Deepcoin Leverage Calculator

Calculate Potential Outcomes with Deepcoin Leverage

Enter your investment amount, selected leverage, and price movement to see potential profits or losses.

Trading Outcome Summary

Initial Investment: $0.00

Leverage Used: 0x

Price Movement: 0.00%

Total Position Value: $0.00

Potential Profit/Loss: $0.00

New Account Balance: $0.00

Looking for a crypto platform that mixes ultra‑high leverage with the option to stay off the radar? Deepcoin review breaks down exactly what this Singapore‑based exchange offers, where it shines, and where it falls short, so you can decide if it fits your trading style.

What is Deepcoin?

Deepcoin is a cryptocurrency derivatives exchange registered in Singapore that launched on 11November2018. By early2023 the platform moved into the top‑5 globally for 24‑hour contract volume, handling roughly $13.3billion a day. While its core focus is on futures and perpetual contracts, Deepcoin also offers spot trading and a copy‑trading feature across more than 100 crypto assets.

Key Features at a Glance

- Derivatives‑first architecture with over 100 crypto pairs.

- Leverage up to 125:1 - among the highest in the market.

- Flat 0.1% maker and taker fee on both spot and contracts.

- Optional KYC - you can trade anonymously unless you need fiat on‑ramps.

- Fiat conversion via Simplex and Banxa (minimum $50 purchase).

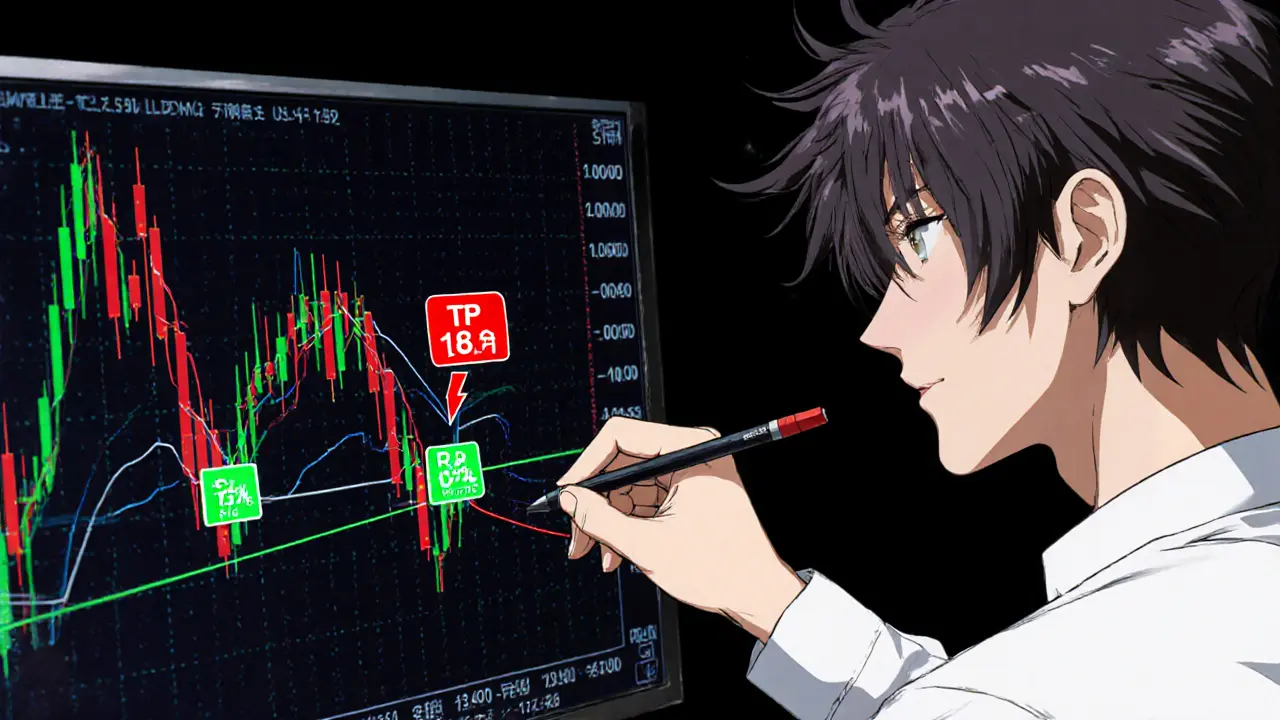

- Drag‑and‑drop TP/SL system supporting up to 50 orders per position.

How Deepcoin Handles Leverage and Risk

The platform’s 125:1 leverage lets you control $125,000 with just $1,000 of margin. That power comes with steep liquidation risk: a 0.8% adverse price move can wipe out a position at that level. To mitigate, Deepcoin provides built‑in automatic partial liquidation and a real‑time margin‑call visual on the chart. Advanced users appreciate the ability to set multiple take‑profit (TP) and stop‑loss (SL) orders - three distinct modes let you lock in gains at incremental price points or cascade SL levels as the trade moves in your favor.

Fee Structure - Who Pays More?

Both maker and taker fees sit at a flat 0.1% across spot and derivatives. Compared with rivals like Gate.io (0.05% maker, 0.15% taker) or Binance (0.02% maker, 0.04% taker for most pairs), Deepcoin’s fees are on the higher side for frequent limit‑order traders. However, for pure spot traders the fee is still competitive because many exchanges add tier‑based discounts only after locking in native tokens - a benefit Deepcoin deliberately avoids.

Anonymous Trading - A Double‑Edged Sword

Deepcoin’s optional KYC policy is its headline attraction. You can create an account, deposit crypto, and start trading without ever uploading an ID. This appeals to privacy‑focused users in regions with strict capital controls. The trade‑off is limited fiat support; you must purchase crypto elsewhere and transfer it on‑chain before you can trade on Deepcoin. For users who rely on direct bank deposits, this extra step adds friction and may increase overall cost due to fees on the third‑party fiat gateway.

Comparison with Leading Exchanges

| Feature | Deepcoin | Gate.io | Binance | Bybit |

|---|---|---|---|---|

| Leverage max | 125:1 | 100:1 | 125:1 | 125:1 |

| Spot fee (taker) | 0.1% | 0.15% | 0.04% | 0.075% |

| KYC required for trading | No (optional) | Yes | Yes | Yes |

| Fiat on‑ramp | Via Simplex & Banxa (min $50) | Direct bank, credit card | Direct bank, credit card, P2P | Direct bank, credit card |

| Number of crypto pairs | ~100 | 1,400+ | 2,000+ | 300+ |

| Trust score (independent) | 4.3 / 10 | 6.0 / 10 | 8.5 / 10 | 7.2 / 10 |

From the table you can see Deepcoin excels in leverage and anonymity but lags behind in asset variety, fee competitiveness, and overall trust scores. If you’re an experienced trader chasing high‑risk, high‑reward futures, Deepcoin’s edge may outweigh the downsides. Casual spot investors or newcomers might find Gate.io or Binance more user‑friendly.

User Experience - What Traders Say

Real‑world feedback highlights a clean, chart‑centric UI where TP/SL controls sit right on the price axis. Users love the ability to drag a line to adjust stop loss instantly, a feature praised by analysts at CryptoNinjas. On the flip side, reviewers on YouTube flag the higher maker fees and the lack of a native token for fee discounts. Customer support is limited to a live‑chat widget, which can be slow during peak market hours.

How to Get Started (Step‑by‑Step)

- Visit the official Deepcoin website and click “Register”.

- Enter an email address and set a strong password. No ID upload is required unless you plan to use fiat on‑ramps.

- Secure your account with two‑factor authentication (Google Authenticator or Authy).

- Deposit crypto by copying your Deepcoin wallet address (BTC, ETH, USDT, etc.) and sending funds from your external wallet.

- If you need fiat, click the “Buy Crypto” button and choose either Simplex or Banxa. Complete the KYC on that provider only.

- Navigate to the “Derivatives” tab, select a contract (e.g., BTCUSDT perpetual), set your desired leverage, and place a market or limit order.

- Use the on‑chart TP/SL tool to add multiple profit targets or stop levels before confirming the trade.

With these steps you can be trading in under ten minutes - a stark contrast to exchanges that demand weeks of document verification.

Risk Management Tips for High‑Leverage Users

- Never risk more than 1‑2% of your account on a single position.

- Start with lower leverage (e.g., 10‑20:1) until you’re comfortable with liquidation thresholds.

- Set a “hard stop” at 50% of your margin to avoid a full wipe‑out.

- Use the multi‑TP feature to take profits gradually instead of aiming for a single target.

- Keep a small reserve of stablecoins for margin calls; moving funds from a spot wallet to the futures wallet is instant on Deepcoin.

Is Deepcoin Worth Your Time?

If you value privacy, crave the highest leverage on major contracts, and are comfortable managing liquidation risk, Deepcoin lands in the ‘yes’ column. If you prioritize a massive selection of altcoins, lower fees for limit orders, or a robust support system, you may lean toward larger rivals. The platform’s growth-over one million users and a top‑5 contract volume rank-shows it’s not just a niche experiment; it’s an established player in the derivatives arena.

Frequently Asked Questions

Does Deepcoin require KYC for crypto trading?

No. You can open an account, deposit crypto, and start trading without any identity verification. KYC is only needed if you use the Simplex or Banxa fiat on‑ramp services.

What is the maximum leverage available on Deepcoin?

The platform offers up to 125:1 leverage on major perpetual contracts such as BTC/USDT and ETH/USDT.

How do Deepcoin’s fees compare to other exchanges?

Both maker and taker fees are a flat 0.1% on spot and derivatives. This is higher than Binance’s 0.04% taker fee but comparable to many mid‑size platforms. The fee advantage disappears if you heavily use limit orders due to higher maker fees.

Can I withdraw fiat directly from Deepcoin?

No. Withdrawals are limited to cryptocurrencies. To get fiat you must first sell crypto on an exchange that supports fiat withdrawals.

Is there a native token that offers fee discounts?

Deepcoin does not have a native utility token, so there are no built‑in fee‑reduction programs like those found on Binance (BNB) or Bybit (BIT).

Bottom Line

Deepcoin sits at the intersection of high‑risk derivatives trading and privacy‑first onboarding. Its 125:1 leverage, drag‑and‑drop TP/SL tools, and optional KYC make it a strong candidate for seasoned traders who are comfortable with fast‑moving markets. For beginners or users who need a wide array of altcoins and low‑cost fiat options, other exchanges may deliver a smoother experience. The choice ultimately hinges on whether you value anonymity and leverage over breadth of assets and lower fees.

Patrick MANCLIÈRE

August 27, 2025 AT 19:33Alright folks, let me break down why Deepcoin’s 125:1 leverage is a double‑edged sword. The margin call visual is snazzy, but you’ve got less than a 1% move to get liquidated on max leverage. If you’re new, start at 10‑20x and scale up only after you’ve tested the partial‑liquidation feature. Remember, using stop‑loss orders on each tier can save you from a nasty wipe‑out.

Eva Lee

August 27, 2025 AT 21:46When you dive into the order‑book depth on Deepcoin, you’ll notice the spread compression only at high liquidity tiers, which is a subtle but critical metric for scalpers. The platform’s API latency sits around 12 ms on average, giving high‑frequency bots a marginal edge-if you’re comfortable handling the websockets and signature scheme. Also, the funding rate oscillates with a mean reversion pattern that savvy traders can arbitrage. Keep an eye on the index price feed latency; any lag can compound slippage beyond the quoted 0.1% fee.

Ciaran Byrne

August 28, 2025 AT 00:00Deepcoin’s optional KYC really lets you trade without any paperwork.

Taylor Gibbs

August 28, 2025 AT 02:13yeah i get u, its cool that u can hop on without docs but just make sure u lock down 2FA and keep ur seed phrase safe.

stephanie lauman

August 28, 2025 AT 04:26It is frankly astonishing how Deepcoin touts “privacy” while hubbing a 0.1% fee that eclipses most competitors; this fee structure is a hidden tax on anonymity. Moreover, the absence of a native token eliminates any possibility for fee rebates, effectively penalising high‑volume traders. One must also question the regulatory oversight of a Singapore‑registered entity that offers such high leverage without stringent KYC, a recipe for market manipulation. 🤨

Cathy Ruff

August 28, 2025 AT 06:40yeah the fees are insane its a ripoff and the support is basically a ghost chat

Promise Usoh

August 28, 2025 AT 08:53In the grand tapestry of digital finance, Deepcoin emerges as a paradoxical node where liberty and peril intertwine. One could argue that the platform’s embrace of anonymity mirrors the age‑old quest for sovereignty over one’s assets, yet the specter of 125:1 leverage looms as a modern Sisyphus. The trader, in this scenario, becomes both Prometheus stealing fire and Icarus soaring too close to the sun, ever‑aware that a 0.8% adverse move may incinerate the margin. Such dynamics invite a contemplation of risk not merely as a statistical figure but as an existential condition. Is the pursuit of exponential returns a rational calculus or a manifestation of hubris? The fee model, flat at 0.1%, while transparent, subtly extracts value from each trade, echoing the ancient tithe. Simultaneously, the lack of a native token eschews the temptations of token‑driven gamification, perhaps a deliberate design to avoid speculative loops. Yet, this very omission can be perceived as a missed opportunity to align incentives between the exchange and its user‑base. Balancing these forces demands a disciplined approach, akin to the stoic’s measured breath. Traders must internalize the margin call visuals as a warning gong, not just a UI flourish. The multi‑TP/SL tools provide a semblance of control, yet they cannot rewrite the immutable law of market volatility. While the platform’s UI is indeed sleek, the underlying architecture remains a black box to most, fostering an environment where trust is earned, not given. In a world increasingly regulated, Deepcoin’s optional KYC stands as a bold statement of ideological freedom, but also a potential regulatory Achilles’ heel. Ultimately, the decision to engage with Deepcoin is a reflection of one’s tolerance for uncertainty and devotion to principle. One must ask: does the allure of privacy outweigh the shadows cast by high leverage? The answer, dear trader, resides within your own risk horizon.

Scott McReynolds

August 28, 2025 AT 11:06Scott here, and I’d add that the philosophical musings you just shared resonate deeply with the trader’s psyche. When you treat leverage as a mirror of ego, the feedback loop can be both enlightening and destructive. It’s crucial to embed disciplined risk parameters, perhaps by capping exposure at a modest 2‑3% of equity per trade. Moreover, employing a tiered stop‑loss strategy-setting an initial tight stop and then scaling it out as the position profits-mirrors the ancient practice of incremental mastery. The multi‑TP feature, when used judiciously, can transform a single‑point profit target into a series of micro‑wins, reducing emotional strain. I’ve observed that traders who journal each adjustment tend to develop a more objective perspective on market noise. In addition, leveraging the platform’s real‑time margin alerts can serve as a radar for impending liquidation, akin to a ship’s sounding line. While Deepcoin’s fee might appear flat, integrating it into your breakeven calculations ensures you’re not caught off guard. Remember, the psychological cost of a forced liquidation often outweighs the monetary hit. By treating each trade as an experiment rather than a gamble, you cultivate resilience. Finally, always keep a reserve of stablecoins, as they act as a buffer against sudden margin calls, preserving your ability to stay in the game. This holistic approach bridges the gap between theory and practical execution.

Shaian Rawlins

August 28, 2025 AT 13:20Hey everyone! I’ve been testing Deepcoin for a few weeks now, and I have to say the drag‑and‑drop TP/SL tool feels super intuitive. You can just grab the line on the chart and slide it where you want your stop‑loss or profit‑target to sit, which makes adjustments feel almost effortless. The platform’s clean UI also means I spend less time hunting through menus and more time actually analyzing price action. For newcomers, the fact that you don’t need to upload any ID to start trading is a huge plus, especially if you’re worried about privacy. On the flip side, the 0.1% fee can add up if you’re a heavy limit‑order trader, so keep an eye on your cost basis. I also love that they support a decent number of crypto pairs, even if it’s not as extensive as Binance. Overall, if you’re comfortable with high leverage and want a straightforward interface, Deepcoin could be a solid choice. Keep your risk low and enjoy the experience!

Amy Harrison

August 28, 2025 AT 15:33Yay 😄! I totally agree-those drag‑and‑drop tools make setting stops feel like a game. Just make sure you don’t get too greedy; lock in those small wins! 🎉

Rob Watts

August 28, 2025 AT 17:46Deepcoin looks sleek its UI is clean and the leverage options are insane

Miranda Co

August 28, 2025 AT 20:00While I understand the draw of anonymity, the fact that you can’t withdraw fiat directly is a serious drawback that many traders overlook. The platform’s fee isn’t the only issue; limited withdrawal options force you into extra steps that increase exposure to network fees. If you value a seamless experience, you might be better off with an exchange that integrates fiat on‑ramps natively. Consider your overall cost before diving in.

Katherine Sparks

August 28, 2025 AT 22:13Dear fellow traders, I would like to highlight that Deepcoin’s risk management tools, such as the partial liquidation system, are commendable. However, the absence of a native utility token precludes users from benefitting from fee discounts, which is a notable omission in today’s competitive landscape. Moreover, the optional KYC process, while appealing for privacy‑concious individuals, may impede the onboarding experience for those seeking immediate fiat access. It is advisable to weigh these factors carefully when evaluating the platform’s suitability for your trading strategy. 😊

Amal Al.

August 29, 2025 AT 00:26Indeed, the trade‑off between privacy and convenience is a classic dilemma; however, let us not forget that the over‑reliance on third‑party fiat gateways introduces additional layers of compliance and potential latency-factors that can materially affect execution speed! Therefore, it is paramount that traders conduct a holistic assessment, factoring in both the technological merits and the regulatory implications before committing capital.

mukesh chy

August 29, 2025 AT 02:40Oh great, another exchange promising “anonymous” trading while charging you a flat 0.1% fee-because who doesn’t love paying extra to stay hidden? It’s like buying premium invisibility cloaks that also come with a subscription. If you enjoy juggling high leverage with the constant threat of liquidation, then Deepcoin is your new playground. Otherwise, maybe stick to something less theatrical.

Marc Addington

August 29, 2025 AT 04:53Look, if you’re an American trader and you care about supporting home‑grown platforms, you should steer clear of a Singapore‑based exchange that hides behind optional KYC. It’s better to keep your money on domestic exchanges that are regulated and transparent. This way you’re not feeding foreign entities while taking unnecessary risks.

John Corey Turner

August 29, 2025 AT 07:06Deepcoin’s UI is a sleek tapestry of chrome and glass, inviting both the veteran scalper and the curious rookie to dance on its high‑leverage stage. Yet, beneath the polished veneer lies a fee structure that can gnaw at profit margins like a prowling tiger. If you’re adept at juggling multiple TP lines, the platform can feel like a well‑orchestrated symphony; if not, you might hear more discord than harmony. The optional KYC is the cherry on top-sweet for privacy lovers, sour for those craving straightforward fiat routes.

Twinkle Shop

August 29, 2025 AT 09:20From a technical perspective, Deepcoin’s architecture leverages a micro‑service framework that decouples order matching from risk assessment, thereby reducing latency spikes during periods of market turbulence. The RESTful API endpoints adhere to industry‑standard authentication schemas, utilizing HMAC‑SHA256 signatures to ensure request integrity. Moreover, the platform’s order book depth is dynamically adjusted via a hidden liquidity pool, which can be accessed through the “Liquidity Vault” API for institutional participants. In terms of risk metrics, the system continuously calculates the insurance fund contribution, a crucial component that underwrites partial liquidations when user positions exceed the maintenance margin threshold. The margin‑call visualization employs a real‑time heatmap overlay, enabling traders to gauge proximity to liquidation with sub‑second refresh rates. Additionally, Deepcoin integrates a multi‑chain wallet solution, supporting ERC‑20, BEP‑20, and Solana tokens, thereby broadening the asset ingress and egress pathways. The platform’s fee ledger is transparent; every trade event is logged on an immutable audit trail, facilitating compliance checks for regulated entities. While the optional KYC module is modular, it interacts seamlessly with third‑party fiat gateways like Simplex, ensuring AML checks are performed only when fiat conversion is initiated. Users who prefer cryptographic anonymity can bypass this module entirely, preserving on‑chain pseudonymity. However, it is worth noting that the absence of a native utility token eliminates the possibility of staking‑based fee rebates, a feature commonplace among competitors. This design choice aligns with Deepcoin’s philosophy of minimizing token‑centric dependencies. For high‑frequency traders, the websocket feed provides tick‑level data with a sub‑10‑ms latency, a critical factor for arbitrage strategies. The platform also offers a sandbox environment for algorithmic developers to back‑test strategies against historical order book snapshots. In summary, Deepcoin combines a robust, modular backend with a user‑centric front‑end, delivering a high‑leverage trading experience that is both performant and privacy‑oriented.

Kimberly Kempken

August 29, 2025 AT 11:33Sure, all that jargon sounds impressive, but at the end of the day you’re still paying a flat 0.1% fee and risking total liquidation on a 0.8% move. If you think the tech hype justifies the risk, you’re buying a ticket to a very volatile rollercoaster.

WILMAR MURIEL

August 29, 2025 AT 13:46Friends, I want to emphasize that while Deepcoin offers tantalizing leverage and privacy options, the core of successful trading still rests on disciplined risk management. It’s easy to get swept up in the allure of 125:1, but remember that every leveraged position magnifies both profit and loss. I encourage you to set clear entry and exit criteria, perhaps using the multi‑TP feature to lock in incremental gains rather than chasing a single target. Keep a modest portion of your portfolio in stablecoins as a safety net for potential margin calls; this buffer can be the difference between a temporary setback and a permanent exit. Also, don’t underestimate the value of community insight-reading forums, watching tutorials, and discussing strategies can provide perspectives you might otherwise miss. Finally, revisit your position sizing regularly; as your account grows, you can afford to adjust leverage downwards to preserve capital. By marrying Deepcoin’s advanced tools with a solid, conservative mindset, you stand a much better chance of thriving in the high‑risk derivatives arena.