When you're looking for a crypto exchange that doesn't feel like a wild west gamble, ZORIXchange stands out-not because it's the biggest, but because it's one of the few trying to do things the right way. Launched in September 2022, this exchange isn’t chasing viral memecoins or flashy ads. It’s building a regulated, bank-grade platform for people who want to trade crypto without worrying about their funds vanishing overnight. If you’ve been burned by shady exchanges or frustrated by slow support, ZORIXchange might be worth a closer look.

Who Is ZORIXchange Really For?

ZORIXchange isn’t built for crypto speculators chasing 10x returns on obscure tokens. It’s for traders who care about safety, compliance, and clear rules. The CEO, Dilys Cheng, comes from HSBC with 17 years in banking compliance. That’s rare. Most crypto founders came from tech or crypto startups. She knows how regulators think-and that’s the whole point. ZORIXchange isn’t trying to bypass rules. It’s trying to follow them, across multiple countries. If you’re in Southeast Asia, the Middle East, or planning to move there, ZORIXchange’s focus on Malaysia, Singapore, Dubai, and soon Australia makes it one of the few exchanges actually tailored for your region. Most big platforms pulled out of these markets after 2022’s crash. ZORIXchange moved in.Security: Bank-Level Protection, But Is It Verified?

Security is where ZORIXchange tries hardest to impress. They claim 95% of user funds are in cold wallets with biometric access controls. That’s better than most. They use SSL/TLS 1.3 encryption, mandatory two-factor authentication, and multi-layered internal access protocols. No public hacks. No reported losses. That’s a good sign. But here’s the catch: they haven’t published any third-party security audits. Not a SOC 2 report. Not a CertiK scan. Not even a PeckShield review. Coinbase, Kraken, and Gemini all publish these. ZORIXchange doesn’t. That’s a red flag for institutional investors and cautious users. You’re trusting them on their word alone. If you’re a retail trader with $5,000 to trade, the security setup is probably fine. If you’re holding $500,000? You’d want proof, not promises.Fees: Competitive, But Only If You Trade Big

Fees on ZORIXchange are simple:- Taker fee: 0.10%

- Maker fee: 0.02%

Cryptocurrencies and Liquidity: Limited, But Focused

ZORIXchange lists around 120 cryptocurrencies. That sounds like a lot-until you realize Binance lists over 1,000. You won’t find Cardano (ADA), Polkadot (DOT), or Solana (SOL) on ZORIXchange as of late 2023. That’s a dealbreaker for altcoin hunters. Their focus is on Bitcoin, Ethereum, and major stablecoins like USDT and USDC. That’s smart. It reduces risk and keeps compliance manageable. But if you’re into niche DeFi tokens or new launches, you’ll need another exchange. Liquidity is another issue. Daily trading volume hovers around $85 million. That’s tiny compared to Binance’s $15 billion or Coinbase’s $1.2 billion. Slippage can be an issue on larger trades. If you’re buying $10,000 of ETH, you might get a worse price than on a bigger exchange.

How Easy Is It to Use?

The interface is clean, modern, and intuitive. No cluttered dashboards. No confusing tabs. You get spot trading, Earn, Dual Investments, and basic derivatives-all in one place. The mobile app works smoothly on iOS and Android. New users report they can start trading within 15 minutes after verification. That’s faster than most. ZORIXchange’s internal data shows tutorial completion rates are 22% higher than industry average. That means they’ve put real thought into onboarding. But advanced traders will miss features like stop-loss orders on derivatives, trailing stops, or advanced charting tools. This isn’t a platform for day traders using 5-minute charts. It’s for people who want to hold, earn, and trade with confidence.The Dual Investment Feature: High Returns, Hidden Risks

ZORIXchange’s Dual Investment product is their biggest differentiator. You lock up stablecoins like USDT and earn up to 25% annual returns. Sounds amazing, right? Here’s the fine print: it’s not staking. It’s not lending. It’s a structured product where ZORIXchange uses your funds to generate returns through options strategies. That means you’re exposed to counterparty risk-if they fail, you lose your money. No decentralized insurance. No smart contract audits. It’s like buying a high-yield bond from a company you’ve never heard of. The returns look great. But you’re trusting their financial strategy, not blockchain technology. Use this feature only with money you can afford to lose.Customer Support: Where ZORIXchange Wins

This is the one area where ZORIXchange consistently outperforms bigger exchanges. Users on Reddit and Trustpilot rave about live chat support. One user reported their KYC issue resolved in 22 minutes. That’s unheard of on Binance or Coinbase, where support can take days. They offer 24/7 support in English, Mandarin, Arabic, and Malay. Response times are 4 minutes for VIP users and 27 minutes for regulars. That’s excellent. Most exchanges don’t even publish their average response times. Their help center has 147 articles and 28 video tutorials. It’s not as deep as Binance Academy, but it covers the basics well. If you’re new to crypto, this is one of the most user-friendly support systems you’ll find.

KYC and Withdrawals: Slow, But Secure

ZORIXchange has a strict, tiered KYC system:- Level 1 (email + phone): $1,000 daily withdrawal limit

- Level 2 (government ID): $50,000 daily limit

- Level 3 (proof of address + source of funds): $500,000 daily limit

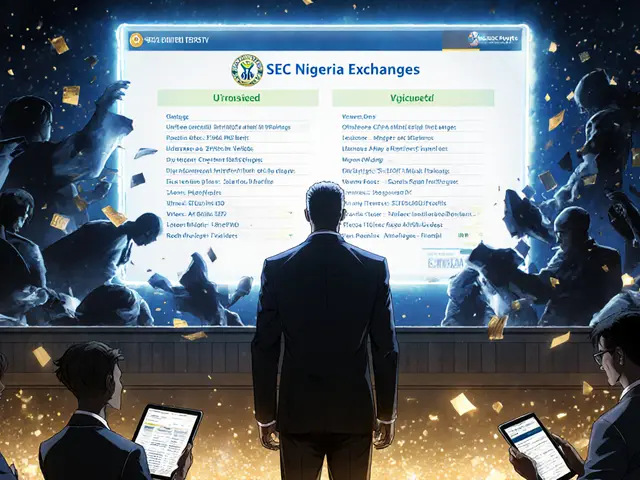

Regulatory Status: The Real Edge

ZORIXchange’s biggest strength isn’t its app or fees. It’s licensing. In November 2023, they became one of the first exchanges to get a full license from Dubai’s Virtual Assets Regulatory Authority (VARA). That’s huge. VARA is one of the strictest crypto regulators in the world. They’re also applying for licenses in Malaysia and Slovakia. That’s not marketing fluff. It’s legal groundwork. Most exchanges fight regulators. ZORIXchange is working with them. This matters because 2024 and 2025 will see more countries banning unlicensed exchanges. If you’re in a regulated jurisdiction, having a licensed exchange isn’t optional-it’s necessary.Who Should Avoid ZORIXchange?

- You want to trade 500+ altcoins. ZORIXchange lists only 120. - You need advanced trading tools like grid bots, trailing stops, or futures with 100x leverage. - You want instant fiat withdrawals. Bank transfers take up to 3 days. - You’re looking for tax reporting tools built into the platform. - You’re comfortable with unregulated exchanges. If you don’t care about compliance, you’ll find better liquidity elsewhere.Final Verdict: A Safe Bet for the Long Haul

ZORIXchange isn’t the flashiest crypto exchange. It won’t make you rich overnight. But if you want a platform that treats your money like a bank would, it’s one of the best options emerging in 2026. It’s not for everyone. But if you’re tired of exchanges that vanish after a crash, if you value compliance over hype, and if you’re trading in Southeast Asia or the Middle East-ZORIXchange is a rare find. It’s not perfect. But it’s trying to do the right thing. The real test? Can they scale? Can they grow liquidity without sacrificing security? Can they keep their support fast while handling 1 million users by 2024? So far, they’re passing. And in crypto, that’s more than most can say.Is ZORIXchange safe to use in 2026?

Yes, ZORIXchange is one of the safer exchanges available in 2026, especially for users in regulated regions. It stores 95% of funds in cold wallets, uses bank-grade security protocols, and has no reported security breaches. However, it hasn’t published third-party security audits, so you’re trusting their internal claims. For small to medium traders, the risk is low. For large holders, consider using a hardware wallet for long-term storage.

Does ZORIXchange support USD and EUR deposits?

Yes, ZORIXchange supports 47 fiat currencies, including USD, EUR, GBP, AUD, SGD, and MYR. You can deposit via bank transfer, SEPA, or local payment methods depending on your country. Withdrawals to bank accounts can take up to 72 hours, but crypto deposits and withdrawals are processed quickly.

Can I trade Bitcoin and Ethereum on ZORIXchange?

Yes, Bitcoin (BTC) and Ethereum (ETH) are among the most liquid assets on ZORIXchange. They’re supported for spot trading, staking, and Dual Investment. These are the two most traded pairs on the platform, so you’ll find tight spreads and reliable execution.

Why doesn’t ZORIXchange list Cardano or Polkadot?

ZORIXchange prioritizes regulatory compliance over listing volume. Coins like Cardano and Polkadot have faced scrutiny from regulators over their governance and token distribution models. To maintain its licensing in Dubai and other jurisdictions, ZORIXchange avoids tokens with unclear legal status. This reduces risk but limits altcoin selection.

Is the Dual Investment feature worth it?

The Dual Investment feature offers high returns-up to 25% APY-but it’s not risk-free. Your funds are used in structured financial products, not staking or lending. If ZORIXchange faces financial trouble, you could lose your money. Only use this with funds you can afford to lose. For safer returns, consider staking ETH or SOL on regulated platforms like Coinbase or Kraken.

How long does KYC verification take on ZORIXchange?

Level 1 KYC (email and phone) takes under 10 minutes. Level 2 (government ID) usually takes 1-2 business days. Level 3 (proof of address and source of funds) can take up to 5 days, especially if you’re submitting non-standard documents. Support is responsive, and many users report faster processing than on other exchanges.

Does ZORIXchange have a mobile app?

Yes, ZORIXchange has official mobile apps for iOS and Android. The app is clean, fast, and supports all core features: spot trading, Earn, Dual Investment, and account management. It’s rated 4.6 on both app stores, with users praising its reliability and ease of use.

Can I use ZORIXchange if I live in the United States?

As of 2026, ZORIXchange does not serve users in the United States. The U.S. regulatory environment is too complex for new entrants without a dedicated legal team and state-by-state licensing. Users in the U.S. should consider Coinbase, Kraken, or Gemini instead.

Jacob Clark

January 12, 2026 AT 05:35Okay, so ZORIXchange is ‘bank-grade’? LOL. If your definition of bank-grade is ‘we didn’t get hacked yet’ then sure. But no third-party audits? No SOC2? No CertiK? That’s not security, that’s wishful thinking. I’ve seen startups like this implode overnight - remember Terra? Same energy. Don’t be the guy holding the bag when the lights go out.

Jon Martín

January 13, 2026 AT 10:29Guys I just switched to ZORIXchange last week and I’m already making moves 🚀

Support answered me in 12 minutes. No joke. I had a question about my USDT deposit and they walked me through it like I was their favorite cousin. If you’re tired of waiting days for help on Binance, this is your sign. Stop scrolling. Start trading. You got this 💪

Mujibur Rahman

January 14, 2026 AT 22:30Let’s be clear - ZORIXchange’s regulatory positioning is the only thing that makes this viable. VARA licensing in Dubai is a heavyweight credential. Most exchanges treat compliance like an inconvenience. This team treats it as a competitive moat. That’s not marketing - that’s institutional-grade thinking. If you’re trading in MENA or SEA, this isn’t an alternative - it’s the only sane option left.

Also, 95% cold storage with biometric access? That’s not standard. That’s enterprise-grade. Most ‘secure’ exchanges use 2FA and call it a day. ZORIXchange locks the vault with fingerprints AND time-based access controls. You’re not just trusting them - you’re trusting their operational discipline.

Jennah Grant

January 15, 2026 AT 06:46I appreciate the balanced take. The Dual Investment feature is tempting - 25% APY is insane - but the counterparty risk is real. I’d treat it like a high-yield corporate bond from a startup: attractive yield, zero FDIC insurance. Only park money there you’re prepared to lose. For the rest, stick to BTC/ETH spot and cold storage. Safety first, returns second.

Dennis Mbuthia

January 15, 2026 AT 22:08Look, I’m not some crypto bro but I’ve been in this space since 2017 and let me tell you - this is the most legit exchange I’ve seen since Coinbase’s early days. They’re not trying to be Binance. They’re trying to be the bank that crypto deserves. And yeah, they don’t list Dogecoin or Shiba Inu - good. That’s not a bug, that’s a feature. If you’re chasing memecoins, you’re not ready for real finance anyway. Also, why are people mad they don’t list SOL? Because it’s a security? Probably. ZORIXchange doesn’t play games. They follow the law. That’s why they’re still here in 2026 while 80% of exchanges vanished.

Becky Chenier

January 17, 2026 AT 03:53Interesting analysis. I’m curious - if they’re so compliant, why don’t they serve the U.S.? The article says it’s too complex, but that’s a cop-out. If they can get VARA, they can get a BitLicense. It’s not impossible - it’s just not profitable enough. That’s the real story. They’re not building for the U.S. because they don’t want to deal with the SEC’s bureaucracy. So they’re targeting easier markets. That’s business, not ethics.

Staci Armezzani

January 18, 2026 AT 04:11Just wanted to say - if you’re new to crypto and overwhelmed by everything, ZORIXchange’s onboarding is actually the best I’ve seen. I did my KYC on a Tuesday, started trading by Thursday, and didn’t feel lost once. Their tutorial videos are short, clear, and not full of jargon. I’m 58 and I finally understand how to buy ETH without asking my nephew. That’s huge. Most platforms treat new users like they’re supposed to already know everything. ZORIXchange gets it.

Tracey Grammer-Porter

January 19, 2026 AT 11:34Does anyone know if they plan to add staking for ETH? The Dual Investment thing feels sketchy, but if they offered proper staking with transparent rewards and slashing protection, I’d move everything there. Also, why no ADA or DOT? Is it really regulatory? Or are they just avoiding tokens with active communities? I’m trying to understand the real reason behind the list.

jim carry

January 19, 2026 AT 17:22So you’re telling me this exchange is ‘safe’ because it’s not hacked yet? That’s like saying your house is safe because no one’s broken in… yet. And you’re trusting a CEO from HSBC? Let me guess - she left because she got tired of watching banks launder money for dictators? This whole thing smells like a rebrand of a shell company. No audits? No transparency? No thank you. I’ll take my chances with a decentralized exchange any day.

Rahul Sharma

January 20, 2026 AT 17:26Very good review 🙏

From India, I can say ZORIXchange is one of the few that supports UPI and local bank transfers smoothly. No hidden fees. No delays. Support team speaks Hindi too 😊

My only concern: liquidity for INR pairs is low. But for BTC/ETH, it's fine. Keep going, ZORIXchange! 🇮🇳

Allen Dometita

January 21, 2026 AT 00:31Just tried the mobile app - smooth as butter 🤖

Got my first $200 in ETH in 5 minutes. No drama. No errors. The interface is so clean I almost cried. I used to spend hours on Binance trying to find the buy button. Here? It’s right there. Like magic. Also, the 24/7 chat? Real people. Not bots. I asked if I could trade on weekends and they said ‘of course’ with a smile emoji 😄

Best crypto experience ever.

Brittany Slick

January 22, 2026 AT 07:12I don’t trade much, but I keep a little stash here because it feels… peaceful? Like a quiet library in the middle of a rave. Everyone else is screaming about moonshots. I’m just holding BTC, earning 5% quietly, and not losing sleep. ZORIXchange doesn’t shout. It just… works. And sometimes, that’s all you need.

greg greg

January 22, 2026 AT 21:02Let’s break down the liquidity issue. $85 million daily volume? That’s less than what a single whale moves on Binance in an hour. If you’re trying to trade more than $50k in a single order, you’re going to get slippage that’ll make you cry. And they don’t even have limit orders on derivatives? That’s not user-friendly - that’s negligent. If you’re serious about trading, you need tools. ZORIXchange is built for passive holders, not active traders. Don’t confuse safety with functionality. They’re not the same thing.

LeeAnn Herker

January 24, 2026 AT 04:40Oh wow, a crypto exchange that’s ‘compliant’? What a shocker. Next they’ll tell us they use recycled paper for their whitepapers. Let me guess - the CEO went to Harvard, wears a blazer, and thinks ‘regulation’ is a synonym for ‘profit’. This isn’t safe - it’s a velvet cage. They’re not protecting you. They’re controlling you. And that 25% APY? That’s not yield. That’s a Ponzi teaser. If it sounds too good to be true, it’s because it is. And the fact that they won’t list Solana? Because it’s too decentralized? Yeah, that’s the real red flag.

Andy Schichter

January 24, 2026 AT 05:46So they’re ‘trying to do the right thing’? Cute. That’s what every failed startup says before they vanish with your funds. ‘We’re not chasing hype’ - said every exchange that went bankrupt in 2022. I’ve seen this movie before. The guy in the suit with the HSBC badge. The ‘bank-grade’ jargon. The lack of audits. The ‘we’re different’ pitch. It’s all the same. They’re not building for users. They’re building for regulators. And when the regulators change their minds? You’ll be the one holding the bag. Again.

Caitlin Colwell

January 25, 2026 AT 13:18I live in Canada. They don’t serve us. But I still read this. Feels like a quiet hope for something better.

Denise Paiva

January 26, 2026 AT 02:45Regulatory compliance is not a feature - it’s a surrender. Crypto was born to break systems. ZORIXchange is trying to become the system. That’s not innovation. That’s assimilation. If you want a bank with crypto buttons, go to Chase. Don’t call it blockchain. It’s just a new kind of gatekeeper with a better UI.

Charlotte Parker

January 27, 2026 AT 05:48They’re not trying to do the right thing. They’re trying to do the profitable thing. And the most profitable thing right now is being the ‘safe’ option for people who are too scared to use anything else. They’re not the hero. They’re the safe house. And safe houses don’t change the world - they just let you hide until the storm passes. I’d rather be in the storm.

Calen Adams

January 27, 2026 AT 10:49Look - I’ve traded on 12 exchanges. ZORIXchange isn’t perfect. But for once, someone’s building with integrity. The support? Unreal. The compliance? Actually thoughtful. The lack of altcoins? Strategic. You want to trade 500 tokens? Go to KuCoin. But if you want to sleep at night knowing your BTC won’t disappear because someone clicked a phishing link? This is it. Don’t overthink it. This is the quiet revolution. And it’s working.