Licensing Rights in Crypto: What You Need to Know About Legal Use and Compliance

When we talk about licensing rights, the legal permission granted by a government or regulatory body to operate within a specific financial or technological framework. Also known as crypto permits, it’s not just paperwork—it’s the line between running a legal business and facing fines, account freezes, or jail. In crypto, licensing rights aren’t optional if you’re handling money, issuing tokens, or running an exchange. Countries like Nigeria, India, and Singapore now require financial institutions to only bank licensed crypto firms. Skip this step, and you’re playing Russian roulette with your funds and freedom.

These rights connect directly to crypto regulations, the official rules that define how blockchain businesses can operate within a jurisdiction. For example, Russia bans most businesses from accepting crypto payments unless they’re state-linked giants. Egypt’s Law 194 of 2020 shuts down all trading and promotion without Central Bank approval. Meanwhile, the SEC in Nigeria forces banks to verify licenses before touching any crypto-related accounts. These aren’t abstract laws—they’re daily realities for traders, developers, and startups. If your project relies on token sales, exchange services, or even fan tokens like TRA or LEPA, you’re already in the licensing game—even if you didn’t ask to be.

crypto legality, whether a country permits or prohibits crypto activities under its national laws varies wildly. Bangladesh makes trading illegal and punishes offenders with jail time. India allows holding and trading but bans businesses from accepting crypto as payment. Singapore lets exchanges operate—but only if they’re licensed and audited. And in the U.S., tokenized securities on platforms like Oasis Pro Markets need SEC approval, while pure crypto swaps fall under different rules. Licensing rights are the bridge between what’s technically possible and what’s legally allowed. Without them, even the most innovative DeFi protocol becomes a liability.

You’ll find posts here that show exactly how licensing shapes real crypto outcomes. From Bithumb Singapore’s shutdown to SEC Nigeria’s 2025 guidelines, the pattern is clear: no license, no future. Some projects hide behind vague claims—like fake airdrops for ZHT or HAI—but the real danger isn’t scams. It’s operating without knowing the rules. Whether you’re building a DEX, launching a token, or just trading in a country with strict laws, licensing rights decide your next move. Below, you’ll see how these rules play out in practice—across exchanges, governments, and user experiences. No theory. Just what happened, why, and what it means for you.

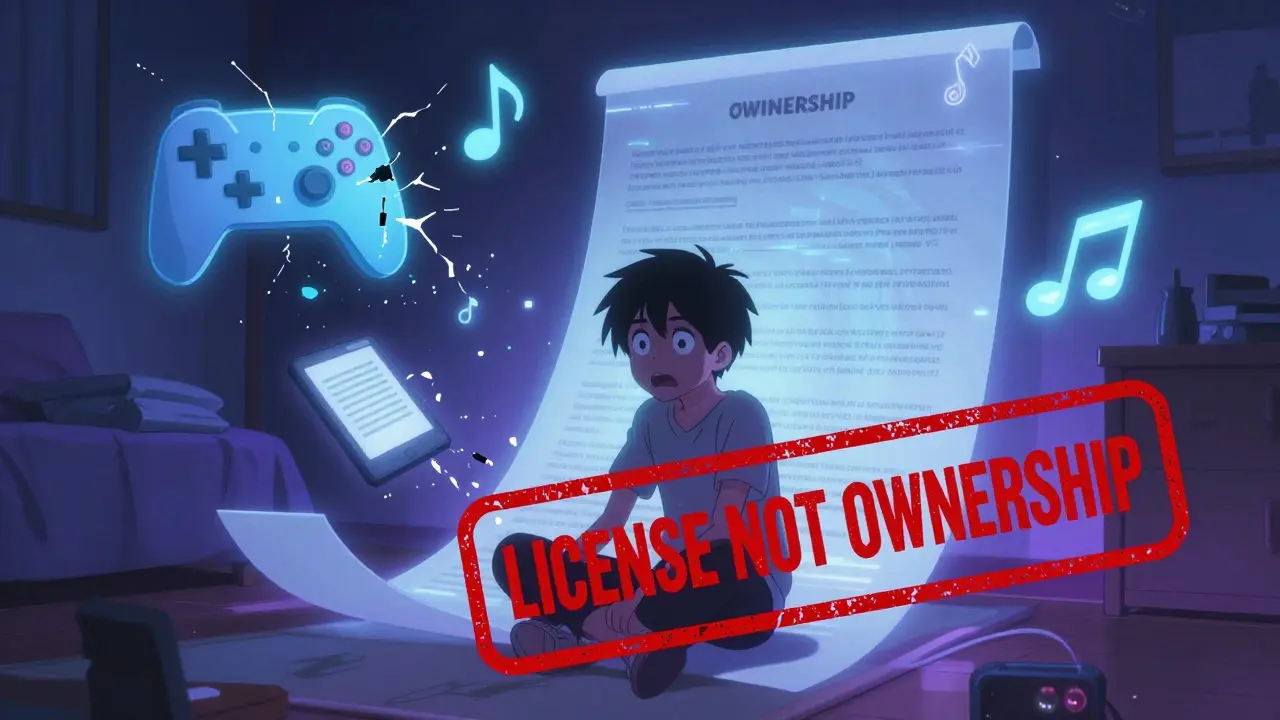

Most digital purchases aren’t sales - they’re licenses. Learn what you really own online, how California’s new law forces transparency, why blockchain offers real ownership, and what steps you can take to protect your digital assets.

Read More