

What was AOFEX?

AOFEX was a cryptocurrency exchange that launched in 2019 and claimed to be the first platform to offer non‑standardized option trading. Headquartered in London with an office in Singapore, the service marketed spot, futures, margin, and even a decentralized‑exchange (DEX) component. According to archived data, the exchange listed over 370‑400 trading pairs, including major assets like Bitcoin (BTC), Ethereum (ETH), Tether (USDT) and its own token AQ. Users could buy crypto with fiat via a gateway that accepted USdollars, Chinese yuan, Japanese yen and a few other major currencies.

Core Features (When It Was Operational)

- Spot and futures trading across 400+ pairs.

- Margin trading with up to 100x leverage.

- Non‑standardized option contracts - a rare offering for a small exchange.

- Fiat on‑ramps for credit‑card purchases.

- Desktop web interface plus native mobile apps for iOS and Android.

- OTC desk for large‑volume purchases.

- Launchpad for new token sales.

During its peak, CoinMarketCap recorded a 24‑hour volume of about USD270million in June2021, climbing to roughly USD1.2billion by December2021. Those numbers look impressive on paper, but they hide a fragile infrastructure and limited regulatory oversight.

Red Flags & Regulatory Concerns

The first warning sign came from the lack of any public audit or proof‑of‑reserves. Unlike established platforms such as Binance or Coinbase, AOFEX never published transparency reports. Regulatory filings also turned sour: Wikibit noted an “Exceeded FinCEN license” issue, suggesting the exchange operated beyond the limits of its U.S. money‑transmitter registration.

In early 2022, the platform announced a “system upgrade” and went dark for ten days. When the site failed to reappear, community members on Reddit and Telegram labeled the event a “rug pull”. CaptainAltcoin published a scathing review titled “Aofex Review - WARNING Barely Legit, More Likely a Scam”, confirming that user funds were locked and the native token AQ became worthless.

Comparison with Major Exchanges

| Feature | AOFEX | Binance | Coinbase |

|---|---|---|---|

| Trading pairs | ~400 | >6,000 | >400 |

| Maximum leverage | 100x | 125x (futures) | 5x (margin) |

| Regulatory compliance | FinCEN violations reported | Global licenses, AML/KYC | U.S. charter, extensive audits |

| Proof‑of‑reserves | None disclosed | Periodic audits | Monthly attestations |

| Current status (2025) | Defunct - site offline | Active | Active |

User Experience & Community Feedback

Before its shutdown, users praised AOFEX’s slick UI and fast order execution. However, the positive sentiment vanished once withdrawals stopped. Posts on major crypto forums describe a common pattern:

- Deposit fiat or crypto into the exchange.

- Attempt to withdraw after the “upgrade” notice.

- Customer support becomes unresponsive - phone lines go dead, emails bounce.

- Funds remain locked indefinitely.

Many users reported total loss of their AQ tokens, which were rendered valueless after the platform ceased operations. The lack of a clear roadmap or recovery plan cemented AOFEX’s reputation as a scam.

How to Protect Yourself - Lessons Learned

- Prefer exchanges that publish regular third‑party audits and proof‑of‑reserves.

- Check for a valid money‑transmitter license in your jurisdiction (e.g., FinCEN in the U.S.).

- Avoid platforms that promise ultra‑high leverage without clear risk disclosures.

- Never keep more than a small portion of your portfolio on an exchange; use a hardware wallet for long‑term storage.

- Read community sentiment on multiple forums before depositing large sums.

Final Verdict

AOFEX entered the market with an ambitious feature set but never built the regulatory and security foundations required for lasting trust. Its sudden disappearance, coupled with confirmed FinCEN violations and a non‑functional support line, classifies the platform as a high‑risk, now‑defunct exchange. For anyone looking to trade crypto, steering clear of AOFEX and sticking with well‑established, audited exchanges is the safest route.

Frequently Asked Questions

Is AOFEX still operational?

No. As of 2025, multiple sources such as CoinCodex list AOFEX as a non‑operational exchange with no announced plans to reopen.

Can I recover funds I left on AOFEX?

Recovery is unlikely. The exchange’s support channels are offline, and there has been no legal or technical effort reported to return user assets.

What made AOFEX different from Binance or Coinbase?

AOFEX offered non‑standardized options and up to 100x leverage on a relatively small platform. It lacked the regulatory compliance, audit transparency, and extensive liquidity that big exchanges provide.

Should I trust other small‑cap crypto exchanges?

Treat every new exchange with caution. Verify licensing, audit reports, and community reputation before depositing significant funds.

What’s the safest way to store crypto long‑term?

Use a hardware wallet (e.g., Ledger or Trezor) and keep backup phrases offline. Keep only a small amount on exchanges for active trading.

Shaian Rawlins

December 3, 2024 AT 00:41It's scary how quickly a platform can go from hype to nightmare when the foundations are missing.

First, the lack of any audit makes it impossible to trust the numbers they brag about.

Second, the 100x leverage is a recipe for disaster for anyone without professional risk management.

The FinCEN violations are a red flag that should have stopped people from depositing at all.

When the "system upgrade" hit, users suddenly found their funds frozen, which is exactly what a rug pull looks like.

Even the slick UI can't hide the fact that the exchange never had proper licensing in most jurisdictions.

Community sentiment turned negative almost overnight, and that tells you a lot about hidden issues.

Keeping large sums on any exchange that doesn't publish proof‑of‑reserves is just asking for trouble.

By the time the platform disappeared, many traders had already lost significant capital.

Regulators are starting to take notice of such unregulated entities, which is a good sign for the market.

One of the biggest lessons here is that leverage should be used sparingly and only on reputable platforms.

Always diversify your holdings and keep the majority in a hardware wallet.

Never trust marketing hype over transparent data and audits.

If you spot a new exchange, do a deep dive into its licensing, AML policies, and community feedback.

The crypto space is still wild, but we can protect ourselves with due diligence.

Stay safe and keep learning from these cautionary tales.

Miranda Co

December 10, 2024 AT 09:31Look, I get the frustration, but you have to admit that ignoring basic compliance is just reckless. Those users deserved better, and the platform’s silence was unforgivable. I’d say it’s a clear warning sign for anyone chasing high leverage without checks. Stay vigilant.

Promise Usoh

December 17, 2024 AT 18:22In the grand schema of financial systems, an exchange such as AOFEX acts as a fleeting node, unanchored by regulatory legitimacy. Its abrupt dissolution reflects the inherent volatility of under‑regulated financial interludes. One might contend that the absence of audit trails exacerbates systemic risk, thereby inviting inevitable collapse.

Cathy Ruff

December 25, 2024 AT 03:12yeah that was total trash. nobody trusted them after the upgrade and the support vanished. they should have shut down before ruining everyone’s wallets.

Rob Watts

January 1, 2025 AT 12:03Leverage looks cool but it’s a gamble. No audits = no trust. Stay away.

mukesh chy

January 8, 2025 AT 20:53Oh please, another "cautionary tale"? Everyone knows crypto is risky. If you can’t handle 100x, maybe stick to saving in a piggy bank.

Katherine Sparks

January 16, 2025 AT 05:44Dear community, I truly feel for those affected by this collapse. It is disheartening to witness such missteps 🙁. Remember, transparency and auditability are paramount 😊. Always prioritize security over flashy offers.

stephanie lauman

January 23, 2025 AT 14:34One must consider the hidden agenda behind the sudden shutdown; perhaps elite entities orchestrated the failure to eliminate competition 😏. The lack of oversight is no accident; it is a deliberate design to siphon funds unnoticed.

Jim Griffiths

January 30, 2025 AT 23:25Use a hardware wallet for most of your crypto and only keep a small amount on exchanges for trading.

Taylor Gibbs

February 7, 2025 AT 08:15i think the biggest mistake was not checking the licence stuff early on. many people jump in without doing proper due dilligence.

Greer Pitts

February 14, 2025 AT 17:06yeah totally, i wish i had read the fine print before. lesson learned, gonna be more careful now.

Amy Harrison

February 22, 2025 AT 01:56Wow, what a rollercoaster! 😮 Stay safe and keep your crypto where you can actually see it! 🚀💎

Marc Addington

March 1, 2025 AT 10:47This is exactly why we need American crypto platforms that put national interests first. Foreign scams like AOFEX should never touch our investors.

Amal Al.

March 8, 2025 AT 19:37Friends, let us remember that vigilance is our greatest ally! Always verify licensing, and never ignore community alerts! Protect your assets with the highest diligence! 🙏

Alex Gatti

March 16, 2025 AT 04:28Check regs keep safe

Cathy Ruff

March 23, 2025 AT 13:18They were a total scam.

Eva Lee

March 30, 2025 AT 23:09From a systems architecture perspective, the platform's lack of modular redundancy and zero‑knowledge proof integration was a cardinal sin, rendering the entire ledger vulnerable to state‑inconsistent attacks.

Patrick MANCLIÈRE

April 7, 2025 AT 08:00Exactly, the missing sharding and lack of deterministic finality made it a perfect storm for failure. Users should demand transparent protocol specifications.

Ciaran Byrne

April 14, 2025 AT 16:50Always double‑check licensing.

Lurline Wiese

April 22, 2025 AT 01:41OMG, talk about a drama bomb! Who even trusts a platform that disappears faster than my Wi‑Fi when I’m streaming?