Tax Optimization: Maximize Savings in Crypto & Beyond

When working with Tax Optimization, the practice of arranging financial activities to reduce tax liability within legal bounds. Also known as tax planning, it helps individuals and businesses keep more of what they earn. In the crypto world, Crypto Tax Reporting, the process of documenting trades, airdrops, and staking rewards for tax authorities is a core piece of any optimization strategy. Likewise, Capital Gains, the profit made from selling an asset for more than its purchase price determine how much you owe after a trade. By linking tax optimization to capital gains planning, you can decide when to sell a token to stay in a low‑rate bracket or offset gains with losses. This relationship creates the triple: Tax Optimization encompasses Capital Gains, Crypto Tax Reporting influences Tax Optimization, and Capital Gains require strategic timing. The result is a clearer picture of how each move—whether a trade, an airdrop claim, or a staking reward—feeds into your overall tax picture. Below we’ll walk through the main levers you can pull to cut your bill without breaking the law.

Key Strategies for Effective Tax Optimization

One of the most powerful tools is Tax Loss Harvesting, selling assets at a loss to offset taxable gains. When you realize a loss on a low‑performing token, you can use that loss to reduce the tax due on high‑performing sales, effectively lowering your net capital gains. The IRS guidelines, encapsulated in Section 1031, the rule governing like‑kind exchanges and loss recognition, dictate the timing and documentation you need to stay compliant. Pairing loss harvesting with careful record‑keeping satisfies both the optimization goal and the compliance requirement, creating the triple: Tax Loss Harvesting reduces Capital Gains, IRS Guidelines shape Tax Loss Harvesting, and proper documentation ensures Tax Compliance. Another essential piece is understanding the tax treatment of DeFi activities. Staking rewards, liquidity mining, and yield farming generate ordinary income or capital gains depending on the event, so mapping each activity to its tax category is crucial. By treating each DeFi action as a distinct transaction, you avoid surprises at tax time and can plan future moves to stay in favorable brackets.

Beyond individual tactics, broader Tax Compliance, adhering to legal reporting standards and filing requirements ensures your optimization efforts don’t backfire. The 2025 U.S. crypto securities registration rules, for example, add an extra layer of scrutiny for token offerings that might be classified as securities. Aligning your tax strategy with these regulations means you’ll not only reduce liability but also avoid penalties from the SEC or IRS. Tools like crypto‑tax software can automate the aggregation of trades, airdrop receipts, and staking payouts, turning a chaotic spreadsheet into a clean, audit‑ready report. When you combine automated reporting with the strategic levers discussed—capital gains timing, loss harvesting, and DeFi classification—you create a robust framework that maximizes savings while keeping you on the right side of regulators. The articles below dive deeper into each of these topics, offering step‑by‑step guides, real‑world examples, and the latest compliance updates you need to stay ahead.

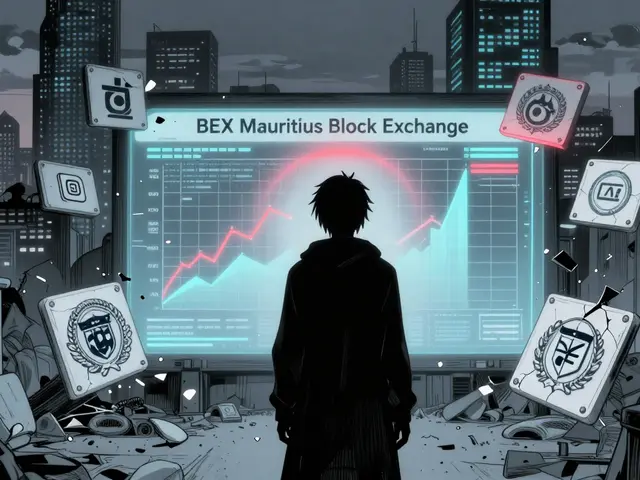

A practical guide to picking the best crypto‑friendly jurisdiction, covering tax, regulation, setup steps and risk management for blockchain businesses.

Read More