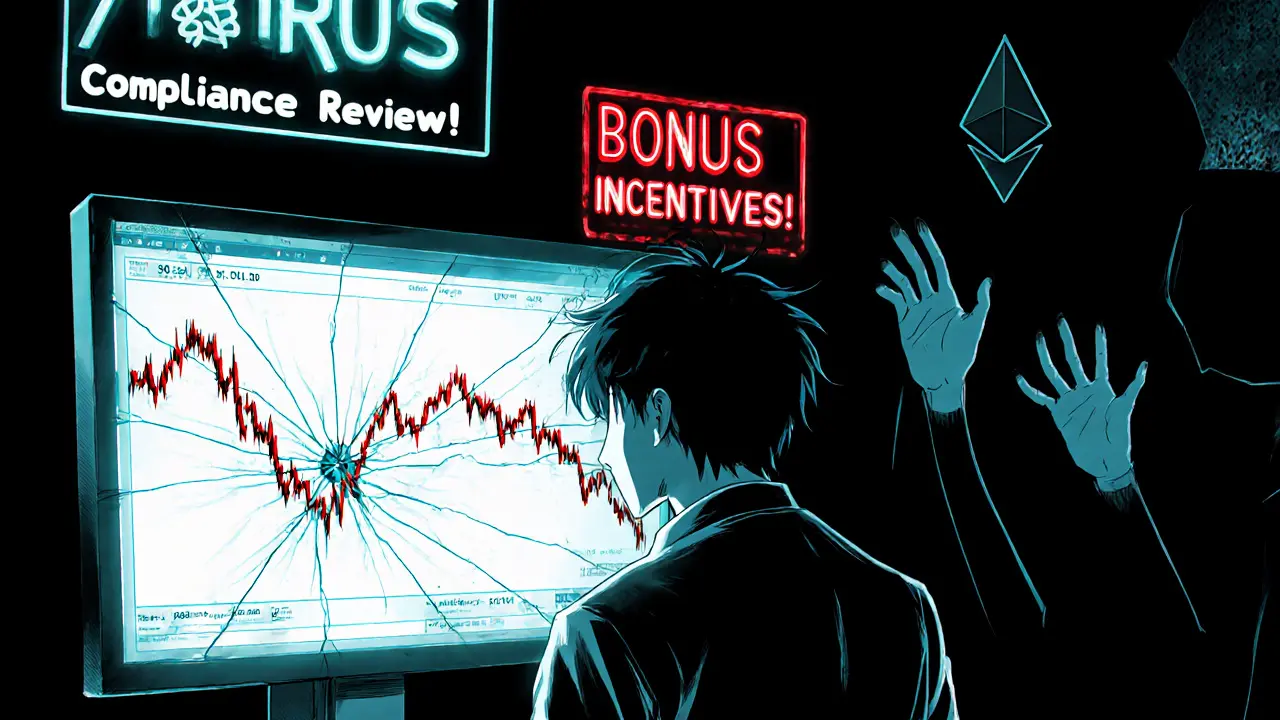

Dangerous Crypto Platform: Red Flags, Scams, and How to Stay Safe

When you hear the term dangerous crypto platform, a digital trading or wallet service that puts your funds at risk through fraud, lack of transparency, or regulatory violations. Also known as fraudulent crypto platform, it’s not just about bad UX—it’s about losing your money with no recourse. These aren’t hypothetical risks. In 2024, the SEC fined crypto firms over $4.68 billion for deceptive practices, and platforms like FDEX were exposed as brand-jacking scams, pretending to be FedEx to trick users into depositing crypto. This isn’t rare. It’s the new normal.

What makes a platform dangerous? It’s not just one thing. A crypto exchange scam, a platform designed to steal assets by hiding its operators, fake audits, or impossible withdrawal conditions often looks polished—clean interface, flashy ads, celebrity endorsements. But behind the curtain? No real liquidity, no licensed custody, no KYC that actually works. Platforms like EtherFlyer vanished overnight, leaving users with empty wallets and zero support. Then there’s the crypto safety, the set of practices and awareness needed to avoid falling for deceptive platforms, including verifying team identities, checking on-chain activity, and avoiding platforms that pressure you to deposit quickly. If a site tells you to hurry up because "the offer expires in 2 hours," that’s not urgency—it’s a trap.

Regulators are catching on. The SEC’s crackdowns aren’t random—they target platforms that ignore securities laws, hide ownership, or lie about their technology. FDEX wasn’t just shady; it copied FedEx’s logo. Deepcoin offers 125:1 leverage, which is legal in some places but deadly for inexperienced traders. PiperX v2 and Minter (BSC) are real platforms with reviews, but they’re not immune to scrutiny. The difference? They publish audits, team info, and clear terms. Dangerous platforms don’t. They rely on hype, not transparency.

You don’t need to be a blockchain expert to spot trouble. Ask: Who runs this? Can I find their real name? Is there a public wallet showing real deposits? Are withdrawals slow or blocked? If the answer is "I don’t know," walk away. The safest crypto platforms don’t need to scream "FREE TOKENS!"—they let their track record speak. And if you’ve already lost money to one? You’re not alone. But you can protect the next person by sharing what you learned.

Below, you’ll find real reviews of platforms that turned out to be scams, deep dives into how regulators are fighting back, and practical checklists to keep your assets safe. No fluff. Just facts from people who’ve been burned—and learned how to avoid it next time.

btcShark crypto exchange shows all signs of a scam: hidden fees, withdrawal blocks, no regulation, and zero transparency. Don't risk your crypto-use a trusted platform instead.

Read More