FIU-IND Crypto: What It Is, Why It Matters, and What You Should Know

When you hear FIU-IND crypto, the cryptocurrency transactions monitored by India’s Financial Intelligence Unit. Also known as crypto reporting under PMLA, it’s not a coin or a project—it’s the government’s system for tracking digital asset flows to stop money laundering and illegal funding. This isn’t about Bitcoin or Ethereum alone. It’s about who’s sending money, where it’s going, and whether it’s tied to fraud, tax evasion, or sanctions. If you’re trading crypto in India—or even just holding it—you’re part of this system, whether you realize it or not.

The Financial Intelligence Unit—India, the national body responsible for collecting and analyzing financial data to combat money laundering. Also known as FIU-IND, it operates under the Ministry of Finance and works with banks, exchanges, and digital wallet providers. Since 2022, Indian crypto exchanges have been legally required to report all transactions over ₹10,000 to FIU-IND. That includes deposits, withdrawals, swaps, and even staking rewards. It’s not just about big players. If you’ve used WazirX, CoinDCX, or ZebPay in the last year, your activity has been logged. And if you’ve traded tokens like SMT crypto, the SmartMall utility token with high concentration and low liquidity or BRP coin, the BananaRepublic token with no verified supply or team, those trades are flagged too—especially if they’re sudden, large, or linked to unregulated platforms.

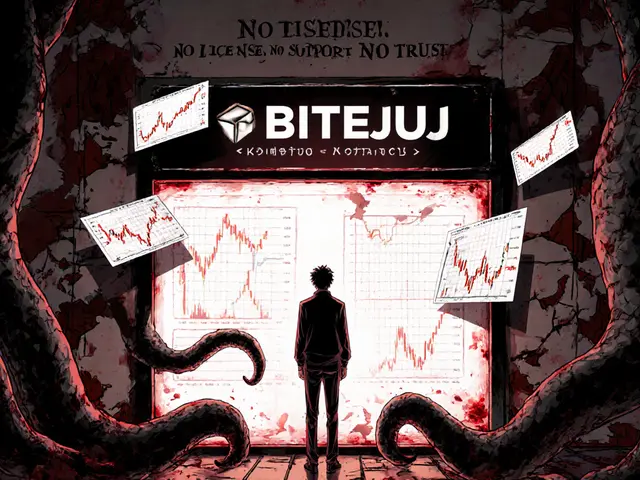

What does this mean for you? If you’re using a regulated exchange, you’ve likely already gone through KYC. That’s your paper trail. But if you’ve tried platforms like BTRL crypto exchange, a platform with no website, no security details, and no regulatory compliance or BITEJIU crypto exchange, a platform with no verified presence or user reviews, you’re not just risking your money—you’re risking legal exposure. FIU-IND doesn’t care if you think a project is a scam. If funds moved through it, and you were involved, you could be asked to explain.

This isn’t about stopping innovation. It’s about cleaning up the mess. Look at the SEC crypto fines, the $4.68 billion in penalties issued in 2024 for violations like unregistered securities and misleading claims. India’s approach is different—it’s not banning crypto, it’s forcing transparency. The same way banks report cash deposits over ₹5 lakh, crypto platforms now report digital transfers. And just like with cash, if your activity looks odd—sudden spikes, multiple small transfers, movement to offshore wallets—you’ll get flagged.

Below, you’ll find real reviews and breakdowns of crypto projects, exchanges, and airdrops that either ran into compliance issues or got caught in the crosshairs of regulators. Some are dead projects. Others are risky bets. All of them show why knowing the rules matters—not just to avoid fines, but to protect your wallet from the next scam hiding behind a fake airdrop or a fake exchange. This isn’t theory. It’s what’s happening right now, in real time, to real people.

Businesses in India cannot legally accept cryptocurrency as payment, but they can trade, hold, or offer crypto services under strict tax and compliance rules. Learn the 2025 laws, penalties, and how to stay compliant.

Read More