Law 194 of 2020: Crypto Regulations, Compliance, and What It Means for Traders

When governments step in to control crypto, they don’t just make rules—they reshape markets. Law 194 of 2020, a regulatory framework introduced in 2020 to bring cryptocurrency activities under formal financial oversight. It’s not a global law, but it became a model for how nations like Nigeria, Singapore, and others began treating digital assets as financial instruments, not just tech experiments. This law didn’t ban crypto—it forced it to grow up. Exchanges had to register. Wallet providers had to verify users. Token issuers had to stop pretending their AI coins were real products.

Behind Law 194 of 2020 was a simple goal: stop scams before they hurt people. You can see its fingerprints in posts about Bithumb Singapore, a crypto exchange that shut down after failing to meet compliance standards, or SEC Nigeria, the agency that started enforcing strict licensing rules for crypto firms. It also explains why projects like TRUST AI, Oracle AI, and ZeroHybrid Network vanished—no team, no code, no license, no future. The law didn’t kill them; their own fraud did. But Law 194 gave regulators the tools to shut them down fast.

What does this mean for you? If you’re trading, investing, or even just claiming airdrops, you’re now operating in a world where legitimacy matters. The crypto compliance, the set of legal and operational requirements that exchanges and projects must follow to operate legally isn’t optional anymore. Platforms like Oasis Pro Markets don’t just call themselves "regulated"—they’re built on the same principles Law 194 pushed for: transparency, licensed operators, and real-world asset backing. Even in places where crypto is banned, like Bangladesh, the law’s influence shows up in how authorities track and punish violations.

You’ll find posts here that dig into the fallout: exchanges that closed, tokens that crashed, airdrops that were fake. But you’ll also see how smart projects adapted—using blockchain for real utility, not hype. Whether it’s DePIN infrastructure, fan tokens, or tokenized securities, the projects that survived did so because they followed the rules, not because they ignored them. Law 194 of 2020 didn’t end crypto’s wild west—it just made the cowboys wear badges. And now, you need to know which ones are real.

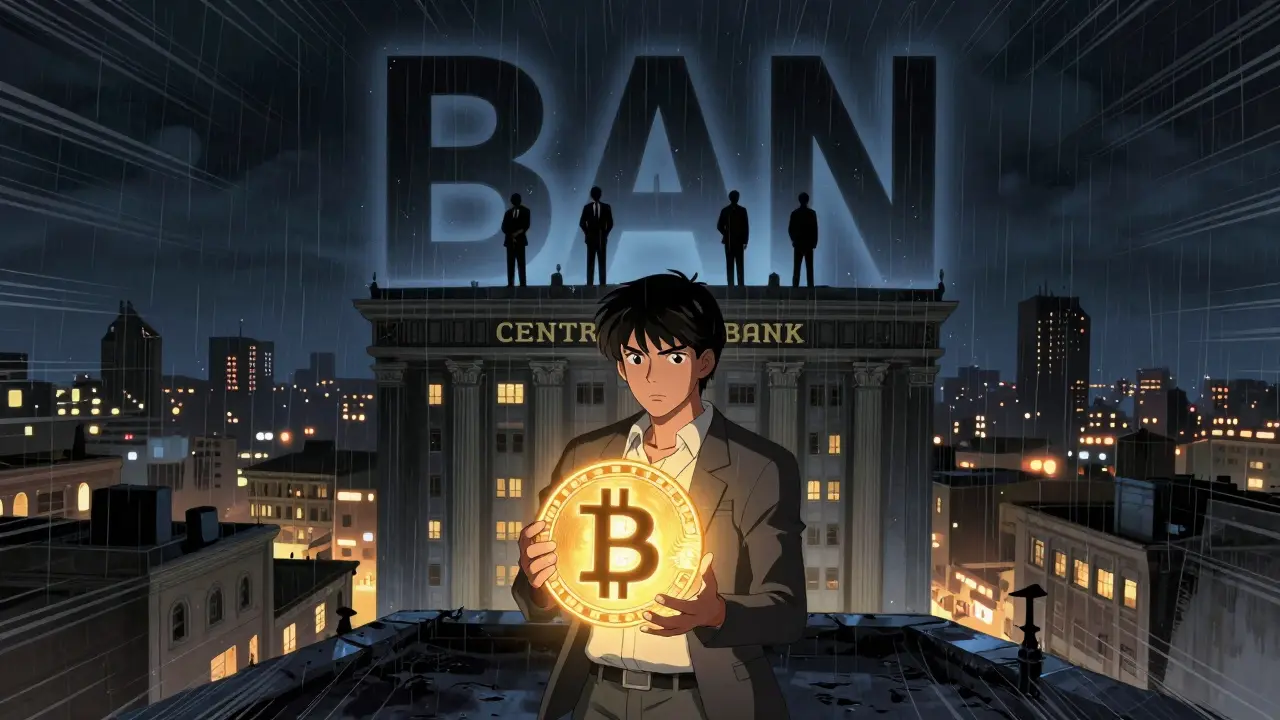

Egypt's Law 194 of 2020 bans all cryptocurrency trading, mining, and promotion without Central Bank approval. No exceptions have been granted, leaving millions of users stranded and startups fleeing the country.

Read More