Ethereum Scaling: How Layer 2 Solutions Are Changing Crypto Trading

When you trade on Ethereum scaling, the collection of technologies designed to make the Ethereum network faster and cheaper by moving transactions off the main chain. Also known as Layer 2 solutions, it enables DeFi apps to run like they’re on a separate highway, avoiding the traffic jams of the main Ethereum network. Without Ethereum scaling, every swap, stake, or NFT purchase meant paying $10, $20, or even $50 in gas fees—just to get your transaction confirmed. That’s not trading. That’s paying tolls just to sit in your car.

That’s where Layer 2 solutions, networks built on top of Ethereum that handle transactions off-chain and then settle them back on Ethereum for security. Also known as rollups, they’re the reason platforms like PancakeSwap v2 on Arbitrum and SithSwap on StarkNet can offer near-zero fees and instant trades. These aren’t sidechains or alternative blockchains—they’re upgrades that keep Ethereum’s security while removing its bottlenecks. And they’re not just for traders. Projects like Xterio (XTER) and Elk Finance use them to let users cross-chain swap tokens without juggling 10 different wallets or paying bridge fees that eat half your profit.

What’s more, Ethereum scaling isn’t just about cost. It’s about usability. Before rollups, DeFi felt like using a dial-up modem in a 5G world. Now, with low slippage on SithSwap, limit orders on Arbitrum DEXs, and cross-chain liquidity on Elk Finance, you’re not just saving money—you’re getting real trading tools. And it’s not theoretical. People are using these systems daily, swapping stablecoins, farming yields, and trading tokens without worrying about their gas bill being higher than their profit.

But scaling isn’t just one thing. It’s a whole ecosystem. From zk-rollups like StarkNet that prove transactions are valid without revealing details, to optimistic rollups like Arbitrum that assume they’re valid unless challenged, each approach has trade-offs. And that’s why you’ll find posts here covering everything from how Arbitrum reduces fees to why StarkNet’s speed makes it ideal for high-frequency trading. You’ll also see how these upgrades affect real users—like traders in India dealing with TDS taxes, or businesses in Russia navigating crypto rules while using faster, cheaper chains to move value.

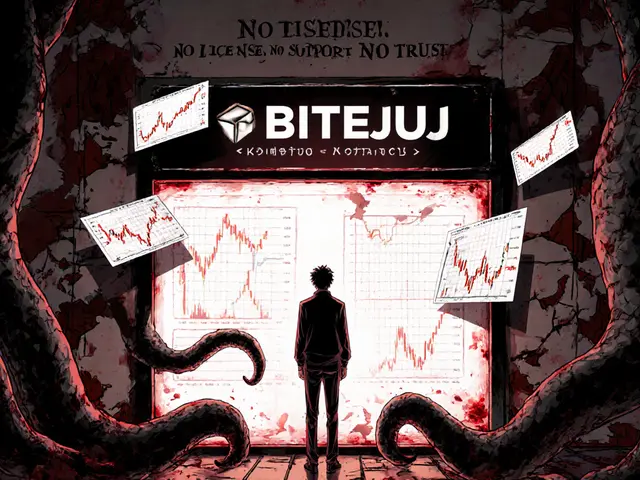

What you won’t find here are hype pieces. No one’s selling you a magic token that "solves scaling." Instead, you’ll get honest reviews of actual platforms—like why Bithumb Singapore shut down while Elk Finance keeps growing, or how YuzuSwap’s trade mining works on the Oasis Network. These aren’t guesses. They’re real-world tests by people who’ve been burned before.

If you’ve ever walked away from a DeFi trade because the gas fee was too high, or avoided a new project because it was stuck on Ethereum’s slow network, this collection is for you. Below, you’ll find real reviews, clear breakdowns, and no-fluff guides on the tools actually making Ethereum usable today. No theory. No promises. Just what works—and what doesn’t.

Rollups are Ethereum's breakthrough scaling solution, cutting transaction fees by 99% and boosting speed to thousands of transactions per second while keeping Ethereum's security intact. Learn how optimistic and ZK rollups work and why they're the future of Web3.

Read More