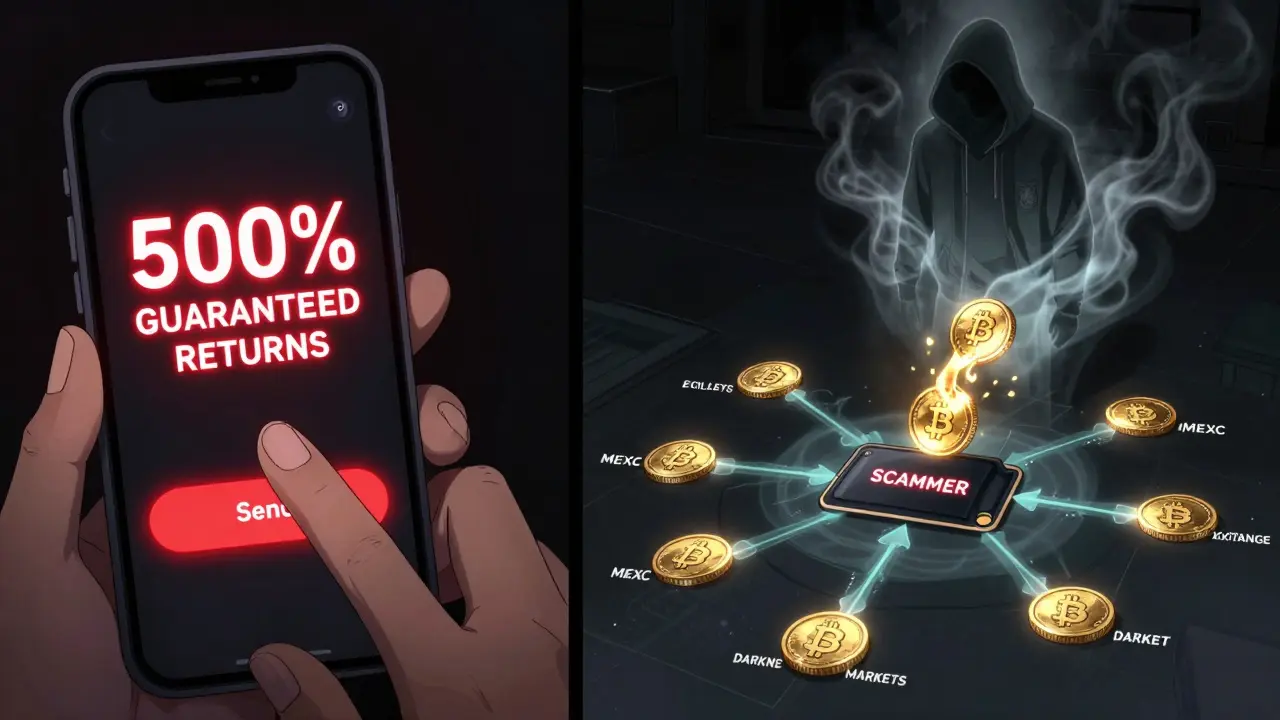

Every year, millions of people lose billions in cryptocurrency to scams that feel real-until it’s too late. In 2024 alone, U.S. victims reported over $9.3 billion lost to crypto fraud. These aren’t just phishing emails anymore. Scammers now use AI-generated videos of Elon Musk begging for donations, fake investment apps promising 500% returns, and even fake customer support lines that walk you through sending your crypto to a wallet they control. The worst part? Most victims don’t know where to turn after it happens. You’re not alone. And yes, reporting matters-even if you think recovery is impossible.

What to Do Immediately After Realizing You’ve Been Scammed

The first 24 hours are critical. Your priority isn’t anger. It’s containment. Stop all communication with the scammer. Block their phone number, email, social media profile, and any app they used to contact you. If you’re still logged into a fake exchange or wallet site, log out immediately. Don’t click anything else. Don’t send more crypto. Don’t try to ‘win it back’-that’s how people lose twice. Next, secure what’s left. Move any remaining cryptocurrency from wallets you used during the scam to a new, secure wallet you control. Use a hardware wallet if you have one. If you’re using a software wallet, generate a brand-new seed phrase and transfer funds there. Never reuse a seed phrase that was ever exposed to a scammer’s site or app. Then, start collecting evidence. Every detail matters. Screenshots of chats, recordings of voice calls, links to websites, emails, timestamps, and even the names they used. Save your browser history. California’s DFPI specifically advises checking your browsing history to make sure you didn’t miss any scam-related sites. Take screenshots of every page you visited, even if it looked legit at the time.How to Find the Transaction Details You Need

To report a crypto scam, you need blockchain data. This sounds technical, but you don’t need to be an expert. Here’s what you’re looking for:- Wallet address you sent crypto to (e.g., 0x58566904f57eac4E9EDd81BbC2f877865ECd35985)

- Amount sent and type of cryptocurrency (e.g., 1.02345 ETH, 0.8 BTC)

- Date and time of the transaction (include timezone, e.g., 1 January 2023, 12:01 AM EST)

- Transaction hash (a long string of letters and numbers like 0xfa485de419011ceefdd3cd00a4ff64e52bf9a0dfa528e4fff8bb4c9c)

Where to Report Crypto Scams (Official Channels)

There’s no single place to report crypto scams. You need to file with multiple agencies because they handle different parts of the crime. FBI’s IC3 (Internet Crime Complaint Center) - This is your most important report. IC3 investigates criminal fraud, including pig butchering schemes, blackmail, and impersonation scams. They work with international law enforcement and have direct access to blockchain analytics firms like Elliptic. File at ic3.gov. You’ll need to provide:- Full scam timeline (when you first contacted them, how they contacted you)

- Communication records (emails, texts, screenshots of chats)

- Wallet addresses and transaction hashes

- Names, phone numbers, websites, apps used

- Which exchange you used to send funds

Why Reporting Matters (Even If You Don’t Get Your Money Back)

Most victims assume reporting won’t help them personally. That’s a myth. While recovery rates are rarely published, agencies use your report to build cases. One report might seem small. But if 50 people report the same wallet address, law enforcement can trace the money across exchanges, freeze accounts, and shut down entire operations. In June 2024, a deepfake video of Elon Musk on YouTube tricked over 2,000 people into sending ETH to a single wallet. Within 20 minutes, over $5 million flowed in. Blockchain analysts at Elliptic flagged the wallet’s behavior-sudden inflows from hundreds of new addresses, quick transfers to MEXC exchange, then to darknet markets. That report led to a coordinated takedown. Victims didn’t get their money back, but the scammer’s infrastructure collapsed. Others were warned before they lost anything. Your report helps prevent the next person from being scammed. It also helps regulators update rules. FinCEN’s 2025 notice on crypto kiosks came from hundreds of reports like yours.What Recovery Actually Looks Like (The Hard Truth)

Let’s be clear: recovering crypto is rare. Once it’s sent to a scammer’s wallet, it’s usually gone for good. That’s how blockchain works-no central authority can reverse it. But that doesn’t mean all hope is lost. In some cases, if the scammer used a centralized exchange like MEXC or Binance, law enforcement can freeze the account if they have enough evidence. This happened in late 2024 when a pig butchering ring in Southeast Asia was traced through wallet clusters and exchange KYC data. Over $12 million was frozen, and some victims received partial refunds months later. The key is speed and detail. The faster you report with accurate transaction data, the higher the chance the money hasn’t been moved to a mixer or converted to privacy coins like Monero. If the funds are still on an exchange, recovery is possible. If they’ve been laundered through multiple chains or decentralized protocols, recovery becomes nearly impossible. Don’t fall for "recovery services" that ask for more crypto upfront. They’re scams too. Legitimate agencies never ask you to pay to get your money back.

How to Spot the Next Scam Before It Happens

The scams are getting smarter. AI deepfakes can mimic voices and faces in real time. Fake apps look identical to Coinbase or MetaMask. Scammers now use live video calls to show you "proof" of your fake investment returns. Here’s how to protect yourself:- Never trust a cold message-whether on Instagram, Telegram, or WhatsApp. Legit companies don’t DM you asking for crypto.

- Verify everything. If someone claims to be Elon Musk, check his official social media. He’s never asked for funds.

- Use two-factor authentication on all wallets and exchanges. Even if a scammer gets your password, they can’t move funds without the code.

- Check wallet addresses before sending. A single wrong character can send your crypto to a scammer.

- Use blockchain explorers like Etherscan to check if a wallet has a history of scams. Type the address in-look for multiple small deposits from different users.

What’s Changing in 2026

Blockchain analytics tools are getting better. Elliptic and Chainalysis now use AI to detect scam wallets before they’re even used. They watch for patterns: sudden large inflows, rapid transfers between chains, or connections to known darknet markets. These tools are now used by exchanges to block suspicious deposits before they happen. Regulators are also coordinating better. Agencies that used to work in silos are now sharing data. The FBI, FTC, and CFTC are testing a new cross-agency portal that lets you file one report and have it routed to all relevant departments. The biggest shift? Public awareness. More people are learning to report. And that’s what’s slowing the scams down.Can I get my crypto back after reporting a scam?

Recovery is rare but not impossible. If the scammer’s wallet is still linked to a regulated exchange and law enforcement acts quickly, funds may be frozen and partially returned. Most often, however, crypto is moved too quickly to be recovered. Reporting helps shut down the scammer’s operation and prevents others from being targeted.

Do I need to report to every agency?

No, but you should file with at least the FBI’s IC3 and the FTC. If your scam involved a fake investment, also file with the SEC. If you used a crypto ATM, report to FinCEN. Each agency has a different focus-filing with multiple ones gives investigators more tools to act.

What if I don’t know the transaction hash or wallet address?

Still report it. The FBI explicitly says to submit reports even with partial information. Write down what you remember: the date, how much you sent, the name the scammer used, and any website or app you interacted with. Even small details help connect your case to others.

Are recovery companies that ask for upfront fees legitimate?

No. Any company asking you to pay more crypto to "recover" your funds is a second scam. Legitimate law enforcement agencies never charge victims to investigate or recover assets. Avoid anyone promising guaranteed recovery-they’re preying on desperation.

How long does it take for a crypto scam report to be reviewed?

There’s no fixed timeline. Reports are reviewed based on urgency and available data. High-value cases with clear blockchain trails are prioritized. Some reports are reviewed in days; others take months. Don’t expect a response, but keep your case number. If more victims report the same scam, investigators will act faster.

Andy Simms

January 23, 2026 AT 06:15Just wanted to say this guide is spot-on. I lost a chunk of ETH last year and didn’t know where to start. Followed the steps here-blocked everything, moved funds, screenshotted every chat-and filed with IC3 and FTC. Took 3 weeks, but they actually reached out with a case number. Didn’t get my money back, but I felt like I did something. That counts.

Also, never use those ‘crypto recovery’ firms. They’re just waiting for you to get scammed twice.

MOHAN KUMAR

January 24, 2026 AT 16:00Scams are getting wild. I saw a fake Elon video on Telegram yesterday. 100 people sent ETH. I reported it. No point crying. Just report. Block. Move on.

Abdulahi Oluwasegun Fagbayi

January 26, 2026 AT 06:16It’s funny how we blame the victim when they send crypto to a fake Elon Musk

But we never ask why the system lets this happen

Why do exchanges not flag wallets with 200 small deposits in 10 minutes

Why do social platforms allow deepfakes to run wild

Reporting helps but the real fix is systemic

We’re putting bandages on a hemorrhage

Andy Marsland

January 26, 2026 AT 06:29Let me be clear-this entire post is dangerously incomplete. You mention IC3 and FTC but completely ignore the fact that the SEC has jurisdiction over any token marketed as an investment, which covers 80% of these scams. And you didn’t even mention the CFTC’s role in futures-based fraud, which is growing exponentially with leverage tokens. Also, blockchain explorers aren’t enough-you need to cross-reference with Chainalysis or Elliptic’s public dashboards to see if the wallet is already flagged. And don’t forget to check the transaction’s gas fees-high gas means it was likely sent from a bot farm. If you’re not doing all of this, you’re wasting your time. Most people don’t even know what a transaction hash is, let alone how to trace it across chains. This guide is a good start but it’s like giving someone a map of New York and expecting them to find Times Square without knowing what a street is.

Anna Topping

January 27, 2026 AT 01:39I cried after I lost my savings. Not because of the money. Because I felt so stupid. Like I was the only one who fell for it. Then I read this. And realized I wasn’t alone. That’s the real gift here. Not the steps. Not the agencies. Just knowing I didn’t fail. I was targeted. And I’m still here.

Thank you.

Jeffrey Dufoe

January 27, 2026 AT 10:40Good stuff. I used this exact process after my friend got scammed. We got the transaction hash, filed with IC3, and even emailed the exchange. They froze the wallet two days later. We didn’t get it all back, but we got 40%. It’s possible. Just don’t wait.

katie gibson

January 28, 2026 AT 07:27okay so like i lost 12k in a fake coinbase ad and then i cried for 3 days and then i found out the scammer was in nigeria and i was like oh my god the world is ending and then i saw this post and i was like wait… i can REPORT THEM??? like i can actually do something?? i’m so mad i didn’t know this before. i’m filing right now. also i hate my life but also i’m proud of myself??

Ashok Sharma

January 29, 2026 AT 11:58Thank you for sharing this. Many in my community are new to crypto and unaware of these dangers. I will share this with them. Reporting is not just for justice-it is for protection. Keep calm. Act fast. Stay safe.

Mike Stay

January 30, 2026 AT 19:24As someone who’s spent years studying global financial crime networks, I can tell you this: the real revolution isn’t in reporting-it’s in the shift from reactive to predictive enforcement. The fact that Elliptic and Chainalysis now use AI to flag scam wallets before they’re even deployed is a game-changer. In 2024, over 12,000 scam wallets were blocked at the point of entry because of behavioral patterns, not after-the-fact reports. That’s the future. And it’s already here. What we’re seeing now is the last gasp of chaotic, decentralized fraud. In five years, you won’t be able to send crypto to a wallet with a history of 50+ small deposits from different users-it’ll be automatically flagged by the exchange itself. The system is learning. We just have to keep feeding it data. Your report isn’t just a form. It’s a brick in the wall.

HARSHA NAVALKAR

February 1, 2026 AT 02:16I lost everything. My mom’s medical fund. I didn’t report because I was too ashamed. Now I’m here, reading this, and I feel like I’m being punished for not acting. Why did no one tell me this before? Why did I have to learn this the hard way? I just want to scream into the void.

Bonnie Sands

February 2, 2026 AT 09:55Okay but have you considered that the government is LITERALLY in on this? Like why do you think they don’t recover the money? Because they WANT you to lose it so they can track your movements and build a biometric database. The ‘IC3’? Just a front. The real goal is social control. I lost my crypto and now my smart fridge is spying on me. I’m not paranoid. I’m prepared.

Jennifer Duke

February 4, 2026 AT 05:16Look, I appreciate the effort, but this guide is so basic. If you’re not using a cold wallet, you’re basically giving your money to the state. And why are you even using Ethereum? It’s a garbage chain with insane fees. Use Solana or Polygon if you’re serious. Also, you didn’t mention that the FTC is useless in the U.S.-they only take reports to look good. The FBI is the only one that matters. And if you’re not from California, why are you even bothering with DFPI? That’s just a state-level vanity project. Real crypto users know the drill: secure, report, move on. This is kindergarten-level advice for people who still think ‘crypto’ means ‘free money’.

Matthew Kelly

February 4, 2026 AT 22:45Thanks for this. I shared it with my cousin in Vancouver who got scammed last week. He was about to pay a ‘recovery specialist’ $2k in BTC. I showed him this and he cried. Then he filed his report. We’re all in this together. 💪🫶