There’s no such thing as a cryptocurrency called "Wonderful Memories (WMEMO)"-at least not as a standalone project. What you’re likely seeing is a confusion between the name and the actual token: Wrapped MEMO (wMEMO). This is a wrapped version of the original MEMO token from Olympus DAO, designed to work across different blockchains. It’s not a new coin with its own story or purpose. It’s a technical tool, built for a very specific job: letting MEMO holders vote on Olympus DAO’s future without having to move their tokens back and forth between networks.

What is Wrapped MEMO (wMEMO)?

Wrapped MEMO isn’t mined or minted like Bitcoin or Ethereum. It’s created when someone takes their native MEMO token-issued by Olympus DAO-and locks it in a smart contract on Ethereum, then issues an equivalent amount of wMEMO on another chain, like Avalanche or Fantom. Think of it like exchanging a U.S. dollar bill for a voucher you can use in another country. The voucher isn’t money on its own, but it represents the same value and lets you do things where the original currency doesn’t work. The original MEMO token is the governance token of Olympus DAO, a decentralized protocol that tries to create a reserve currency backed by crypto assets like DAI, FRAX, and liquidity pool tokens. Holders of MEMO vote on treasury decisions, interest rates, and protocol upgrades. But if you want to use your MEMO on Avalanche instead of Ethereum, you can’t just send it there-it won’t work. That’s where wMEMO comes in. It lets you keep your governance power on a different chain without moving your original tokens.How does it work in practice?

To get wMEMO, you need to:- Have native MEMO tokens in your Web3 wallet (like MetaMask).

- Connect to Olympus DAO’s official wrapper contract.

- Choose which blockchain you want to wrap it for-usually Avalanche or Fantom.

- Confirm the transaction and pay gas fees on the original chain.

- Wait a few minutes while the contract locks your MEMO and mints wMEMO on the target chain.

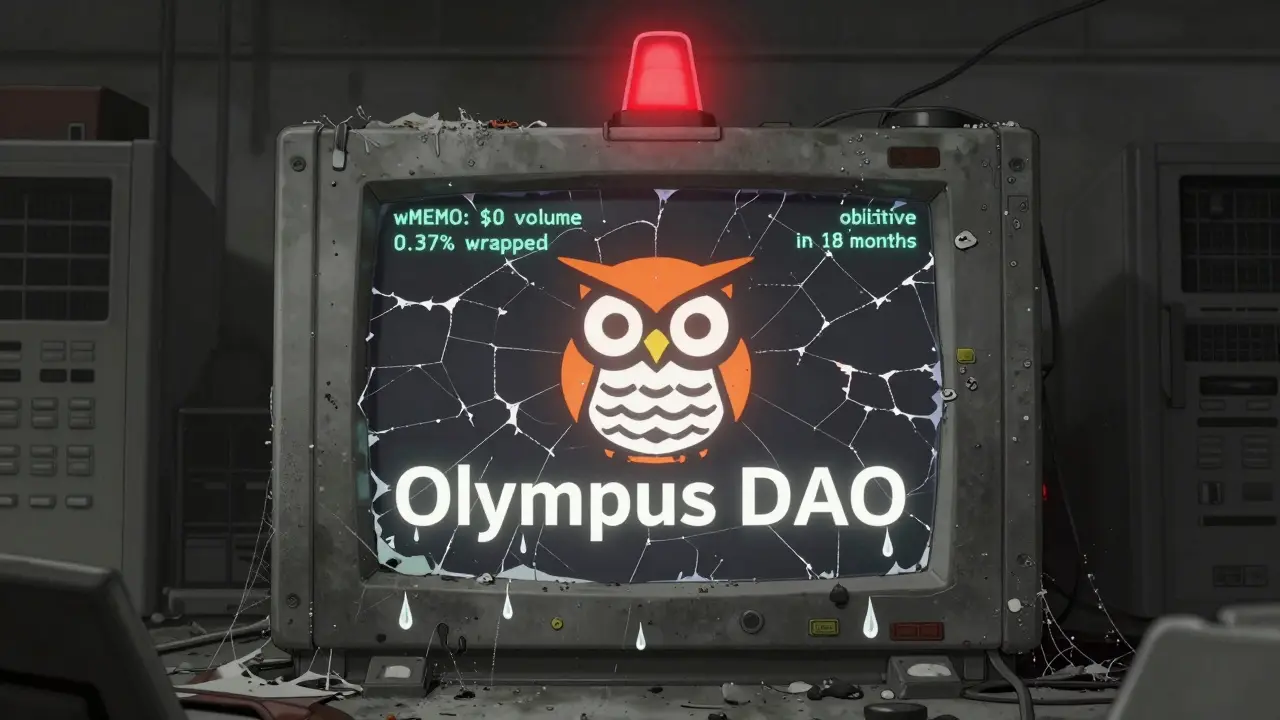

Market status and liquidity

As of September 2023, wMEMO had a 24-hour trading volume of less than $10 across all exchanges. CoinGecko listed it at $51.50, Bybit at $52.19, and Crypto.com at $6.00 volume with a -2.16% price change. These numbers aren’t mistakes-they reflect reality. There’s almost no trading activity. The token’s market cap isn’t even tracked by most platforms because there’s simply not enough movement. One alarming anomaly appeared on CoinDesk: a listing showing wMEMO priced at $29,653.71 with $0 volume. That’s not real. It’s a data glitch or a mislabeled token. Don’t trust that number. The real value of wMEMO is tied directly to the price of native MEMO. If MEMO drops 10%, wMEMO should drop 10% too. But because liquidity is so thin, price gaps of over 5% happen regularly. That creates arbitrage opportunities-but also risks. If you’re trying to vote on a proposal and your wMEMO price is off by 8%, you might accidentally vote with less power than you think.

Why does it exist if no one uses it?

Olympus DAO’s team says wMEMO is "critical infrastructure" for their multi-chain vision. They want MEMO holders to participate in governance no matter which blockchain they’re on. But in practice, very few people do. As of September 2023, only 0.37% of the total MEMO supply was wrapped as wMEMO across all chains. Reddit threads show users switching back to native MEMO because it’s easier, cheaper, and more liquid. One user wrote: "Tried using WMEMO for governance on Avalanche but switched back to native MEMO due to better liquidity and no wrapping fees." Compare that to wOHM (Wrapped OHM), another wrapped governance token from the same ecosystem. wOHM had $1.2 million in daily volume. wMEMO? Under $10. That’s not a small difference-it’s a chasm. Most users don’t care about cross-chain governance enough to jump through these hoops. The demand simply isn’t there.Risks and downsides

Using wMEMO isn’t just low-activity-it’s risky. Here’s what you need to know:- Price slippage: With less than $50 in liquidity on most exchanges, buying or selling even a small amount can move the price by 10% or more.

- Wrapping fees: You pay gas fees twice-once to lock MEMO, once to claim wMEMO. If the network is congested, you could lose hundreds of dollars in fees for nothing.

- Governance vulnerability: If 90% of voting power is still on Ethereum, but 10% is on Avalanche via wMEMO, the system becomes unbalanced. A small group could swing votes on a minor chain.

- Regulatory gray zone: The U.S. SEC’s 2023 framework flagged wrapped tokens as potentially subject to securities laws if the underlying asset is a security. MEMO already walks that line. wMEMO might make it worse.

Anandaraj Br

February 19, 2026 AT 07:19Why do people think crypto is a lottery when it's clearly just a tech manual with a price tag