itBit isn’t your typical crypto exchange. You won’t find a mobile app, ACH deposits, or one-click buy buttons. If you’re looking for a simple way to buy $100 of Bitcoin on your phone, this isn’t the place. But if you’re managing institutional funds, trading hundreds of BTC per month, or need a platform that answers to U.S. regulators - itBit might be the only exchange you should consider.

What Makes itBit Different?

itBit launched in 2013 and became the first Bitcoin exchange in the world to receive federal regulation from the New York Department of Financial Services (DFS). Today, it operates under Paxos Trust Company, which holds a trust charter and is subject to strict audits, capital requirements, and daily reporting. That’s not something Coinbase or Binance can claim in the same way. This regulation means itBit has to prove it holds every dollar and every Bitcoin it claims to. There are no hidden reserves. No risky lending practices. No opaque custody solutions. The DFS requires real-time monitoring of all transactions, and itBit uses blockchain analytics tools to flag suspicious activity. That’s why hedge funds, family offices, and crypto funds trust itBit with billions in assets.Supported Cryptocurrencies and Trading Pairs

itBit doesn’t try to be everything to everyone. It supports just 12 cryptocurrencies, all paired with USD:- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- AAVE

- BUSD

- LINK

- MATIC

- PAXG (Paxos Gold)

- UNI

- USDP (Pax Dollar)

Fees: Low for Makers, High for Takers

itBit’s fee structure is built for liquidity providers:- Taker fee: 0.35%

- Maker fee: -0.03% (you get paid to add liquidity)

Trading Interface: Built for Pros, Not Beginners

The itBit interface looks like it was designed in 2018 - and that’s intentional. There’s no flashy dashboard. No trending coins section. No social feed. Just a clean order book, a price chart, a buy/sell panel, and your trade history. It’s not user-friendly for someone who’s never traded before. But for someone who’s used to Bloomberg terminals or TradingView with advanced order types - it’s perfect. You get:- Limit, market, stop-limit orders

- OCO (One-Cancels-the-Other) orders

- Time-in-force options (IOC, FOK)

- Real-time depth of book

- API access for algorithmic trading

No Mobile App? That’s the Point

You won’t find an itBit app on the App Store or Google Play. And that’s not an oversight - it’s a strategy. Retail traders use apps for quick buys, impulse trades, and FOMO. itBit targets professionals who trade with discipline, not emotion. They don’t need push notifications. They need secure, stable, auditable access - and that’s only possible through a web interface. If you’re used to checking your portfolio on your phone every hour, you’ll find this frustrating. But if you’re managing a fund and need to log in from a secure workstation, this is actually safer.OTC Desk: Where Big Money Trades

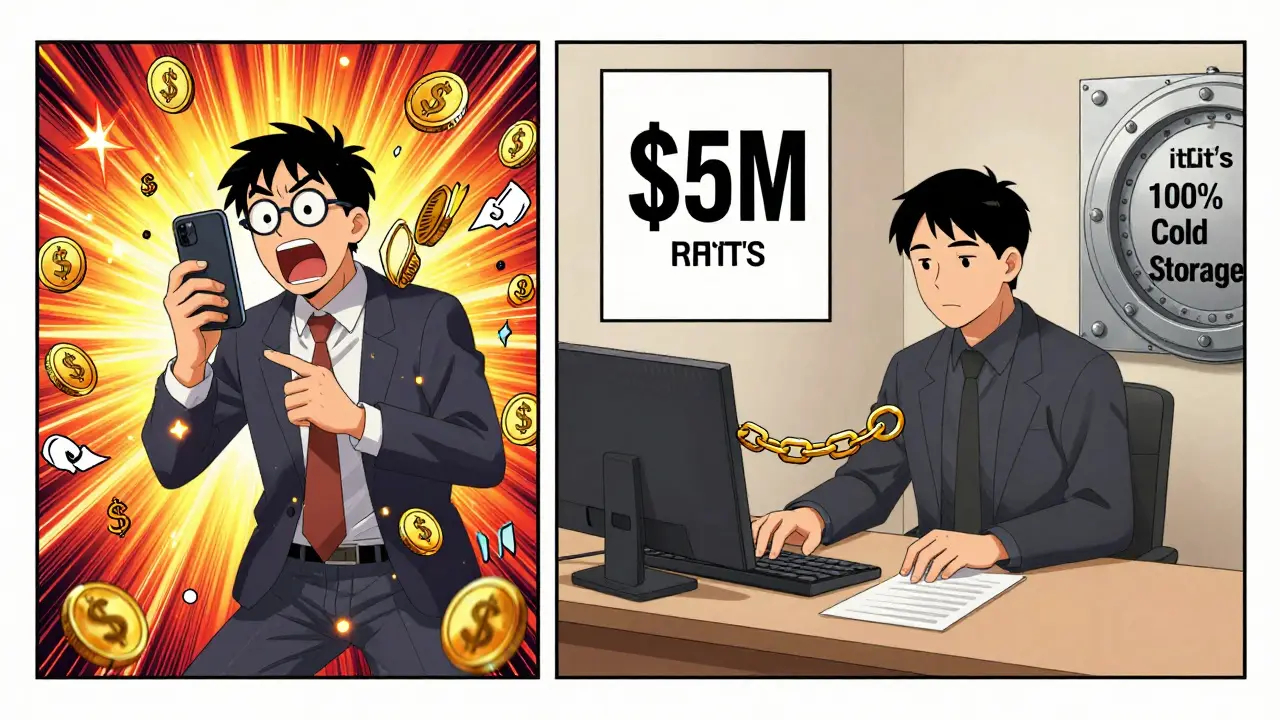

One of itBit’s biggest advantages is its Over-The-Counter (OTC) trading desk. This isn’t a feature - it’s a service. If you want to buy $10 million in Bitcoin without moving the market, you don’t place a limit order. You call itBit’s OTC desk. They find a counterparty, negotiate the price privately, and settle the trade off-chain. No slippage. No visible order book impact. No price spikes. This is how institutional investors move massive amounts of crypto without causing panic or attracting attention. Competitors like Coinbase and Kraken offer OTC too, but itBit’s integration with its regulated exchange means the settlement is faster, more transparent, and fully auditable.Security and Compliance: The Gold Standard

itBit holds 100% of customer assets in cold storage - except for the small amount needed for daily trading. That’s not marketing fluff. The DFS requires them to prove it every day. All customer funds are segregated from Paxos’ corporate assets. There’s no rehypothecation. No lending to third parties. No crypto-backed loans. If the exchange were to collapse tomorrow, your Bitcoin and USD would still be there. Identity verification is strict. You’ll need to upload a government-issued ID and a recent utility bill or bank statement. No faceless accounts. No anonymity. That’s the price of being federally regulated. The platform is also compliant with FATF travel rule, meaning all transfers above $1,000 include sender and receiver info - a requirement for regulated entities.Who Should Use itBit?

Use itBit if:- You’re an institutional investor, fund manager, or high-net-worth trader

- You trade more than 2,500 BTC per month

- You need regulatory assurance and audit trails

- You’re comfortable with wire transfers and no mobile app

- You prioritize security over convenience

- You want to buy crypto with a credit card

- You need a mobile app or instant deposits

- You trade small amounts under $10,000

- You want access to hundreds of altcoins

- You’re new to crypto and need hand-holding

How it Compares to Other Exchanges

| Feature | itBit | Coinbase Pro | Kraken | Binance US | |--------|-------|--------------|--------|------------| | Regulation | NYDFS (federal) | NYDFS | NYDFS | FinCEN (federal) | | Maker Fee | -0.03% | -0.01% | -0.01% | -0.01% | | Taker Fee | 0.35% | 0.25% | 0.16% | 0.20% | | Crypto Withdrawal Fees | $0 | $0 | $0 | $0 | | USD Deposit Methods | Bank wire only | ACH, wire, card | ACH, wire, card | ACH, wire | | Mobile App | No | Yes | Yes | Yes | | OTC Desk | Yes | Yes | Yes | Yes | | Supported Coins | 12 | 150+ | 180+ | 100+ | | Best For | Institutional traders | Retail + pros | Retail + pros | Retail traders | itBit isn’t trying to beat Coinbase on coin selection. It’s trying to beat them on trust.Real User Feedback

Institutional users on G2 give itBit high marks:- “Using the itBit Custody service is amazing. I love it.”

- “The OTC desk saved us $120K in slippage on a $5M BTC purchase.”

- “We switched from Kraken because we needed DFS-level compliance.”

Future Outlook

itBit’s future is tied to Paxos. The company is working on Bitcoin ETF custody solutions and has been mentioned as a potential partner for the first U.S.-approved Bitcoin ETF. That’s a big deal. If a Bitcoin ETF launches, Paxos could be the custodian behind it - and itBit would be the trading gateway. The platform won’t add more coins. It won’t build a mobile app. It won’t start accepting credit cards. That’s not the plan. The plan is to become the most trusted, regulated gateway for institutional crypto capital.Final Verdict

itBit isn’t the best crypto exchange for most people. But it’s the only one you should consider if you’re managing institutional money, trading large volumes, or need ironclad regulatory backing. For everyone else - Coinbase, Kraken, or even Binance US are better choices. They’re easier, faster, and more feature-rich. But if you’re serious about crypto at scale - if you need to know your assets are protected by federal regulators, not just a company’s word - then itBit isn’t just an option. It’s the standard.Is itBit safe to use?

Yes, itBit is one of the safest crypto exchanges in the world. It’s federally regulated by the New York Department of Financial Services (DFS), which requires daily audits, full asset backing, and segregation of customer funds. All crypto is held in cold storage, and the platform uses blockchain monitoring tools to prevent fraud. Unlike many exchanges, itBit doesn’t lend out customer assets or use them for yield products.

Can I use itBit if I live outside the U.S.?

Yes, itBit serves users in over 100 countries, including Canada, the UK, Australia, Japan, and most of Europe and Latin America. However, you can only trade USD. That means you’ll need to transfer U.S. dollars via bank wire from your local bank. It doesn’t support EUR, GBP, or AUD deposits directly.

Does itBit have a mobile app?

No, itBit does not have a mobile app. The platform is web-only, designed for professional traders who use desktop terminals and secure workstations. This is intentional - it reduces security risks and aligns with institutional use cases. If you need to trade on the go, you’ll need to use a different exchange.

What are the trading fees on itBit?

itBit charges a 0.35% fee for takers (market orders) and a -0.03% fee for makers (limit orders that add liquidity). That means if you place a limit order that doesn’t immediately fill, you get paid 0.03% of the trade value. There are no withdrawal fees for crypto, but USD withdrawals via wire cost $25 per transfer.

Can I buy Bitcoin with a credit card on itBit?

No, itBit does not accept credit cards, debit cards, or instant payment methods like PayPal or Apple Pay. The only way to deposit USD is via bank wire transfer. This limits accessibility for retail users but enhances security and compliance for institutional clients.

What’s the minimum deposit on itBit?

There’s no official minimum deposit. You can deposit as little as $100. But the platform is designed for high-volume traders. If you’re trading under $10,000 per month, you’ll find better options with lower fees and easier deposits. The real value of itBit kicks in when you’re trading 100+ BTC or more than $5 million monthly.

Does itBit support altcoins?

Yes, but only 12 altcoins are supported - all paired with USD. These include Ethereum, Litecoin, Bitcoin Cash, AAVE, LINK, UNI, MATIC, and PAXG. There are no meme coins, no new tokens, and no staking. The focus is on established, liquid assets with institutional demand.

Krista Hoefle

January 11, 2026 AT 12:43Emily Hipps

January 13, 2026 AT 12:26Most people don’t get it yet but institutions aren’t playing games. They’re building wealth. And this platform makes sure your assets don’t vanish overnight.

Jessie X

January 14, 2026 AT 04:34Kip Metcalf

January 15, 2026 AT 12:30Mujibur Rahman

January 15, 2026 AT 22:42Also the OTC desk? Absolute game changer. You move $5M without a single ripple. That’s not magic. That’s engineering.

Danyelle Ostrye

January 17, 2026 AT 21:34Jennah Grant

January 19, 2026 AT 11:22Dennis Mbuthia

January 20, 2026 AT 15:45And don’t even get me started on Binance. That’s a cartoon. This? This is real. You want safety? Then stop being lazy and wire your money.

Dave Lite

January 22, 2026 AT 04:18Also free crypto withdrawals? That’s unheard of. Other exchanges charge $15 to move BTC like it’s a luxury. Here? Just click send.

👏👏👏

Becky Chenier

January 23, 2026 AT 03:57Staci Armezzani

January 24, 2026 AT 05:03But if you’re managing money? This is the quiet powerhouse behind the scenes. The one no one talks about because they don’t need to. Their clients are too busy making money to post on Reddit.

Tracey Grammer-Porter

January 24, 2026 AT 22:06itBit doesn’t just say they’re compliant. They prove it every single day. That’s worth more than any app feature.

Katrina Recto

January 26, 2026 AT 12:33Veronica Mead

January 28, 2026 AT 07:36Surendra Chopde

January 29, 2026 AT 19:03Tiffani Frey

January 31, 2026 AT 08:15Tre Smith

February 1, 2026 AT 17:32It’s not better. It’s just safer for people who don’t want to lose. Which is fine. But don’t pretend it’s revolutionary.

Ritu Singh

February 3, 2026 AT 14:49And don’t you think it’s weird they don’t list Solana? Coincidence? I think not. The central banks don’t like decentralized alternatives. This is suppression disguised as compliance.

kris serafin

February 4, 2026 AT 12:50Also the OTC desk is pure magic. Did a $2M trade last week. Zero slippage. Zero stress. Just a call and boom - done.

Best platform for serious money.

Jordan Leon

February 6, 2026 AT 06:32It’s a quiet rebellion against the attention economy. And in a world of noise, silence is the most powerful statement.

Rahul Sharma

February 6, 2026 AT 08:45