Crypto Price: Real‑Time Data, Airdrops, Mining Pools and More

When you talk about crypto price, the current market value of a digital asset expressed in fiat or another cryptocurrency. Also known as coin price, it updates every second as traders buy, sell, and react to news. Crypto price isn’t just a number; it’s a snapshot of market sentiment, liquidity, and network activity rolled into one. If you’re chasing a free token or running a mining rig, that snapshot decides whether you’re looking at a profit opportunity or a risky gamble. The moment you understand how this figure is built, you can start asking the right questions: where does the data come from, how fast does it change, and what events can push it up or down? This page breaks those questions down by linking the price to the biggest movers we see in the crypto world today.

Key Movers That Shape Crypto Price

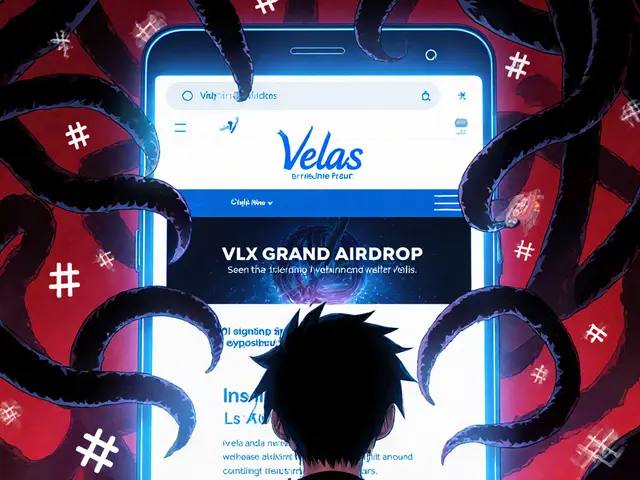

Airdrops, distribution events where projects give away tokens to community members for free or as a reward for certain actions. free token drops are a classic price catalyst. When a project announces an airdrop, new users rush to buy the underlying asset to qualify, creating a short‑term demand spike. That spike often translates into a noticeable bump in the crypto price, even if the long‑term fundamentals stay the same. Airdrops also widen the holder base, which can lead to more organic trading volume later on. In our collection you’ll find guides on how to claim airdrops like Midnight (NIGHT) or Coin98’s C98 holder rewards, showing exactly how these events can affect price charts.

Mining pools, groups of miners that combine their hash power to solve blocks more consistently and share the rewards play a quieter but equally important role. Higher pool participation usually means a more secure network, which builds confidence among investors. When pools increase their hash rate, it signals that miners expect the crypto price to stay strong enough to cover operational costs, which can buoy the price. Conversely, sudden drops in pool participation often foreshadow price declines because miners may be switching to more profitable coins. Our posts on cryptocurrency mining pools explain the inner workings, risks, and how pool rewards can indirectly support price stability.

Beyond airdrops and mining pools, the broader blockchain, the distributed ledger technology that records all transactions for a cryptocurrency and its security mechanisms shape price behavior. Validator nodes, for example, secure proof‑of‑stake networks; when more validators stake, the network becomes stronger, which can attract institutional interest and push price higher. Real‑time price feeds from major exchanges are the data backbone that powers dashboards, alerts, and trading bots. Accurate crypto price tracking requires reliable APIs, low latency, and redundancy to avoid spoofed data. Understanding these technical layers helps you interpret why a sudden price swing might be a data glitch, a delayed feed, or a genuine market reaction.

All of these pieces—airdrop hype, mining pool health, validator activity, and solid data pipelines—interlock to form the ecosystem that moves crypto price up and down. In the list below you’ll see deep dives that walk you through each factor, from step‑by‑step airdrop claims to mining pool comparisons and blockchain security overviews. Whether you’re a beginner trying to grasp why Bitcoin’s price jumps after a major news story, or a seasoned trader looking for the next price signal, the articles ahead give you practical insight you can act on right away.

Learn what DOB on Base is, how the token works, its marketplace utility, tokenomics, price differences, acquisition steps, risks, and future outlook in this detailed guide.

Read More