Crypto Token Classification Checker

Answer the following questions to determine if your token is likely a security or commodity:

Trying to launch a token and wondering if you have to file paperwork with the SEC? You’re not alone. The rules for crypto securities registration have shifted dramatically in 2025, and missing a step can halt a fundraising round fast. This guide walks you through the core legal backdrop, how to decide if your token is a security, the exact disclosures the SEC now expects, and where the CFTC fits in.

Legal Foundations: The Two Core Securities Laws

Everything starts with two statutes that still govern most investment products in the United States.

Securities Act of 1933 is the federal law that requires issuers to register securities before offering them to the public, unless an exemption applies. It’s mainly about disclosure - the prospectus must give investors the facts they need to decide.

Securities Exchange Act of 1934 regulates the secondary trading of securities and gives the SEC ongoing reporting powers. Together, these statutes form the backbone of today’s registration requirements for crypto‑based assets.

Who’s Shaping the Rules? The SEC’s Crypto Task Force

In early 2025 Acting SEC Chairman Mark T. Uyeda formed the Crypto Task Force to create a clear, unified regulatory framework for crypto assets. The task force has issued a series of staff statements, guidance memos, and a joint statement with the CFTC that now define the practical steps issuers must follow.

The most relevant pieces of guidance include:

- April10,2025 - Division of Corporation Finance clarifies that all disclosures must protect investors and promote market efficiency.

- July1,2025 - Comprehensive rules for Crypto Asset Exchange‑Traded Products (ETPs) that spell out prospectus summaries, risk factors, and fee disclosures in plain language.

- March20,2025 - Statement that pure crypto‑mining operations are not securities.

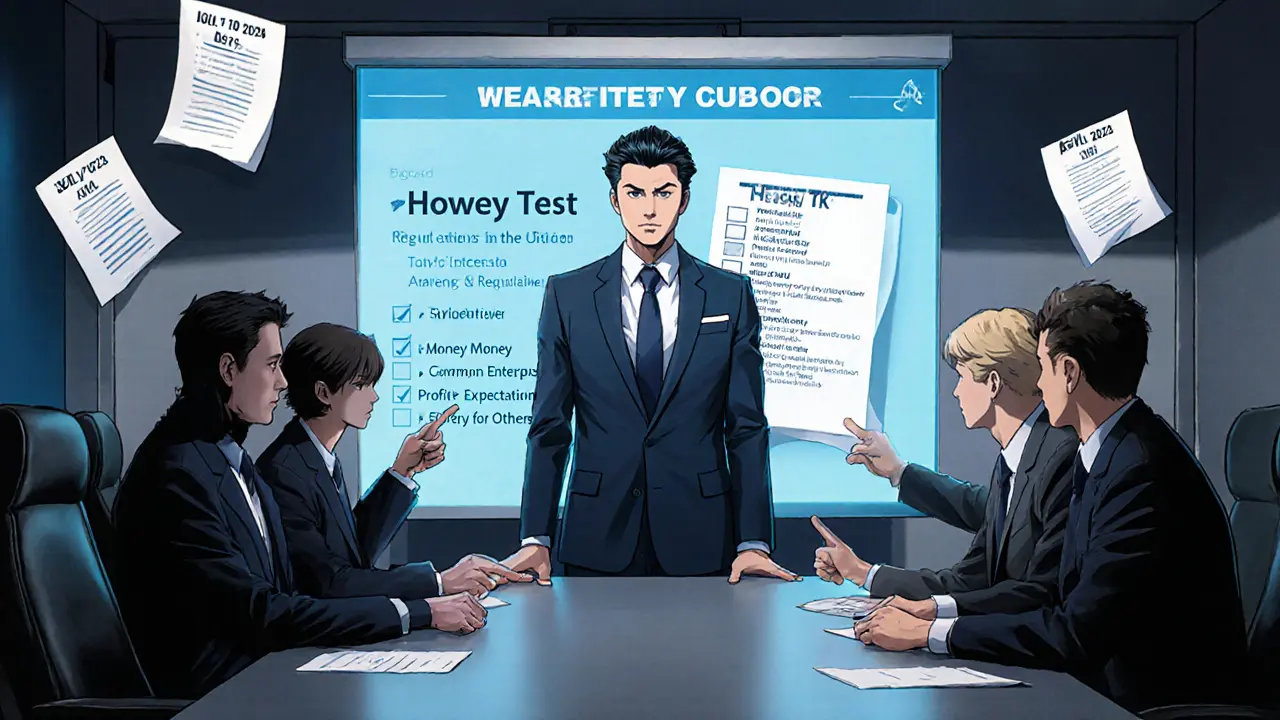

Is Your Token a Security? Applying the Howey Test

The SEC still leans on the classic Howey test a four‑part test to determine whether an arrangement qualifies as an investment contract, and thus a security. The four elements are:

- An investment of money.

- In a common enterprise.

- With the expectation of profits.

- Derived primarily from the efforts of others.

If your token meets all four, you’re looking at a security registration.

Real‑world examples:

- Tokenized equity - Shares of a startup issued as blockchain tokens; investors expect dividends and price appreciation, making it a security.

- Utility token with on‑chain incentives - Grants access to a platform and rewards users for activity; often passes the Howey test only if the rewards are tied to the issuer’s performance.

- Pure commodity token like Bitcoin - No expectation of profit from the issuer’s effort; typically treated as a commodity, not a security.

Registration Pathways: Full Registration, Exemptions, and Safe Harbors

When the Howey test says “yes,” you have three main routes:

- Full registration - File a Form S‑1 (or S‑3 for qualified issuers) with the SEC, attach a detailed prospectus, and comply with ongoing reporting under the Exchange Act.

- Exempt offerings - Use Regulation D (private placements), Regulation A+ (mini‑IPO), or Regulation S (offshore offerings) if you meet the specific thresholds.

- Safe‑harbor disclosures - The 2025 guidance proposes tailored templates for Initial Coin Offerings (ICOs), airdrops, and network rewards that reduce the paperwork burden while still satisfying the core disclosure goals.

For each route, the SEC now expects a uniform set of disclosure elements:

- Prospectus summary - a two‑page snapshot of the offering.

- Risk factors - clear, jargon‑free description of market, technological, and regulatory risks.

- Business description - how the token fits into the overall business model.

- Service providers and custodians - who holds the crypto, what insurance is in place.

- Fees and expenses - detailed breakdown of all costs to the investor.

- Plan of distribution - how the token will be sold and marketed.

- Management and conflicts of interest - biographies and any related‑party relationships.

- Financial statements - audited reports for issuers above $10million in assets.

Commodity vs. Security: The CLARITY Act and CFTC Overlap

The proposed CLARITY Act a bill that would reclassify many decentralized tokens as commodities under CFTC jurisdiction. If passed, Bitcoin‑type tokens would no longer fall under SEC Rule204A‑1 reporting, easing the compliance load for Registered Investment Advisers (RIAs).

Meanwhile, the CFTC the Commodity Futures Trading Commission, which regulates futures, swaps, and commodities. A joint SEC‑CFTC statement released on September2,2025 clarified that:

- National securities exchanges can list spot crypto‑asset products, provided they follow existing securities rules.

- Designated contract markets can list the same products under CFTC rules, as long as they meet clearing and margin requirements.

This dual‑regime means token issuers must first decide the legal label (security vs. commodity) before choosing the appropriate filing path.

Practical Checklist: How to Prepare for Registration

Below is a step‑by‑step list that most issuers find useful. Tick each box before you submit anything to the SEC.

- Identify the token’s functional promise - does it promise profits from the issuer’s effort? If yes, treat it as a security.

- Run a Howey test analysis - document each of the four elements with supporting facts.

- Choose a filing route - full registration, Regulation D/A+, or safe‑harbor template.

- Gather required disclosures - use the 2025 guidance checklist (prospectus summary, risk factors, etc.).

- Select custodians and insurers - ensure they are SEC‑approved and can provide audit trails.

- Prepare audited financial statements - required for offerings above the $10million threshold.

- Draft the registration statement - keep language plain, avoid blockchain jargon unless explained.

- Submit Form S‑1 (or chosen form) via the SEC’s EDGAR system - watch for comments and be ready to amend.

- Set up ongoing reporting - Form 10‑K, 10‑Q, and 8‑K filings as required after the offering closes.

Tip: Keep a “Disclosure Log” that records every change to the prospectus. The SEC staff has warned that undocumented alterations can trigger enforcement actions.

Common Pitfalls and Pro Tips

Even seasoned teams stumble. Here are the mistakes that usually cause delays:

- Using too much technical jargon - The 2025 guidance penalizes language that isn’t understandable to an average investor.

- Failing to disclose custodial risks - If your token lives in a self‑custody wallet, you must describe the security controls and insurance coverage.

- Mixing commodity and security assets - Treat each token type separately; a hybrid prospectus can confuse the SEC and the CFTC.

- Overlooking the CLARITY Act timeline - If the Act passes while your filing is in progress, you may need to re‑classify the token.

Pro tip: Run a mock review with an external counsel who specializes in crypto securities before you hit “submit.” A fresh set of eyes often catches ambiguous risk language that the SEC staff flags later.

Summary of Key Takeaways

- The 1933 and 1934 securities laws still apply to token offerings that meet the Howey test.

- MarkT. Uyeda’s Crypto Task Force now provides a clear, plain‑language disclosure checklist.

- Choose the right filing path early - full registration vs. exemption vs. safe‑harbor.

- Watch the CLARITY Act and the SEC‑CFTC joint statement; they determine whether you’re dealing with a security or a commodity.

- Follow the practical checklist to avoid common compliance delays.

Frequently Asked Questions

Do I need to register a token that is used only for platform access?

If the token provides a functional utility and does not promise profits from the issuer’s effort, it usually passes the Howey test and can be treated as a non‑security. However, you still need to ensure no hidden profit expectations are embedded in the tokenomics.

What’s the difference between a Form S‑1 and a Regulation D filing?

Form S‑1 is a full public registration that requires a prospectus and ongoing reporting. Regulation D is a private placement exemption that limits the number of investors and the amount of money raised, and it does not require a public prospectus.

How does the CLARITY Act affect existing security token offerings?

If the Act reclassifies a token as a commodity, the issuer may need to shift reporting from SEC Rule204A‑1 to CFTC requirements. That could mean filing with the CFTC, adjusting custodial arrangements, and updating marketing materials.

Can a registered exchange list a spot crypto token without a new law?

Yes. The September2025 joint SEC‑CFTC statement clarified that existing securities‑exchange rules already permit listing spot crypto products, as long as the exchange follows standard disclosure and market‑making requirements.

What are the most common risk factors I should disclose?

Typical risk factors include market volatility, regulatory uncertainty, smart‑contract bugs, custodial security breaches, and liquidity constraints on secondary markets.

| Feature | Tokenized Equity (Security) | Commodity Token (e.g., BTC) |

|---|---|---|

| Legal Test | Howey test - meets all four elements | Not an investment contract; treated as a commodity |

| Primary Regulator | SEC (Securities Act & Exchange Act) | CFTC (Commodity Futures Trading Act) |

| Typical Filing | Form S‑1 or exemption (Reg D/A+) | No SEC filing; CFTC reporting if Futures/Swaps involved |

| Disclosure Requirements | Prospectus, risk factors, financials, custodian info | Generally none for spot token; disclose only for derivatives |

| Ongoing Reporting | Form 10‑K, 10‑Q, 8‑K | Annual CFTC reports only if regulated products exist |

Jason Wuchenich

October 9, 2025 AT 08:15Hey, great effort pulling this guide together. The way you broke down the Howey test into bite‑size steps is really helpful for founders who are just getting their heads around securities law. Keep the focus on plain language – investors appreciate clarity more than dense legalese. If you keep updating it with the latest SEC memo, it’ll stay a go‑to resource.

Kate O'Brien

October 10, 2025 AT 06:29Read that guide and it felt like the SEC is hiding something big. They keep changing the rules and never tell us the real agenda. Makes you wonder who's really pulling the strings behind these crypto regulations.

Ricky Xibey

October 11, 2025 AT 04:42Nice breakdown, really handy for devs. Just remember to double‑check the filing deadlines.

Sal Sam

October 12, 2025 AT 02:55Spot on with the technical jargon – especially the part about “prospectus summary” and “risk factor articulation.” Those sections often trip up teams that aren’t used to securities compliance. Your checklist mitigates the typical back‑and‑forth with the SEC staff. Also, the note on custodial risk disclosure is crucial for any token that lives in a self‑custody wallet. Overall, solid work.

Moses Yeo

October 13, 2025 AT 01:09Interesting narrative, yet I can’t help but see the hidden paradox; you present a so‑called "clear" pathway while the regulatory landscape remains a labyrinthine construct, designed perhaps to perpetuate a power asymmetry. One might argue that any guide is merely a veneer, a superficial overlay on an inherently opaque system. Nevertheless, the checklist does provide a semblance of order amidst the chaos.

Lara Decker

October 13, 2025 AT 23:22While the guide is comprehensive, I’d caution teams to avoid over‑reliance on template language. The SEC often flags boilerplate text as insufficient.

Anna Engel

October 14, 2025 AT 21:35Oh great, another “ultimate guide.” As if anyone actually reads all fifteen paragraphs before yawning. Guess we’ll see how many startups actually follow this “perfect” script.

manika nathaemploy

October 15, 2025 AT 19:49i think this guide is super helpful! i like how you broke down the steps. its easy to follow and not too many big words. great job sharing this info with us.

Debra Sears

October 16, 2025 AT 18:02I really appreciate how you laid out the checklist in a logical order. Starting with the token’s functional promise helps teams self‑diagnose early. The section on custodial risk is often overlooked, so it's good to see it highlighted. Also, reminding founders to keep a “Disclosure Log” is a practical tip that can save a lot of headaches later. Thanks for making this accessible.

Mark Fewster

October 17, 2025 AT 16:15Excellent summary, especially the part about ongoing reporting requirements; the SEC’s expectations are quite detailed, and missing a single filing can trigger enforcement actions, so vigilance is key; also, the risk‑factor checklist is thorough, and it aligns well with the latest staff guidance, which is a plus.

Dawn van der Helm

October 18, 2025 AT 14:29Love the positivity of this guide! 😊 It makes a heavy topic feel more approachable. The emoji breaks are a nice touch for readability. Keep spreading the knowledge! 🌟

Liam Wells

October 19, 2025 AT 12:42It is with a certain degree of formal disdain that I observe this so‑called “guide.” One must question the underlying motivations of the SEC Task Force, whose pronouncements often masquerade as benevolent regulation whilst serving as a mechanism of control. Moreover, the reliance on the Howey test is an antiquated relic, ill‑suited for the nuanced realities of decentralized finance. The checklist, though thorough, may inadvertently shepherd innovators towards a regulatory conformity that stifles genuine innovation. Still, the articulation of risk factors is commendable, if only because it provides a veneer of compliance that can be leveraged in negotiations with legal counsel.

Darren Belisle

October 20, 2025 AT 10:55Great job compiling everything in one place! This will definitely help a lot of founders navigate the murky waters of crypto securities. Stay optimistic and keep sharing.

Heather Zappella

October 21, 2025 AT 09:09Thank you for presenting a comprehensive overview that balances legal rigor with practical guidance. The initial sections succinctly recap the core statutes, which is essential for readers who may not be familiar with the 1933 and 1934 Acts. Your explanation of the Howey test’s four elements is clear, and the inclusion of concrete token examples helps illustrate each point effectively. The checklist that follows is organized logically, beginning with token functionality and proceeding through disclosure requirements, custodial considerations, and financial statements. I particularly appreciate the emphasis on plain‑language risk factors; avoiding jargon not only satisfies SEC expectations but also protects investors from misunderstandings. The advice to maintain a “Disclosure Log” is a valuable operational tip that can mitigate enforcement risk. Additionally, the discussion of the CLARITY Act provides foresight into future regulatory shifts, ensuring that issuers can anticipate potential re‑classification. The section on dual regulation by the SEC and CFTC is well‑structured, clarifying the overlapping jurisdictions without overwhelming the reader. Your table summarizing registration paths offers an at‑a‑glance comparison that is both informative and easy to reference. By concluding with a FAQ, you address common concerns that often arise when teams embark on token offerings, reinforcing the guide’s utility. Overall, the guide’s depth, clarity, and actionable items make it an indispensable resource for anyone navigating the evolving landscape of crypto securities compliance.

Don Price

October 22, 2025 AT 07:22The SEC’s sudden shift in 2025 is not a coincidence; it aligns with a broader agenda to consolidate control over financial innovation. By redefining the boundaries between securities and commodities, they create a moving target that keeps the industry perpetually on the defensive. The CLARITY Act, while presented as market‑friendly, may serve to funnel more assets under the CFTC’s jurisdiction, effectively doubling regulatory oversight. It’s a classic divide‑and‑conquer strategy, ensuring that no single entity can challenge the prevailing power structures. We must remain vigilant and question every “clarification” that appears in official memos, as each may contain hidden provisions designed to erode decentralization.

Jasmine Kate

October 23, 2025 AT 05:35Sounds like a typical scare‑tactic narrative.

Caitlin Eliason

October 24, 2025 AT 03:49Honestly, if we keep ignoring the moral implications of these regulatory gambits, we’re complicit in the erosion of financial sovereignty. The SEC’s overreach is not just a legal issue; it’s an ethical one. Let’s demand transparency and hold regulators accountable for the societal impact of their policies.

Ken Pritchard

October 25, 2025 AT 02:02I hear you, Caitlin, and I think the best path forward is collaboration. By sharing resources and creating community‑driven compliance frameworks, we can reduce the burden on individual projects while still meeting regulatory standards. Let’s keep the conversation open and support each other through these changes.