Rug Pull – Spotting Exit Scams in Crypto

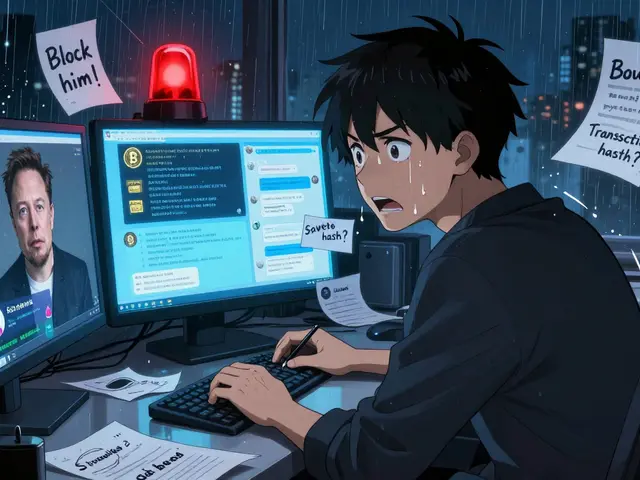

When talking about rug pull, an abrupt disappearance of a project's developers after stealing investors' funds. Also known as an exit scam, a rug pull usually hits new DeFi project, a decentralized finance initiative that promises high yields or a hyped token launch. The core problem is a malicious use of smart contract, self‑executing code that moves money without a central party. By understanding these pieces, you can see why rug pulls keep popping up and what to watch for.

First, a rug pull is a type of crypto scam, any fraudulent scheme that tricks users into sending crypto under false pretenses. Unlike a simple phishing attack, a crypto scam often hides behind a legitimate‑looking website, a flashy tokenomics chart, or a famous influencer endorsement. The scammer writes a vulnerable smart contract, launches the token, then pulls the liquidity pool or swaps the tokens for stablecoins, leaving holders with worthless paper. This chain of events shows the semantic link: rug pull → requires → smart contract → enables → crypto scam.

How a Rug Pull Happens – Step by Step

Most rug pulls start with a token launch, the public release of a new cryptocurrency that promises massive returns. The developers create a liquidity pool on a decentralized exchange (DEX) and lock the pool token for a short period, often only a few days. Investors pour money in, driven by hype on social media and the promise of early‑bird rewards. Once the pool is full, the creators execute a withdrawal function in the smart contract, emptying the pool and disappearing with the funds. The result: the token price crashes to zero, and the community is left with a worthless asset.

Because the contract code is public, a savvy user can audit it before buying. An audit, a third‑party review of a smart contract’s code for vulnerabilities often catches hidden admin functions that enable a rug pull. However, many projects skip audits to save time or money, leaving investors vulnerable. The semantic triple here is: audit → detects → hidden withdrawal functions → prevents → rug pull.

Another red flag is the distribution of tokens. If a few wallets hold the majority of supply, those “whales” can dump the token in one go. This concentration creates a power imbalance that makes a rug pull more likely. Look for tokenomics that show a balanced distribution, vesting schedules for team members, and transparent treasury controls. When these safeguards are missing, the risk spikes.

Community engagement also matters. Genuine projects maintain active developer channels, release regular updates, and respond to security concerns. If you see a silent Discord, a vanished Twitter account, or promises that change overnight, treat it as a warning sign. The relationship can be expressed as: community activity, ongoing interaction between developers and users → builds → trust → reduces → rug pull likelihood.

Lastly, consider the platform where the token is listed. Established DEXs like Uniswap or PancakeSwap have basic safeguards, but they still host malicious contracts. New or obscure platforms may lack any monitoring, making them fertile ground for scams. Choosing a reputable exchange acts as an additional filter against risky projects.

Putting these pieces together, you can build a quick checklist: verify the smart contract code, check for an audit, analyze token distribution, monitor community activity, and prefer reputable exchanges. This approach creates a mental map where each entity—smart contract, audit, token launch, community—connects back to the central goal of avoiding a rug pull.

Below you’ll find a curated list of articles that dive deeper into each of these topics. Whether you’re a newcomer trying to understand the basics or an experienced trader looking for advanced detection methods, the posts cover everything from tokenomics analysis to audit tools, giving you the practical knowledge you need to stay safe.

Learn how smart contract rug pulls operate, their three main types, warning signs, real examples, and steps to protect yourself from DeFi scams.

Read More