What DeFi Composability Really Means

DeFi composability is the idea that financial protocols can snap together like Lego blocks. You don’t need to build a new lending platform from scratch. Instead, you take Aave’s lending engine, plug in Uniswap’s liquidity pool, add Lido’s staking token, and layer on an automated yield optimizer-all in a few hours. This isn’t science fiction. It’s happening right now, every day, on Ethereum and other blockchains.

Before composability, every DeFi app was an island. If you wanted to earn interest on your ETH, you had to deposit it into one platform. If you wanted to trade it, you had to move it out, pay gas fees again, and wait. Now, your ETH can be staked, lent, used as collateral, and swapped-all at once-without ever leaving its digital wallet. That’s the power of composability: permissionless, modular finance.

How It Works: The Building Blocks

The foundation of DeFi composability is standardization. Most protocols follow the same rules: ERC-20 for tokens, ERC-721 for NFTs, and now cross-chain message standards like IBC and LayerZero. These aren’t just technical specs-they’re agreements. When a protocol speaks ERC-20, it knows any other ERC-20-compliant app will understand it. That’s what lets Aave accept Uniswap’s liquidity provider tokens as collateral.

Think of it like APIs in web development. You don’t build your own payment processor-you use Stripe. In DeFi, you don’t build your own liquidity pool-you use Uniswap. Developers use SDKs and smart contract libraries to connect these pieces. A simple yield strategy might involve three steps: deposit ETH into Lido to get stETH, deposit stETH into Aave to earn interest, then use that interest-bearing token as collateral to borrow USDC and reinvest it elsewhere. All of this happens in one transaction chain.

The Real-World Impact: Speed, Efficiency, and Yield

Composability isn’t just clever code-it’s changing how money moves. In traditional finance, launching a new structured product can take months of legal reviews, compliance checks, and system integrations. In DeFi, it takes days. That speed has created a flywheel: more protocols → more combinations → more users → more capital → more innovation.

According to data from DeFiLlama in November 2025, 83% of the top DeFi protocols by total value locked (TVL) rely on composability. Uniswap, Aave, and Curve Finance are the most-used building blocks. Why? Because they’re reliable, well-audited, and widely integrated. A user can now earn 12.7% APY by combining liquid staking, lending, and automated rebalancing across three protocols-something impossible in a bank or brokerage.

Capital efficiency is up 37% compared to siloed systems, according to Pantera Capital’s 2025 analysis. Assets aren’t sitting idle. They’re working in multiple places at once. A single ETH can be staked, borrowed against, and used as liquidity-all generating returns simultaneously.

The Dark Side: Combinatorial Risk

But there’s a catch. When everything connects, one failure can trigger a chain reaction. In 2022, the Euler Finance exploit wiped out $200 million because attackers used a flaw in one protocol to drain connected lending pools. In 2023, the Terra/Luna collapse caused $40 billion in losses across interconnected DeFi apps in just three days. It wasn’t just one bad project-it was the system’s interdependence that turned a local problem into a global crash.

Chainalysis recorded $2.8 billion in losses from protocol exploits between 2022 and 2023, mostly due to cascading failures. This is called combinatorial risk. The more protocols you link together, the more potential failure points you create. A small bug in a lesser-known oracle service can cause a ripple effect through dozens of apps that depend on it.

Users aren’t immune either. In Q3 2025, $47 million in user funds were lost due to misconfigured yield strategies. One Reddit user lost $1,843 trying to combine leveraged farming with liquid staking-when volatility spiked, his position got liquidated because the risk model didn’t account for the interaction between the two protocols.

Who’s Using It-and Who’s Struggling

Experienced users love composability. On Reddit’s r/DeFi, 78% of 1,243 surveyed users said it unlocked yield opportunities they could never get elsewhere. The top performers aren’t just trading-they’re engineering financial strategies. They’re the ones who know how to read contract events, monitor gas costs, and track protocol updates.

But beginners? They’re overwhelmed. On DappRadar, 63% of negative reviews cite complexity as the main issue. Aggregators like 1inch and Matcha make it easier with one-click interfaces, but they often downplay the risks. Trustpilot ratings hover around 3.8/5, with users praising convenience but complaining about lack of warnings. The gap between expert and novice is wider than ever.

According to Lunar Strategy’s 2025 survey of 2,500 users, 68% of experienced DeFi users see composability as essential. But 82% of beginners find it intimidating-and risky. That’s the biggest barrier to mass adoption: usability without safety.

The Next Evolution: Intent-Based DeFi

The next wave of composability isn’t about making it easier to connect protocols-it’s about making it easier to use them. Enter intent-based systems.

Instead of asking users to pick Aave, then Uniswap, then Curve, and set slippage, gas limits, and approval amounts, intent-based platforms let you say: “I want to maximize my yield on ETH with low risk.” The system then finds the best combination automatically, using AI to analyze real-time data on liquidity, fees, and risk exposure. Platforms like BlockApex and SUAVE are leading this shift.

Optimism’s October 2025 case study showed a 63% drop in user errors when using intent-based interfaces. GoMining reported 22% higher yield optimization using AI-driven composability compared to manual setups. This isn’t just convenience-it’s risk mitigation. The system handles the complexity. The user just states their goal.

Regulation and Institutional Adoption

Regulators are catching up. The EU’s MiCA framework, effective December 2024, requires DeFi aggregators to perform “combinatorial risk assessments” before allowing protocol integrations. In the U.S., the SEC has issued 17 enforcement actions against DeFi platforms since early 2024, mostly targeting unregistered securities offered through yield strategies.

But institutions are moving in. Coinbase’s data shows institutional TVL in DeFi jumped from 2% in 2022 to 23% in 2025. Why? Because they see the efficiency. Forty-one Fortune 500 companies are now testing real-world asset (RWA) DeFi stacks-like tokenized commercial paper or treasury bonds-connected to DeFi protocols. Deloitte reports these RWAs could unlock $16 trillion in new capital.

Gartner predicts that by 2027, 65% of institutional DeFi participation will happen through curated, risk-controlled composability stacks. That means no more wild west. Expect “circuit breakers,” limit orders, and automated risk thresholds baked into the protocols themselves.

Where It’s Headed: Consolidation, Not Collapse

Some fear DeFi will implode under its own complexity. Others think it’s just getting started. The truth is probably somewhere in between.

Ark Invest compares DeFi’s evolution to SaaS: first, you had dozens of standalone tools. Then came integrations. Now, you see suites like Notion or Salesforce that combine multiple functions into one seamless experience. DeFi is following the same path. Specialized protocols won’t disappear-they’ll just get bundled. Imagine a single app that offers staking, lending, borrowing, swaps, and insurance-all with one click and built-in safety guards.

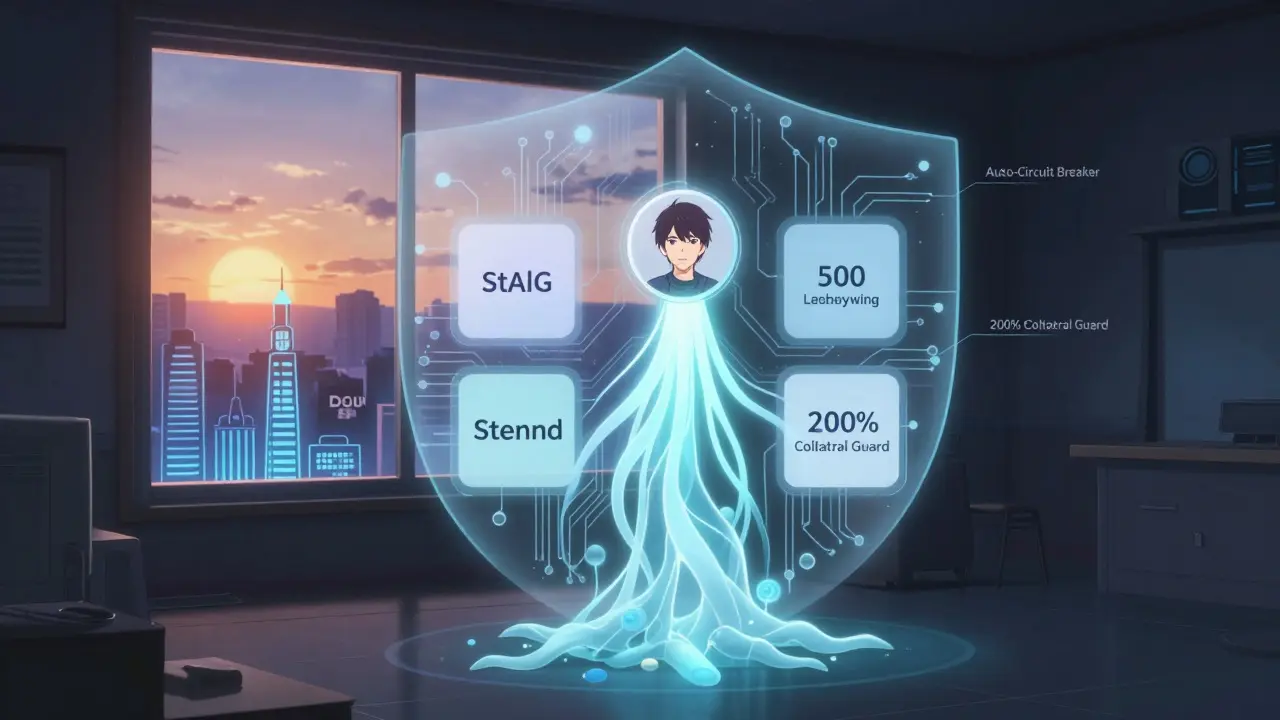

Consensys is already working on modular account abstraction, which lets users set their own risk rules. “If my portfolio drops 15%, automatically pause all leveraged positions” or “Only allow lending against assets with 200% collateralization.” This turns composability from a developer tool into a user-controlled system.

By 2030, Gartner forecasts DeFi could handle 2.7% of global financial transactions-up from 0.3% today. That’s not because everyone will be coding smart contracts. It’s because the complexity will be hidden. The future of DeFi isn’t more protocols. It’s smarter, safer, and simpler ways to use them.

What You Need to Know Right Now

If you’re new to DeFi: don’t try to combine more than two protocols until you understand how each one works. Start with simple strategies-like staking ETH and earning interest on it in one place. Learn how liquidations work. Read the documentation. Aave and Uniswap have the best documentation, with 92% and 87% user satisfaction scores, respectively.

If you’re an experienced user: monitor your protocol dependencies. Use tools like DeFiSafu or DeFiLlama’s risk scores. Don’t assume a protocol is safe just because it’s popular. A small, poorly audited oracle or bridge can break everything.

If you’re building: focus on security first. Use established patterns from the DeFi-Curated GitHub repo (3,842 verified integrations as of November 2025). Test for cascading failures. Assume your code will be attacked. Write your contracts so that even if one component fails, the whole system doesn’t collapse.

What does DeFi composability mean in simple terms?

DeFi composability means financial apps can connect and work together like Lego blocks. Instead of building everything from scratch, developers reuse existing tools-like lending, swapping, or staking-to create new services faster and cheaper. Your crypto can earn interest, be used as collateral, and be traded-all at the same time-without moving it between platforms.

Is DeFi composability safe?

It can be, but it’s risky if you don’t understand the connections. When multiple protocols interact, a bug or hack in one can spread to others. The 2022 Euler Finance exploit and the 2023 Terra/Luna collapse both showed how quickly losses can cascade. Always check the risk ratings of protocols you use, avoid over-leveraging, and never connect more than a few apps until you’re confident in how they work together.

Can I earn better yields with composability?

Yes, but with trade-offs. Users who combine liquid staking, lending, and automated rebalancing have reported consistent yields of 10-15% APY-far higher than traditional savings accounts. However, higher yields often mean higher risk. If the market crashes or a protocol fails, your entire strategy can collapse. Use tools like GoMining or BlockApex that use AI to optimize for yield while minimizing exposure.

Why are institutions starting to use DeFi composability?

Because it’s faster and cheaper. Traditional finance takes months to integrate new financial products. DeFi can do it in days. Institutions like JPMorgan and BlackRock are testing tokenized bonds and real estate on DeFi stacks because they can automate compliance, reduce middlemen, and unlock liquidity from $16 trillion in real-world assets. They’re not using wild, unregulated strategies-they’re using curated, audited, and risk-controlled composability layers.

What’s the biggest challenge for DeFi composability right now?

The biggest challenge is usability without safety. Most users don’t understand how protocols interact, and many platforms hide the risks behind simple buttons. The result? Beginners lose money by accident. The solution is intent-based systems-where you say what you want (e.g., “maximize yield with low risk”) and the system figures out the safest way to do it. That’s the future: powerful tools, hidden complexity.

Gavin Francis

January 31, 2026 AT 15:34Brandon Vaidyanathan

January 31, 2026 AT 21:03Gary Gately

February 1, 2026 AT 04:49Freddy Wiryadi

February 1, 2026 AT 08:50Tom Sheppard

February 1, 2026 AT 20:36mary irons

February 3, 2026 AT 19:56christal Rodriguez

February 4, 2026 AT 02:43Akhil Mathew

February 5, 2026 AT 21:57Brianne Hurley

February 7, 2026 AT 16:32Dylan Morrison

February 9, 2026 AT 14:28Joshua Clark

February 10, 2026 AT 07:55Gustavo Gonzalez

February 11, 2026 AT 00:24Rob Duber

February 12, 2026 AT 02:04Tressie Trezza

February 12, 2026 AT 09:40josh gander

February 13, 2026 AT 08:11Gareth Fitzjohn

February 14, 2026 AT 11:49Edward Drawde

February 16, 2026 AT 03:39Meenal Sharma

February 17, 2026 AT 17:08Mark Ganim

February 18, 2026 AT 07:11josh gander

February 19, 2026 AT 10:41