Financial Inclusion: Bridging the Gap with Crypto and Blockchain

When working with financial inclusion, the effort to give everyone, regardless of location or income, access to affordable financial services. Also known as inclusive finance, it aims to bring banking, credit, and payments to people left out of the traditional system.

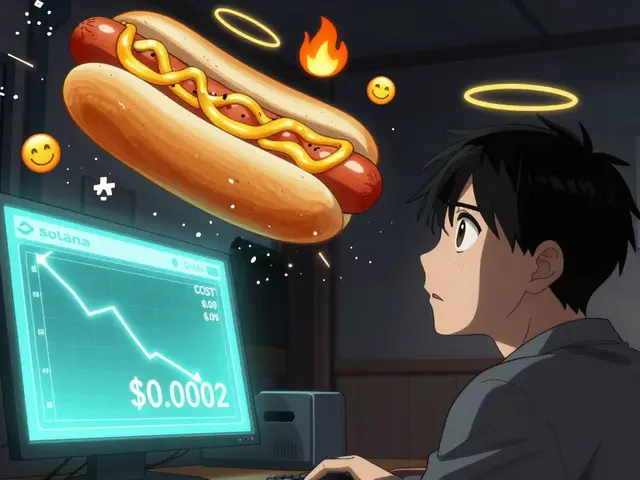

One of the main drivers behind modern cryptocurrency, digital money that runs on peer‑to‑peer networks is its ability to cut out costly intermediaries. Blockchain, a distributed ledger that records transactions in an immutable way provides the transparency and security needed for trust‑less money movement. Together they enable decentralized finance (DeFi), a suite of open‑source protocols that let anyone lend, borrow, or trade without a bank. Financial inclusion encompasses these technologies, requires low‑cost digital infrastructure, and benefits from the openness of DeFi platforms. In practice, a farmer in a remote village can receive a payment on a mobile phone, verify it on a blockchain, and instantly use the funds to buy seed without ever stepping into a bank.

Why the New Tools Matter for the Unbanked

Beyond the tech itself, real‑world impact comes from complementary pieces like digital identity and mobile wallets. A self‑sovereign identity system lets users prove who they are without a central authority, which reduces KYC costs and opens doors to credit for people who lack official documents. Mobile wallets turn a cheap smartphone into a bank branch, letting users store crypto, pay bills, and send remittances across borders at a fraction of traditional fees. These building blocks create a virtuous cycle: cheaper payments attract more users, which fuels liquidity in DeFi pools, which in turn drives down costs further. The result is a financial ecosystem where services once reserved for the wealthy become accessible to anyone with an internet connection.

Below you’ll find a curated set of articles that dive deeper into each of these pieces. From explainers on mining pools and Merkle trees to guides on airdrops, crypto‑securities regulations, and decentralized identity, the collection shows how the pieces fit together to advance financial inclusion. Whether you’re just curious about how crypto can help your community or you’re ready to build a solution, the posts ahead give practical insights you can act on right away.

A clear, in‑depth guide to Central Bank Digital Currencies, covering what they are, how they differ from crypto, global pilots, benefits, challenges, and future outlook.

Read More