DebtCoin Treasury Contribution Calculator

About This Tool

This calculator estimates how much your DebtCoin trades contribute to the U.S. Treasury based on current fees and market data. Every trade incurs a creator fee that is automatically sent to the Treasury.

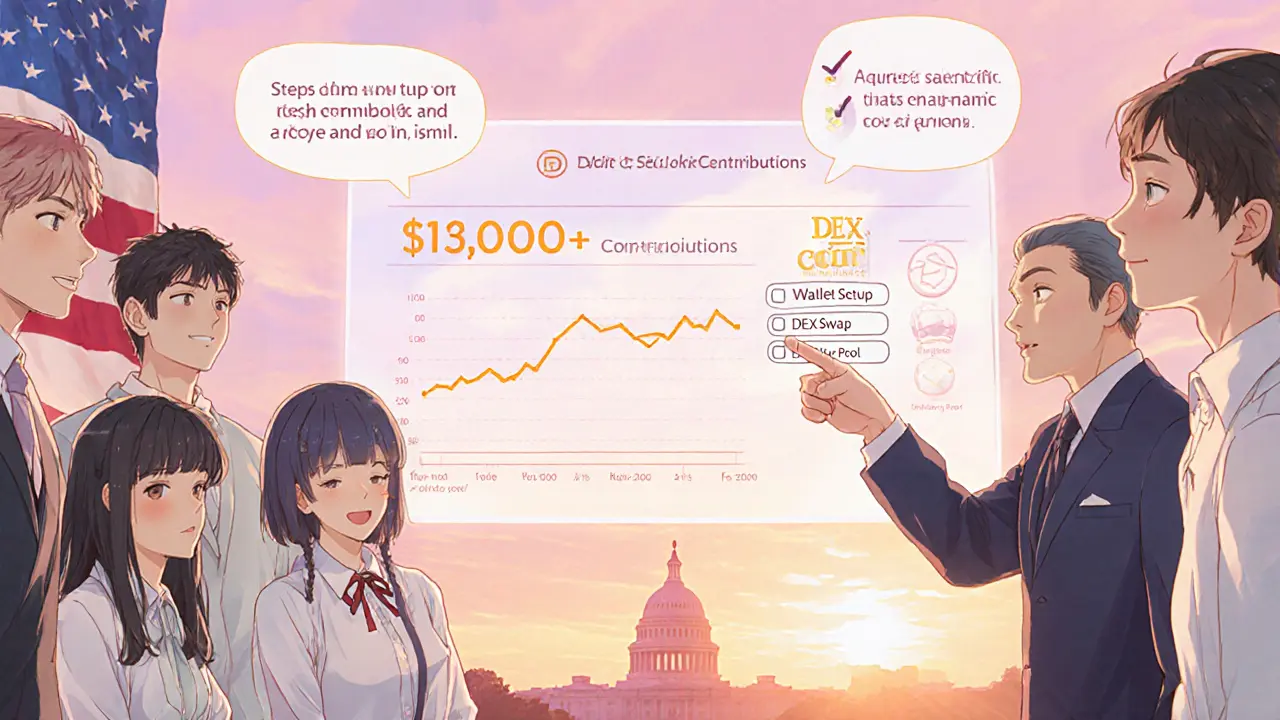

DebtCoin is a Solana‑based memecoin created to funnel trading fees directly to the United States Treasury as a way to chip away at the national debt. While most meme tokens chase hype, DebtCoin tries to turn every trade into a small, verifiable donation. Since its launch the project has already sent more than $130,000 to the Treasury, proving the concept works at a modest scale.

How DebtCoin Turns Trades into Treasury Payments

The core idea is simple: every time someone buys or sells DEBT, the blockchain records a creator fee a small percentage taken from the trade and routed to a dedicated treasury wallet. That wallet automatically converts the collected SOL tokens into U.S. dollars and uses the Pay.gov the U.S. government’s official payment portal to make a contribution under the “Gifts to Reduce the Public Debt” program. Because the payment is processed through a federal system, each contribution receives an official receipt and tracking ID, which the community can view on public block explorers. Transparency is baked in - anyone can see the exact amount sent, the receipt number, and the date of the transaction.

Technical Backbone: Solana and Deflationary Mechanics

DebtCoin lives on Solana a high‑throughput, low‑cost blockchain that can handle thousands of transactions per second. This choice keeps trading fees cheap enough that even a fraction of a cent can be collected for the Treasury without eroding user value. The token also features a built‑in burn mechanism a regular process that permanently removes a portion of DEBT from circulation. By reducing supply over time, the token aims to protect holders from excessive dilution while rewarding early participants if demand stays steady.

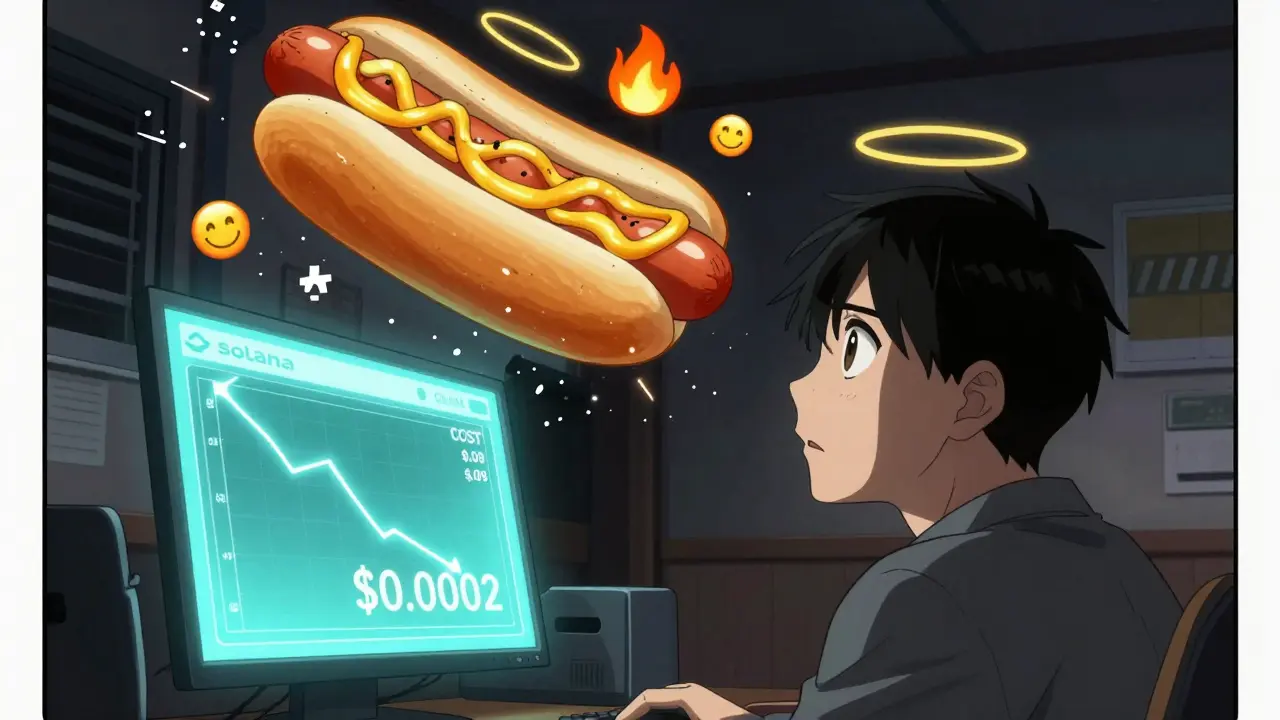

Market Snapshot - Prices, Volume, and Volatility

Because DEBT is a micro‑cap asset, price data can differ across aggregators. As of October2025:

- Blockspot.io lists DEBT at $0.002056 with a market cap of $2.0million and 24‑hour volume of $76000 (+1.4%).

- CoinCodex shows $0.000985.

- CoinGecko reports $0.0005688 with a 24‑hour volume of $107239 (‑13.96%).

These disparities illustrate how low‑liquidity tokens can swing wildly from one source to the next. The 14‑day Relative Strength Index (RSI) sits around 44, indicating a neutral stance, while the 30‑day volatility hovers near 32%.

| Feature | DebtCoin (DEBT) | Dogecoin (DOGE) | Shiba Inu (SHIB) |

|---|---|---|---|

| Blockchain | Solana | Bitcoin‑derived (fork) | Ethereum |

| Social Mission | Direct Treasury contributions | None | None |

| Fee Allocation | All creator fees sent to U.S. Treasury | Fees burned or go to dev wallet | Fees burned + liquidity pool |

| Transparency | Public receipts via Pay.gov | Limited | Limited |

| Deflationary Mechanism | Periodic token burns | No built‑in burn | Token burns |

Community Impact and Real‑World Contributions

Since the first payment, DebtCoin has recorded over $130,000 in contributions. Supporters can pull the Pay.gov receipt ID from the blockchain explorer, paste it into the U.S. Treasury’s payment portal where the government logs each donation to the public‑debt reduction program, and see the amount officially credited. This level of auditability is rare in the crypto space and resonates with users who care about fiscal policy rather than just quick gains.

The community describes itself as “civic‑tech enthusiasts” and “fiscally conscious traders.” While the group doesn’t solicit donations or request wallet connections, it does maintain active channels on Discord and Twitter, sharing live updates of each Treasury transfer and reminding members that every trade, no matter how small, adds to the national‑debt‑reduction pool.

Risks, Outlook, and Price Predictions

Analysts note several headwinds:

- Dependence on trading volume - if excitement wanes, creator fees drop and contributions shrink.

- Regulatory scrutiny - positioning a crypto token as a “gift” to the Treasury could attract attention from the SEC or FinCEN.

- Market sentiment - the Fear & Greed Index sits at 63 (greedy), but the 30‑day green‑day count is only 12 out of 30.

Forecasts for 2026 range between $0.000512 and $0.002059, with a mid‑point around $0.001038. A bearish model from CoinCodex expects a dip to $0.000739 by year‑end, suggesting short‑term traders could profit from a sell‑low, buy‑back strategy.

Getting Started: Buying and Holding DEBT

If you’re ready to join the effort, follow these steps:

- Set up a Solana‑compatible wallet such as Phantom, Solflare, or Trust Wallet and fund it with SOL.

- Connect the wallet to a decentralized exchange (DEX) that lists DEBT - for example, Raydium or Orca.

- Swap a modest amount of SOL for DEBT. Remember the trade will incur the creator fee, which will later be sent to the Treasury.

- Optionally, add DEBT to a supported liquidity pool to earn additional fees that also flow into the treasury wallet.

- Track each Treasury contribution by checking the transaction hash on a Solana explorer and matching the Pay.gov receipt number on the Treasury’s public ledger.

Because the token does not promise returns, treat DEBT as a civic‑style contribution rather than a pure investment. Keeping the position small reduces exposure to price swings while still supporting the mission.

Frequently Asked Questions

What makes DebtCoin different from other meme coins?

DebtCoin diverts every creator fee to the U.S. Treasury via Pay.gov, providing verifiable public‑debt contributions. Most meme coins simply burn fees or send them to a developer wallet.

How can I verify that a payment was made to the Treasury?

Each payment generates a Pay.gov receipt ID. The ID is posted on the blockchain explorer alongside the transaction hash, and you can look it up on the official Treasury portal to see the amount credited.

Do I need to stake DEBT to earn more Treasury contributions?

Staking is not required. Contributions come from every trade fee. However, providing liquidity on a supported DEX can generate extra fees that also flow to the Treasury.

Is DebtCoin regulated by the U.S. government?

The token itself is not a registered security, and the Treasury only receives the fee payments as a gift. Regulatory status remains uncertain, so participants should treat it as a high‑risk, unregulated asset.

Can I use DEBT for everyday purchases?

At present DEBT is primarily traded on DEXs and not widely accepted for goods or services. Its main purpose is to generate Treasury contributions through trade.

Cathy Ruff

April 19, 2025 AT 11:03DebtCoin is just another meme scam trying to cash in on the U.S. debt hype

Kortney Williams

April 26, 2025 AT 08:03When we look at the narrative around DebtCoin, it reflects a deeper desire to monetize collective anxiety about national finances. The token positions itself as a charitable instrument, yet the mechanics remain opaque. In practice, the creator fee simply flows to the treasury, but the market impact is negligible. This raises questions about the sincerity of its mission versus the allure of speculative profit. Ultimately, it's a reminder that financial innovation often masks old‑school opportunism.

Taylor Gibbs

May 3, 2025 AT 05:03Hey folks, let me break it down real simple. DebtCoin runs on Solana, so you get super fast txs and low fees. The creator fee gets auto‑sent to the US Treasury, which is kinda neat if you believe in that. But dont forget, the token price is still driven by hype, so treat it like any other meme coin.

Amy Harrison

May 10, 2025 AT 02:03Love the idea of helping the treasury while trading 😄

Miranda Co

May 16, 2025 AT 23:02It sounds good but it’s just a gimmick

Katherine Sparks

May 23, 2025 AT 20:02Dear community, I would like to address the premise of DebtCoin. While the intent to allocate a creator fee to the Treasury may appear laudable, one must consider the underlying market dynamics. The token’s valuation is largely speculative and not anchored to any tangible asset. Consequently, investors should exercise due diligence before particpation. Regards, Katherine

Jenise Williams-Green

May 30, 2025 AT 17:02DebtCoin is a blight upon the noble pursuit of financial responsibility. It masquerades as a philanthropic venture while feeding the same greed that fuels corrupt Wall Street practices. By co‑opting the United States’ national debt as a marketing gimmick, it trivializes a serious socioeconomic burden. The creators claim virtue, yet they profit from the very speculation they decry. Such a token weaponizes patriotism, turning civic duty into a fleeting meme. Investors, blinded by the promise of contributing to the Treasury, are lured into a Ponzi‑like ecosystem. The creator fee, while framed as a donation, merely redirects funds to a treasury already saturated with debt. Moreover, the token’s price is driven solely by hype, lacking any intrinsic value or utility. This creates a false sense of altruism that masks reckless financial behavior. In the long run, such schemes erode public trust in genuine fiscal initiatives. The community should reject any project that commodifies national obligations for profit. Ethical finance demands transparency, not theatrical deception. Let us recall that true progress arises from sustainable solutions, not meme‑driven shortcuts. Therefore, I implore readers to see through the veneer and reject DebtCoin outright.

Laurie Kathiari

June 6, 2025 AT 14:02While your fervor is admirable, the hyper‑dramatic tone borders on the absurd; a measured critique would serve the community better.

Promise Usoh

June 13, 2025 AT 11:02Respectfully, I acknowledge the moral concerns raised, yet one must also consider the broader context of decentralized finance and its potential for inclusive innovation, despite the imperfections you highlighted.

Shaian Rawlins

June 20, 2025 AT 08:02I understand the anxiety surrounding new tokens like DebtCoin. It is natural to question their purpose, especially when national debt is invoked. However, the ecosystem of Solana offers unique advantages that cannot be dismissed outright. Low transaction costs and high throughput may provide real utility for certain users. While skepticism is healthy, collaboration and open dialogue can lead to better outcomes for all participants. Let us keep the conversation constructive and focus on factual analysis.

Rob Watts

June 27, 2025 AT 05:02People should do their own research before jumping in. The fees are small but they add up. Keep your eyes open

Bhagwat Sen

July 4, 2025 AT 02:02Actually, the calculator you mentioned is quite handy; it shows exactly how much each trade contributes, which many ignore.

mukesh chy

July 10, 2025 AT 23:02Oh sure, because everyone loves staring at numbers while hoping the token shoots to the moon. Classic.

Natalie Rawley

July 17, 2025 AT 20:02OMG this whole DebtCoin saga feels like a soap opera-twists, betrayals, and a cliff‑hanger ending we never asked for!

Scott McReynolds

July 24, 2025 AT 17:01In contemplating DebtCoin, one might view it as a microcosm of humanity's relentless quest to merge purpose with profit. The notion of channeling creator fees into the national treasury is, on the surface, a commendable experiment in civic‑tech integration. While the token rides on meme culture, it also sparks dialogue about unconventional fiscal participation. If even a fraction of traders are motivated by a sense of contribution, the model could evolve into a more structured framework. Nevertheless, sustainability hinges on transparent governance and genuine community stewardship. Let us not dismiss outright but rather observe its trajectory with a balanced lens. Perhaps, in time, such initiatives will inform broader policies on decentralized public finance.

John Corey Turner

July 31, 2025 AT 14:01The concept you paint is indeed vivid; however, the reality remains that tokenomics often outpace regulatory oversight, rendering such optimism precarious.

Kimberly Kempken

August 7, 2025 AT 11:01Optimism aside, the data shows that meme‑coins like DebtCoin typically crash after the hype wave, making any charitable angle moot.