Cryptocurrency Legal Tender: What It Means and Why It Matters

When talking about cryptocurrency legal tender, a digital asset officially recognized by a government for settling debts and paying taxes. Also known as crypto legal tender, it bridges the gap between traditional fiat and decentralized money, giving everyday users a state‑backed way to spend crypto.

One of the biggest forces behind this shift is the rise of Central Bank Digital Currency, a digital version of sovereign currency issued on a blockchain or similar ledger. CBDCs show how a regulator can endorse digital cash without losing control over monetary policy. At the same time, Crypto Securities, tokens that meet the Howey test and are treated like traditional securities are forcing lawmakers to create clear registration rules, as seen in the 2025 U.S. crypto securities guide. Both entities illustrate the legal and technical scaffolding that makes cryptocurrency legal tender possible.

Behind the scenes, Blockchain, a distributed, immutable ledger that records transactions transparently provides the trust layer. Without blockchain’s consensus mechanisms—whether Proof‑of‑Work or Proof‑of‑Stake—governments would struggle to accept a token that can’t be reliably audited. Validator nodes, for example, secure Proof‑of‑Stake networks by staking tokens and voting on new blocks, turning network security into an economic incentive.

These pieces fit together in a simple chain of cause and effect: cryptocurrency legal tender encompasses central bank digital currencies (the state‑issued side) and crypto securities (the regulated investment side); it requires blockchain technology for transparent record‑keeping; and it relies on proof‑of‑stake validators to keep the system honest. When a country decides to grant legal tender status to a crypto, it must first adopt a blockchain framework, then align its securities laws, and finally set up the infrastructure—like validator nodes—to protect the network.

What You’ll Find Below

The articles below dive into each of these building blocks. You’ll get a plain‑English look at mining pools and how they affect network decentralization, a side‑by‑side comparison of Merkle tree structures that power block verification, and a step‑by‑step guide to navigating crypto securities registration. There are also deep dives on CBDCs, validator node setup, and the practical differences between blockchain and traditional databases. Whether you’re a developer, an investor, or just curious about how digital coins can become money you can spend at the grocery store, the collection gives you the context you need to understand the full picture of cryptocurrency legal tender.

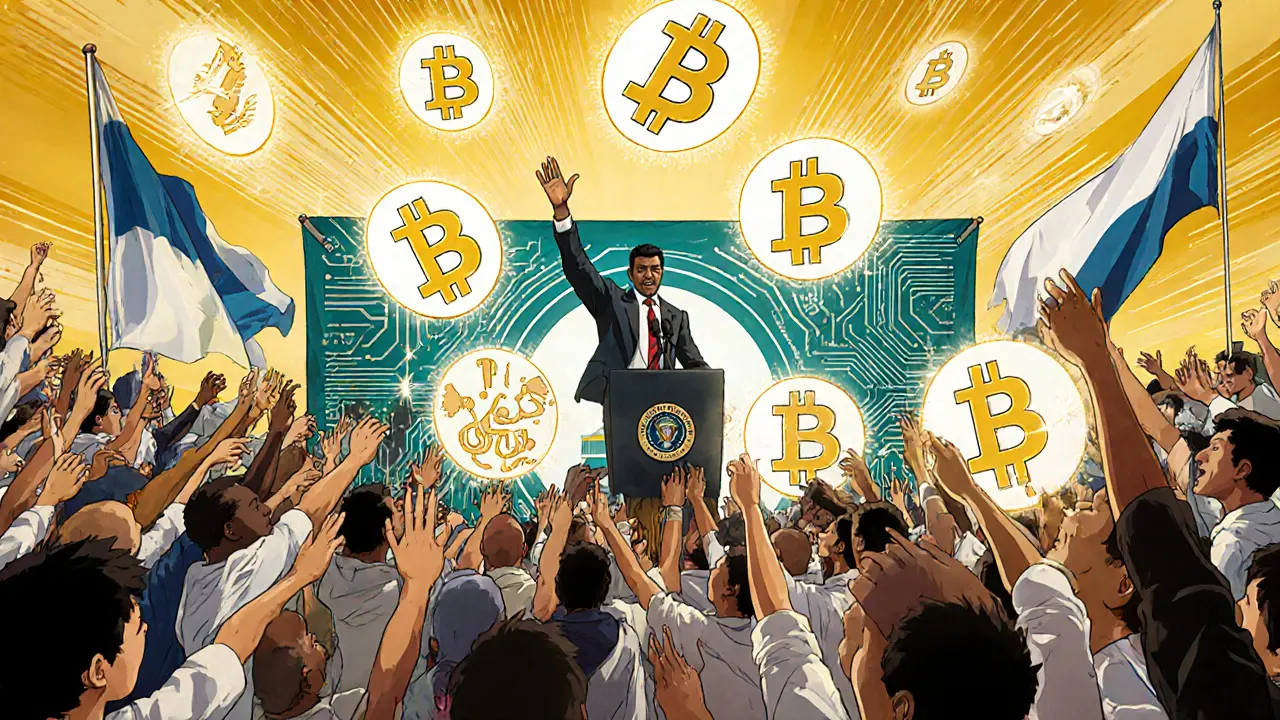

A deep dive into El Salvador's Bitcoin legal tender experiment, its rollout, challenges, IMF‑driven reversal, and lessons for future crypto policies.

Read More