Most people think decentralized exchanges are all the same. You connect your wallet, swap tokens, and hope the price doesn’t move while you wait. But PancakeSwap v2 on Arbitrum changes that. It’s not just another DEX-it’s a full DeFi hub built for speed, low fees, and serious trading. If you’ve been stuck paying $20 in Ethereum gas to swap a few tokens, this is your escape route.

What Makes PancakeSwap v2 on Arbitrum Different?

PancakeSwap didn’t start on Arbitrum. It was born on Binance Smart Chain (BSC) in 2020, where it quickly became the biggest decentralized exchange thanks to cheap trades and high yields. But as BSC got crowded and users wanted more options, PancakeSwap expanded. By 2025, it’s live on Ethereum, Polygon, Arbitrum, and even Aptos. The Arbitrum version? That’s where things get interesting. The core engine hasn’t changed: it still uses an Automated Market Maker (AMM) model. That means there are no order books. Instead, you trade against pools of tokens locked in smart contracts. But v2 fixed the biggest flaw from v1: slippage. On older versions, if you tried to swap a large amount, the price would shift against you, and you’d lose money. v2 introduced smarter routing and tighter spreads, so your trades execute closer to the price you see. On Arbitrum, this matters because of speed. Transactions settle in under 3 seconds. On Ethereum, even with Layer 2 solutions, you’re often waiting 10-15 seconds. On BSC, it’s fast too-but Arbitrum gives you Ethereum-level security without the gas fees.Trading on PancakeSwap v2: Spot, Limits, and Perpetuals

You can do three main types of trading here:- Spot trading-swap one token for another instantly. Simple. Fast. No intermediaries.

- Limit orders-set a price and walk away. The system executes when the market hits your target. This works for most tokens, but not those with transfer taxes (like some meme coins). That’s a known limitation.

- Perpetual futures (v2)-trade leveraged positions up to 10x without expiry. This is new. You’re not just swapping-you’re betting on price direction. It’s not for beginners, but if you’re used to trading on centralized exchanges like Bybit or Binance, this feels familiar.

Why Arbitrum? Lower Fees, Same Power

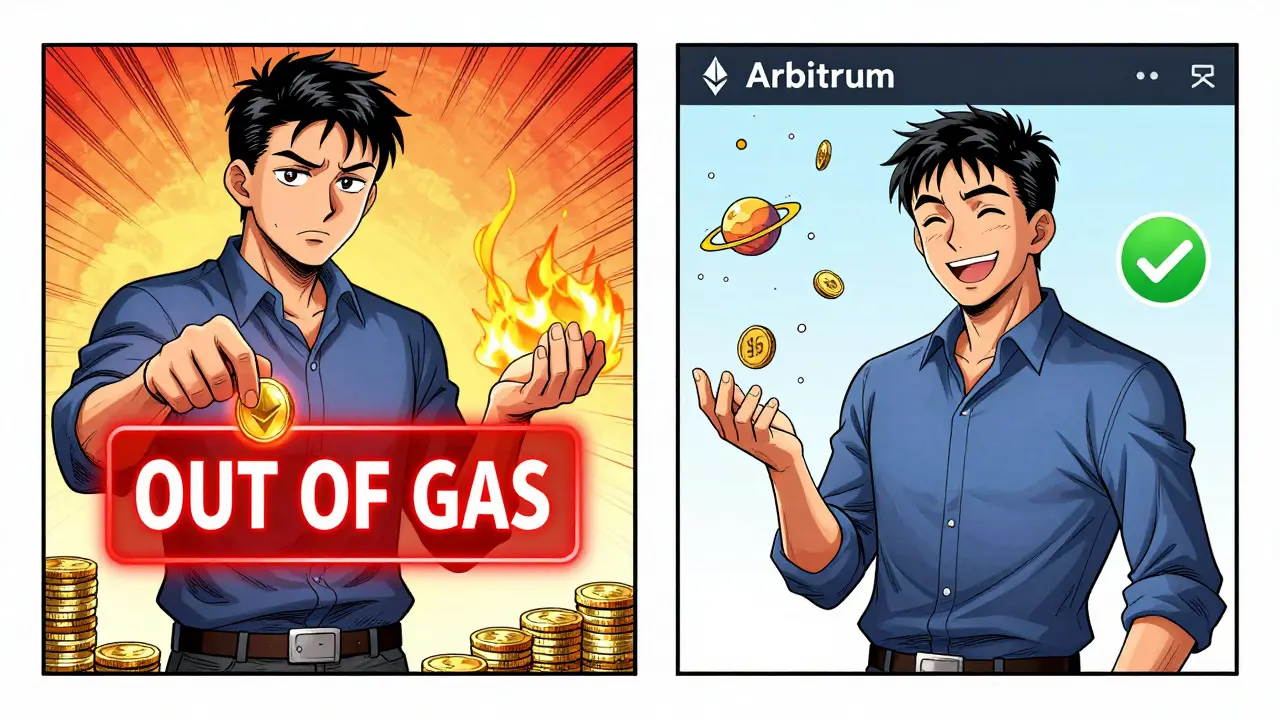

Here’s the real win: fees. On Ethereum mainnet, a simple swap can cost $5-$15. On BSC, it’s about $0.10. On Arbitrum? Around $0.05-$0.15. That’s cheaper than BSC in many cases, and way cheaper than Ethereum. You’re getting Ethereum’s security (it’s a Layer 2 built on Ethereum) with near-BSC-level costs. Transaction speed is another win. While BSC confirms in 3 seconds, Arbitrum does it in 2.5. That’s barely noticeable-but when you’re scalping or trading volatile tokens, every millisecond counts. Plus, Arbitrum’s rollup tech means fewer failed transactions. You won’t see the dreaded ‘Out of Gas’ error as often. Compare that to Uniswap on Ethereum. Uniswap is great, but its fees make small trades impractical. PancakeSwap v2 on Arbitrum lets you swap $10 of a token and still come out ahead. That’s not possible on most Ethereum-based DEXs.More Than Just Swaps: The Full Ecosystem

PancakeSwap isn’t just a swap tool. It’s a DeFi playground. Here’s what else you get:- Yield farming-deposit tokens into liquidity pools and earn CAKE. Some pools offer 20-50% APY, though those are often riskier.

- Syrup Pools-stake your CAKE and earn more CAKE. Simple, low-risk, steady returns.

- Lottery-buy tickets with CAKE. Draw every 24 hours. Winners get big payouts. It’s like a crypto raffle.

- IFOs (Initial Farm Offerings)-get early access to new tokens before they hit public markets. This is how many users first got into projects like Venus or AutoFarm.

- NFT Marketplace-buy, sell, or trade NFTs directly on the platform. No need to jump to OpenSea.

- Prediction Markets-bet on whether the price of CAKE will go up or down in the next 5 minutes. High risk, high reward.

CAKE Token: More Than Just a Reward

The CAKE token is the heartbeat of the whole system. It’s not just a reward token-it’s the key to everything:- Used to pay for lottery tickets

- Required to participate in IFOs

- Staked in Syrup Pools for passive income

- Used for governance voting

- Reduces trading fees by up to 25% when used as a fee token

How It Compares to Uniswap and SushiSwap

Let’s cut through the noise. Here’s how PancakeSwap v2 on Arbitrum stacks up against its biggest rivals:| Feature | PancakeSwap v2 (Arbitrum) | Uniswap v3 (Ethereum) | SushiSwap (Polygon) |

|---|---|---|---|

| Transaction Fee (avg) | $0.05-$0.15 | $5-$15 | $0.10-$0.30 |

| Speed | 2.5 seconds | 10-20 seconds | 3 seconds |

| Limit Orders | Yes | Yes (advanced) | Yes |

| Perpetual Futures | Yes (v2) | No | No |

| Lottery / Prediction Markets | Yes | No | No |

| CAKE Token Benefits | Fee discounts, staking, governance | None | None |

| Best For | Traders who want speed, low cost, and extra features | Large traders with deep pockets | Low-cost swaps without extra features |

Who Should Use It? Who Should Avoid It?

This isn’t for everyone. Here’s who it’s perfect for:- Traders who want low fees and fast trades

- Yield farmers chasing high APYs

- People tired of Ethereum gas wars

- Users who like gamified DeFi (lotteries, predictions)

- Anyone holding CAKE and wanting to use it beyond just trading

- You only trade stablecoins and don’t care about extra features

- You’re new to crypto and don’t understand slippage or impermanent loss

- You want a simple, no-frills interface (try 1inch or Matcha instead)

- You’re uncomfortable with non-custodial wallets

Real User Experience: What People Actually Say

Most users on Reddit and Twitter praise the speed and low cost. One trader from Texas said: “I used to pay $12 to swap ETH for USDC on Uniswap. Now I do it on PancakeSwap Arbitrum for 12 cents. I don’t go back.” Another user in Brazil uses the lottery daily. “I buy 2 tickets with CAKE every night. I’ve won three times. One win covered my entire month’s trading fees.” The complaints? Mostly about the UI being too crowded. There are so many tabs-farming, IFOs, NFTs, predictions-that new users get lost. But once you find your way, it’s intuitive.Security and Risks

PancakeSwap is non-custodial. That means no one holds your funds-not even the team. That’s good. But it also means if you send tokens to the wrong address, or approve a malicious contract, you lose everything. There’s no customer support to call. Always check the contract address. The official PancakeSwap Arbitrum address is verified on their website. Never trust links from Twitter or Discord. Scammers love to clone interfaces. Also, impermanent loss is real. If you provide liquidity to a volatile pair like CAKE/ETH, and one token crashes, you could lose value-even if the price recovers. Don’t put in money you can’t afford to lose.Final Verdict: Is It Worth It?

Yes. If you’re serious about DeFi and tired of paying $10 in fees for every trade, PancakeSwap v2 on Arbitrum is one of the best options in 2025. It’s faster than Ethereum, cheaper than BSC in many cases, and packed with features no other DEX offers at this scale. It’s not perfect. The interface is busy. The risk is high. But if you know what you’re doing, it gives you more tools than any other platform. For traders, farmers, and gamblers in DeFi, this is the Swiss Army knife.Is PancakeSwap v2 on Arbitrum safe to use?

Yes, but only if you follow basic crypto safety rules. PancakeSwap is non-custodial, so your funds are in your wallet, not on a server. The code has been audited multiple times. But scams are common-always verify the official website and contract addresses. Never approve unknown tokens or click random links.

Do I need to hold CAKE to use PancakeSwap?

No, you don’t need CAKE to swap tokens. But you’ll pay higher fees. Using CAKE as a fee token cuts trading costs by up to 25%. If you plan to use the lottery, IFOs, or Syrup Pools, you’ll need CAKE. It’s not required to start, but it unlocks the best value.

How do I connect my wallet to PancakeSwap on Arbitrum?

Open the PancakeSwap website and click ‘Connect Wallet.’ Choose MetaMask, Trust Wallet, or any EVM-compatible wallet. Make sure your wallet is set to the Arbitrum network. If you’re not sure how, switch networks in your wallet settings to ‘Arbitrum One.’ Then connect. You’re ready to trade.

Can I lose money using PancakeSwap?

Yes. You can lose money through impermanent loss in liquidity pools, bad trades, or scams. Perpetual futures are high-risk and can liquidate your position if the market moves against you. Always start small. Never invest more than you’re willing to lose. DeFi is powerful-but it’s not risk-free.

What’s the difference between PancakeSwap v1 and v2?

v1 had high slippage and poor price impact on large trades. v2 introduced better routing algorithms, tighter spreads, and lower fees. It also added limit orders and improved the UI. If you’re still using v1, switch to v2 immediately. You’ll save money and get better trade execution.

Is PancakeSwap better than Uniswap?

It depends. If you only want to swap tokens and don’t care about extra features, Uniswap is fine. But if you want low fees, fast trades, lotteries, NFTs, and futures-all in one place-PancakeSwap v2 on Arbitrum is better. Uniswap is simpler. PancakeSwap is richer. Choose based on your goals.

How do I earn CAKE tokens?

You can earn CAKE by providing liquidity to trading pairs, staking in Syrup Pools, winning the lottery, or participating in IFOs. The most common way is adding liquidity to CAKE/ETH or CAKE/USDT pools. You’ll earn a share of trading fees plus CAKE rewards. APYs vary daily-check the platform for current rates.

Elizabeth Miranda

December 7, 2025 AT 14:30PancakeSwap on Arbitrum is honestly a game-changer for small traders. I used to avoid swapping under $100 because of gas fees, but now I’m swapping $20 worth of tokens daily and paying less than a dime. It’s not just about cost-it’s about freedom. No more waiting for transactions to confirm while the market moves without you.

And the fact that you can do limit orders and perpetuals in one place? That’s rare. Most DEXs make you jump between platforms. Here, it’s all integrated. I’ve started using the Syrup Pools for passive income and haven’t touched my main wallet in weeks.

The UI is cluttered, sure, but once you learn where everything lives, it’s efficient. I wish more platforms would prioritize functionality over minimalism. Sometimes you need the tools, even if they take up space.

Chloe Hayslett

December 9, 2025 AT 05:11Oh wow, another ‘DeFi is the future’ blog post. Let me guess-you also think NFTs are ‘digital art’ and that CAKE token is ‘deflationary magic.’

Real talk: this is just BSC with a different name and a fancy Layer 2 coat of paint. The ‘features’ are just casino mechanics wrapped in blockchain jargon. Lottery? Prediction markets? This isn’t finance-it’s a Vegas slot machine with a whitepaper.

Noriko Robinson

December 10, 2025 AT 20:48I tried this after reading the post and honestly, I was overwhelmed at first. There’s so much going on-farms, IFOs, NFTs, lotteries, futures-it’s like walking into a crypto supermarket with no map.

But I started small. Just swapped 5 USDC, then staked 10 CAKE in Syrup Pool. No drama. No gas disasters. Got a tiny bit of extra CAKE. Didn’t lose anything. Took me three days to even click on the prediction market.

Maybe it’s not for everyone, but if you take it slow, it’s not as scary as it looks. I’m not a trader. I’m just someone who likes earning a little extra while I sleep. And this works for that.

Mairead Stiùbhart

December 11, 2025 AT 19:40Let’s be real-this is what happens when a DeFi project realizes it can’t compete on tech, so it adds gamification instead. Lottery tickets? Prediction markets? Next they’ll have a PancakeSwap horse racing game.

Meanwhile, Uniswap just lets you swap tokens without making you feel like you’re in a crypto-themed carnival. Sometimes simplicity is the real innovation.

ronald dayrit

December 12, 2025 AT 22:25What’s fascinating here isn’t the technical architecture-it’s the sociological shift. We’re witnessing the normalization of financial behavior that was once confined to centralized exchanges, now repackaged as decentralized autonomy. The user isn’t just trading-they’re participating in a ritual economy where tokens function as both currency and symbolic capital.

The CAKE token isn’t merely a utility token; it’s a social contract. Holding it signals alignment with a community that values participation over passive ownership. The burn mechanism isn’t just deflationary-it’s performative. It enacts a narrative of scarcity as virtue.

And yet, the interface’s complexity mirrors the cognitive dissonance of modern DeFi: we want control, but we’re drowning in options. We crave security, but we ignore contract risks. We seek yield, but we misunderstand impermanent loss. This isn’t just a DEX-it’s a mirror.

So when we ask ‘Is it better than Uniswap?’ we’re really asking: ‘Do we want efficiency, or do we want meaning?’ And that’s the real question.

Neal Schechter

December 14, 2025 AT 07:07For anyone new to Arbitrum or PancakeSwap, just connect your wallet, do a tiny swap first-like $5-and see how fast it goes. No need to dive into futures or lotteries right away. The core swap function works like a charm.

Also, if you’re using MetaMask, make sure you’ve added the Arbitrum network manually. A lot of people get stuck because they’re still on Ethereum mainnet and wonder why they’re paying $10 in fees.

And yeah, the UI is busy, but you’ll get used to it. I’ve been using it for 8 months now and I barely look at the other tabs unless I’m bored.

Glenn Jones

December 15, 2025 AT 07:13Y’all are acting like this is some revolutionary breakthrough. It’s not. It’s a glorified BSC clone with a Layer 2 sticker slapped on it.

Perpetuals? On a DEX? Who thought that was a good idea? You think retail traders are ready for 10x leverage on meme coins with 30% slippage? This isn’t DeFi-it’s a pump-and-dump simulator with a ‘gamified’ veneer.

And don’t get me started on the lottery. You’re literally paying CAKE to play a raffle where the odds are worse than a scratch card. This isn’t finance. This is gambling dressed up in smart contract code.

And the devs? They’re not building tools-they’re building addiction engines. You think people are here for yield? No. They’re here for dopamine hits. CAKE burns? More like dopamine burns.

Tara Marshall

December 15, 2025 AT 12:57Arbitrum fees are low. Swap speed is fast. CAKE discounts help. That’s it. No need to overthink it.

Lottery is a waste of time. Perpetuals are dangerous for beginners. Use it for swaps and staking. Ignore the rest.

Joe West

December 16, 2025 AT 17:29Just did my first swap on PancakeSwap Arbitrum today-$30 of ETH to USDC. Paid 8 cents in fees. Took 2 seconds. I was crying. Not from emotion-because I remembered paying $14 for the same thing on Uniswap last month.

Also tried the Syrup Pool. Staked 20 CAKE. Got 0.12 CAKE back in 24 hours. Not life-changing, but it’s free money. I’ll take it.

UI is messy, but I found the swap button. That’s all I need right now.

Regina Jestrow

December 18, 2025 AT 05:17Okay, but what happens when Arbitrum gets congested? Or when the CAKE token price tanks and the staking rewards drop? Or when someone exploits the perpetuals contract? This whole system feels like a house of cards built on optimism and low fees.

I love the speed. I love the cost. But I’m not convinced it’s sustainable. We’ve seen this movie before-high APYs, then the rug pull, then the silence.

Is this innovation? Or just clever marketing wrapped in blockchain?

Martin Hansen

December 18, 2025 AT 08:09Of course you’re praising this. You’re clearly the type who thinks ‘low fees’ justifies gambling on meme coins with leverage. This isn’t finance-it’s a casino operated by people who think ‘decentralized’ means ‘no consequences.’

Uniswap is clean. It’s honest. It doesn’t trick you into buying lottery tickets with your hard-earned ETH. You want to gamble? Go to Las Vegas. Don’t ruin DeFi with your poor life choices.

Lore Vanvliet

December 19, 2025 AT 08:24LOL at people saying this is ‘too complicated.’ If you can’t handle 5 tabs, you shouldn’t be in crypto. This isn’t Robinhood. You want simplicity? Go back to Coinbase.

And the lottery? I won $800 last month from $12 in CAKE tickets. I bought a new GPU. So yeah, I’m not ‘gambling’-I’m optimizing. Your FUD is showing.

Also, CAKE burns are real. Supply is dropping. You’re just mad because you don’t hold any.

PS: I use the prediction market every day. It’s like a crypto version of ‘heads or tails.’ 50/50 odds. I win 60% of the time. Coincidence? I think not.

Scott Sơn

December 21, 2025 AT 02:16This isn’t just a DEX-it’s a symphony. The liquidity pools are the strings, the CAKE burns are the percussion, the lottery is the jazz solo no one asked for but somehow works. The UI? A chaotic masterpiece. Like a Jackson Pollock painting-if Pollock had a PhD in Solidity and a Patreon.

People call it clutter. I call it freedom. I don’t need a minimalist app. I need a universe. And this? This is the universe I signed up for.

Also, I just made 12% APY on Syrup Pool while eating tacos. That’s not DeFi. That’s magic.

Frank Cronin

December 23, 2025 AT 01:24You’re all delusional. This platform is a honeypot for retail sheep. They’ve turned DeFi into a TikTok game. ‘Buy CAKE, win lottery, get rich!’

And you’re eating it up. The contract audits? Meaningless. The team? Anonymous. The ‘deflationary’ CAKE? Just a marketing gimmick to make you feel smart while you lose money to impermanent loss.

Uniswap is the real DeFi. This? This is a crypto MLM with a better UI.

miriam gionfriddo

December 23, 2025 AT 15:37so i tried this and my tx failed 3 times and i lost 0.003 eth in gas trying to swap 5 usdc and now i hate everything

also the lottery is rigged. i bought 10 tickets and won 0.02 cake. that’s less than the fee. i’m not stupid. this is a scam.

Nicole Parker

December 23, 2025 AT 21:20I came into this thinking it was just another DEX. I’ve been in crypto since 2017. I’ve used Uniswap, Sushi, Curve, Balancer. I thought I’d seen it all.

But PancakeSwap on Arbitrum changed how I think about utility in DeFi. It’s not about being the most efficient swap tool-it’s about being the most complete experience. The fact that you can farm, stake, predict, and trade NFTs without switching apps? That’s not convenience. That’s ecosystem design.

Yes, the interface is overwhelming. But I didn’t need to learn everything at once. I started with swaps. Then I tried Syrup Pools. Then I bought one lottery ticket out of curiosity. I won $4. That felt like a gift.

I’m not a trader. I’m not a degens. I’m just someone who likes having options. And this gives me options without forcing me into risk. That’s rare.

Also, the CAKE burn is real. I checked the blockchain. Over 120 million burned in 2024. That’s not marketing. That’s math. And math doesn’t lie.

Cristal Consulting

December 25, 2025 AT 19:32Start small. Swap $10. Use CAKE for fees. Try Syrup Pool. Ignore the rest until you’re comfortable.

Arbitrum is fast. Fees are low. You’re not losing money. You’re learning.

That’s all you need to know.